Housepresso 24 October 21

All you need to know about the housing market this week in one quick hit

Is high multiple mortgage lending the answer to high house prices?

Halifax has increased its lending multiple on some of its mortgage products, increasing it from 5.0 to 5.5x salary. The increased loan-to-income (LTI) multiple is applied where the borrower’s income exceeds £75,000 pa and the loan-to-value (LTV) comes in below 75%.

In our view, the increase to a 5.5x lending multiple is very interesting but we are not sure that it solves the problem of the house price affordability problem

House prices rise again in August

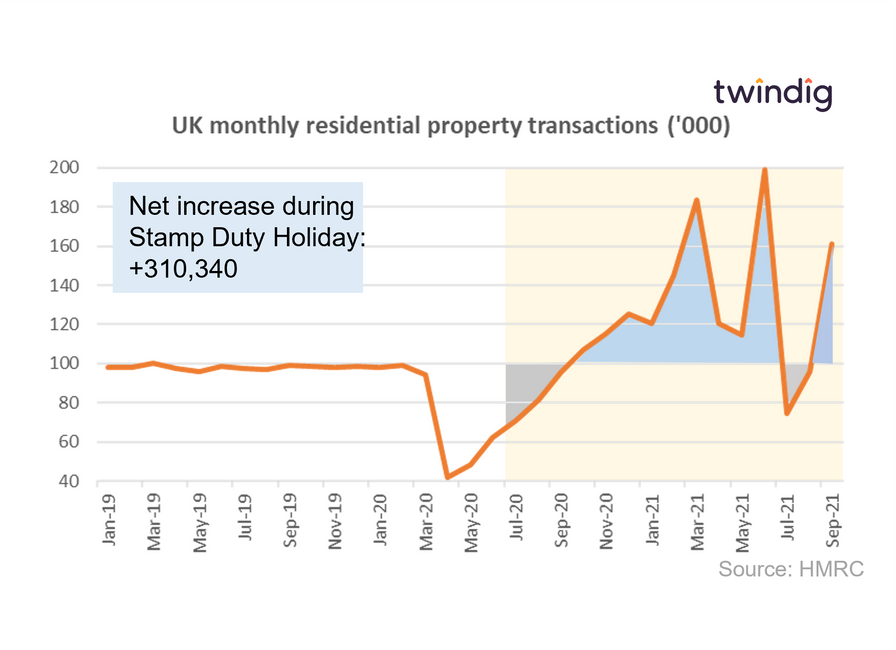

Housing transactions spike in September

Not surprisingly housing transactions spiked in September as the final stage of the Stamp Duty Holiday drew to a close. Provisional data from HMRC suggests there were 160,950 housing transactions in September 2021 which is 68% higher than both August 2021 and September last year. We estimate that there were more than 310,000 additional housing transactions completed during the Stamp Duty Holiday.

Is a long term fixed rate mortgage right for you?

Research from Kensington Mortgages found that more than 80% of homeowners and those looking to buy a home would consider paying a £1,200 premium for a long-term fixed-rate mortgage.

Kensington polled 2,000 renters and 2,000 homeowners and called the extra cash people were willing to pay a ‘certainty premium’

London House Prices by London borough

The latest data from the Land Registry shows that the average house price in London rose by 5.6% or £27,810 to £525,893 in August 2021. House prices rose in 29 of the 34 London boroughs during August.

The biggest London house price gains last month were to be found in the City of Westminster up £93,112 (10.3%), Camden up £79,246 (9.1%) and Kensington and Chelsea up £65,040 (4.7%)

The biggest falls were Harrow down £16,566 (3.5%) Lambeth down £13,369 (2.7%) and Brent down £5,957 (1.1%).

The Twindig Housing Market Index

In a week where the Land Registry reported rising house prices, the Halifax raised mortgage loan-to-income lending multiples, and HMRC reported a rise in housing transactions, the Twindig Housing Market Index fell slightly by 0.3% to 91.6 this week.