Houselungo 19 December 21

This will be the last Twindig Houselungo for 2021, we hope that you all have a great Christmas break and we look forward to seeing you all in the new year.

Monopoly money

House prices have risen faster this year than at any time since the lead up to the Global Financial Crisis, but what has this done to the house prices on the traditional monopoly board? Will you proceed to GO and collect £200? Play our quiz to find out.

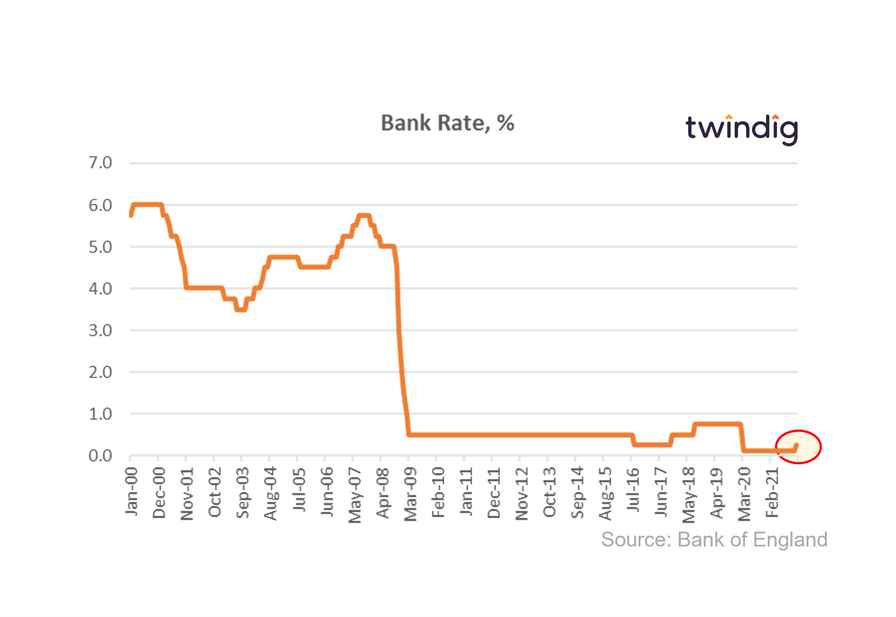

Bank Rate and 'r' rising

We, like many others, were surprised by the Bank of England’s decision to raise Bank Rate. We had thought that with rising COVID-19 cases, the very high ‘R-rate’ of Omicron (estimated to be between 3-5) and the encouragement to work from home and to socialise less – a soft lockdown in all but name, would have led the Bank of England to err on the side of caution concerning a rise in Bank Rate. However, the Bank of England’s MPC remit is clear, to control inflation, and it has used the lever of interest rates to seek to achieve its aim. The Bank of England seeks to provide an economic climate where the Consumer Price Index (CPI) measure of inflation will sustainably be around its 2% target. It is a case of inflation 1, COVID-19, nil.

