Is high multiple mortgage lending the answer to high house prices?

Halifax has increased its lending multiple on some of its mortgage products, increasing it from 5.0 to 5.5x salary. The increased loan-to-income (LTI) multiple is applied where the borrower’s income exceeds £75,000 pa and the loan-to-value (LTV) comes in below 75%.

An unexpected consequence of the COVID-19 pandemic is that house prices have increased significantly pushing homeownership out of the reach of many aspiring first-time buyers and frustrating the plans of home movers.

In our view, the increase to a 5.5x lending multiple is very interesting and in this article, we discuss why.

Why is this significant?

The Financial Policy Committee (FPC) a committee of the Bank of England stipulates that lenders should restrict the amount of lending they do at high LTI’s. The rules say that on a rolling 12 months basis, lending above 4.5x LTI must be less than 15% of the lenders business.

The FPC also has a strict affordability test, where a mortgage rate stress test must be applied to assess whether the borrower could still afford their mortgage if at any time during five years from the start of the loan Bank Rate increased by 3 percentage points.

The Bank of England also points out that the risk of mortgage payment default increases if the borrower’s LTI is more than 4.5x and their Debt Service Ratio (DSR) is above 40%. A DSR measures how much your debt payments take up of your net income.

In our view, this high LTI mortgage pushes at the boundaries set by the Bank of England. However, the mortgage is not high risk in and of itself, the risk relates to how it will be used, and how those using it perceive it.

Putting lending into context: a worked example

The average mortgage rate for a 75% LTV 2 year fixed rate mortgage is currently 1.29%.

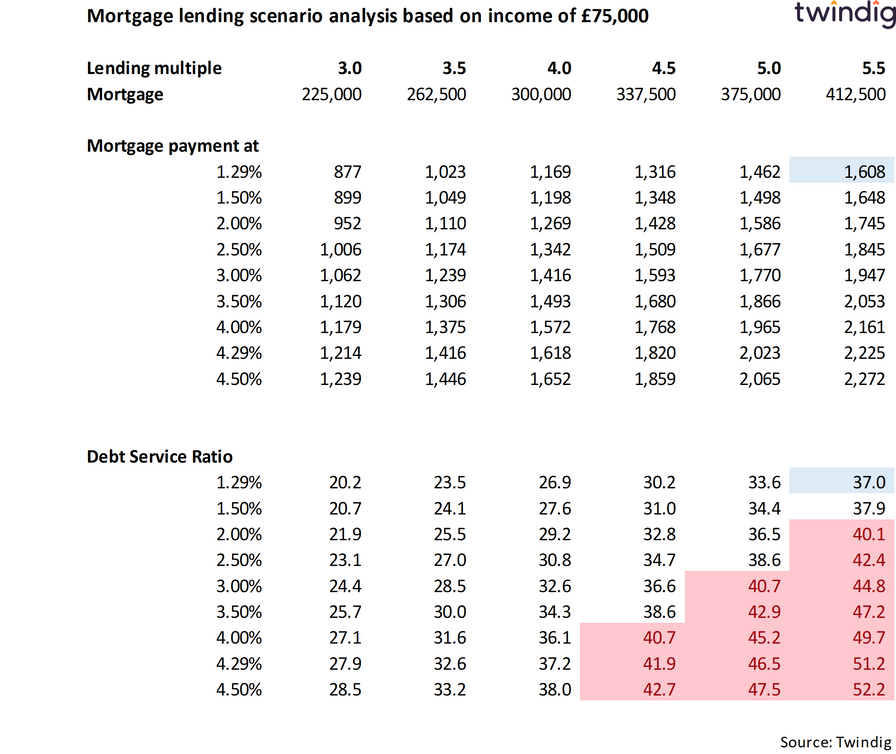

If a borrower earning £75,000 borrowed 5.5x their income (£412,500) on a 25-year repayment mortgage at 1.29% their monthly mortgage payments would be £1,608 a DSR of 37%. The DSR of 37% is reasonably close to the danger zone of 40%.

Mortgage rates are currently at or around all-time lows and we believe that the next move in Bank Rate is more likely to be up than down. We note in the table above that the mortgage rate only needs to increase to 2.0% before the DSR at 5.5x LTI moves into the danger zone.

If we apply the three-percentage point stress test (from 1.29% to 4.29%) we can see that the DSR moves above 40% at a 4.5x lending multiple

To work out your own mortgage payments under different scenarios you can use our mortgage payments calculator

What does this mean?

The conclusion is obvious. Higher multiple lending is higher risk lending, and just because you can borrow a large amount of money doesn’t mean that you should.

Have you got the deposit to match the LTV?

It is one thing to be able to borrow 5.5x income at a 75% LTV, but how many have the deposit to back it up?

In our £75,000 example, a Loan-to-income of 5.5x implies a mortgage of £412,500. At this level, a 75% LTV mortgage implies a deposit of £137,500, which is almost 2x gross income and more than two and a half years’ (32 months) worth of take-home pay.

In our view, the real constraint on mortgage lending is not income multiples, lending multiples or even mortgage rate stress tests, but deposits…