After the Stamp Duty Holiday comes the hangover

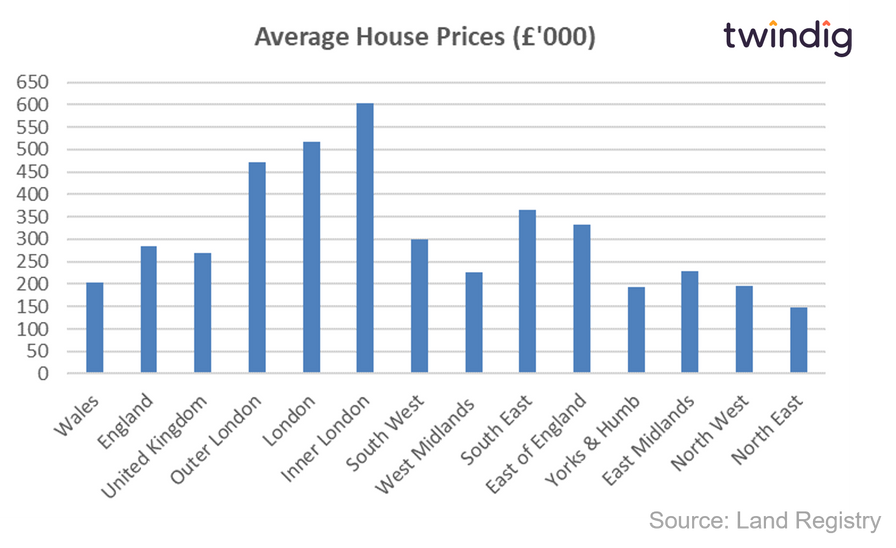

The average house price in the UK is £268,489, average prices have increased by 10.2% or (£24,773) over the last year, and decreased by 1.1% or (£3,019) last month. We note that these figures are provisional and subject to change, however, October is the first month following the end of the Stamp Duty holiday, and a month in which the UK housing market paused for breath.

UK average house prices have increased by 16.4% (£37,740) since the start of the COVID-19 pandemic.

UK average house prices fall in October

The hangover after stamp duty holiday?

UK house prices fell in all regions apart from London and Wales in October 2021, falling on average by £3,019 as the UK housing market caught its breath following the COVID-19 Stamp Duty Holiday.

The fall in house prices in October was not a big surprise as many buyers had been rushing to complete transactions before the 30 September 2021 to benefit from the stamp duty holiday and therefore October was a much quieter and less active month for the UK Housing market.

However, we continue to believe that in the medium-term demand will outstrip underpinning house prices.

In this article, we look at the house price performance of each region across England and Wales.

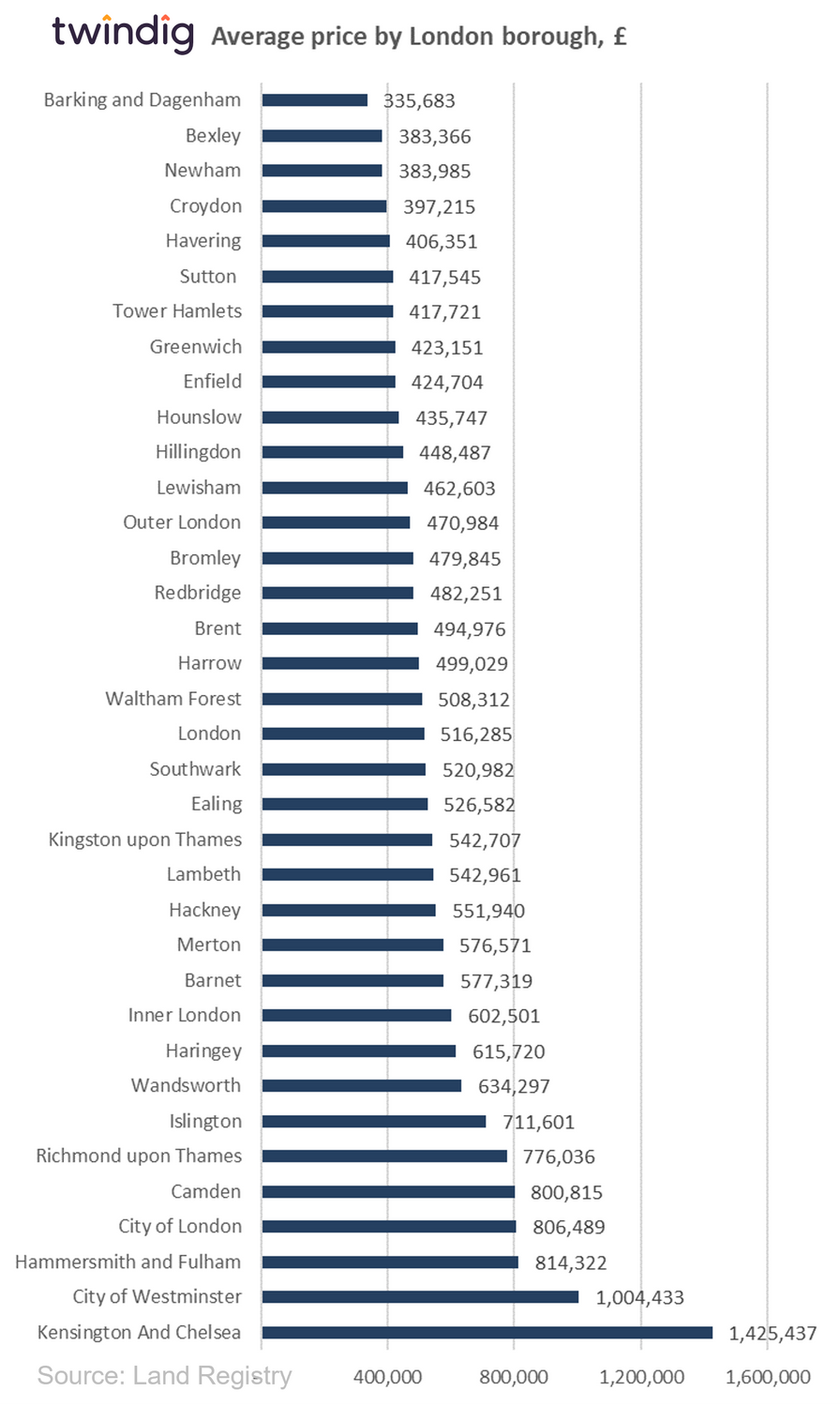

Meanwhile, London house prices riding high

The latest data from the Land Registry shows that the average house price in London rose by 1.9% or £9,430 to £507,253 in October 2021. House prices rose in 20 of the 34 London boroughs during September.

The biggest rises were Barnet up £26,590 (4.8%), Lewisham up £26,247 (6.0%) and the City of Westminster £18,351 (1.9%)

The biggest London house price falls last month were to be found in the Camden down £89,407 (10%), Tower Hamlets down £74,607 (15.2%) and the City of London down £72,367 (8.2%).

House Prices in London

The average house price in London is £516,285. This is 81% or £231,172 higher than the £285,113 average house price in England.

House prices in London have risen by 4.4% over the last twelve months compared to an average increase in house prices across England of 7.5%.

In absolute monetary terms, this translates to an average increase of £30,074 in London and £25,521 in England. House prices in England have therefore increased more in relative, but less in absolute terms than they have in London over the last 12 months.

To see the house prices and house price trends by London borough keep reading, you will find all that house price data in the body of this article.

London House Price Outlook

In the short term, following the outworking of the impacts of the stamp duty holiday, we expect house prices in London to increase. The Stamp Duty Holiday has led to an unusual amount of home buying and selling and the 'race for space' may have changed the broader patterns of housing demand, but we expect house prices in London to remain firm.

In the medium term as the pandemic, risks subside and the UK economy is re-opened we would expect to see a continued recovery in housing transaction volumes and positive momentum maintained for house prices.

Please note that lower than usual levels of housing transactions mean that house prices at the borough level will show higher levels of volatility than normal.

And a bumper year for mortgages

UK Finance (the collective voice for the banking and finance industry) published its mortgage market forecasts for 2022 and 2023 this week.

What they said

Gross mortgage lending will peak in 2021 at £316bn up 31% on 2020 before moderating to £281bn in 2022 and rising in 2023 to £313bn

Total housing transactions will reach 1.5 million in 2021, their highest level since the Global Financial Crisis

While lending will be lower in 2022 and 2023 than in 2021, it will be higher than in 2019 and 2020

Twindig take

The housing market has made hay whilst the stamp duty holiday sun shone, and UK Finance believes that the outlook for the housing market is positive. They expect the mortgage market activity over the next two years to be higher than it was in 2019 and 2020. You can read their full forecasts here.

It is fair to say that the housing and mortgage markets are coping with (and hopefully emerging from) the pandemic in a much stronger place than we had expected they would 18 months ago.

Twindig Housing Market Index

The Twindig Housing Market Index fell by 2.7% from 91.3 to 88.8 this week as the housing market was hit by the rising 'r' rate of Omicron, the raising of Bank Rate and news that house prices across England caught a cold.