Housepresso 24 July 22

8 out of 10 see house price rises

UK house prices rose in eight regions and fell across two regions of the country in May 2022. Overall average house prices rose by £3,412 across the UK, this was a bigger rise than in April when average UK house prices increased by £2,559 suggesting that the costs of living and mortgage rates rises are yet to take some of the heat may be coming out of the UK housing market.

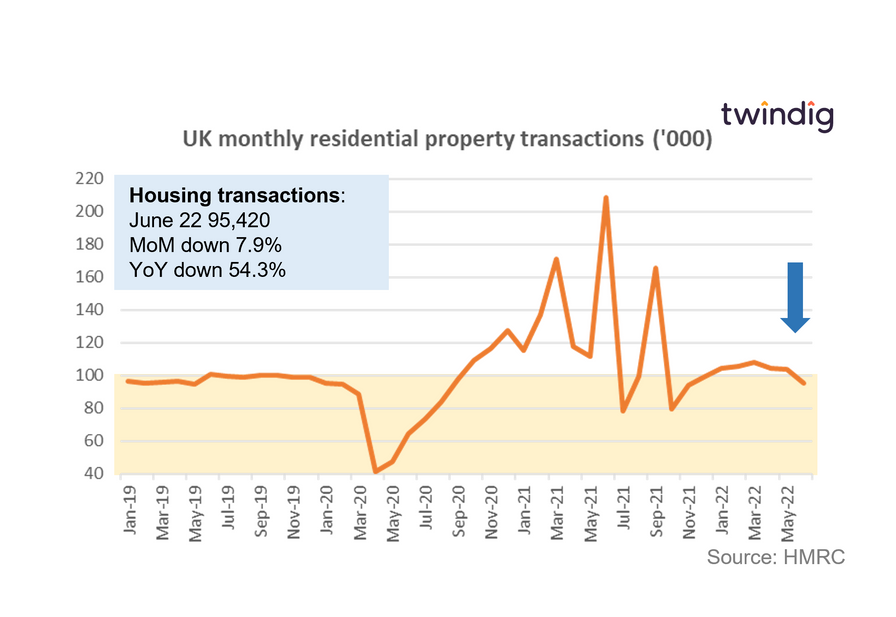

Cost of living bites housing

Housing transactions fell by 8% in June, which we believe is significant, the first time this year that housing transactions have fallen below the long-run average of 97,943, perhaps this is the first sign for the housing market that the cost of living crisis is starting to bite.

London house price growth slowing

The latest data from the Land Registry shows that the average house price in London rise by 0.2% or £992 to £525,183 in May 2022. House prices rose in 24 of the 34 London boroughs during May.

The biggest rises were in Islington up £25,730 (3.6%), Hammersmith and Fulham up £23,440 (3.2%) and Kingston Upon Thames up £16,770 (3.2%).

The biggest London house price falls last month were to be found in Kensington and Chelsea down £113,930 (8.0%), the City of Westminster down £846,980 (8.8%) and the City of London down £62,230 (7.3%).

The UK's hottest housing markets right now

We often talk about 'the UK housing market' and 'UK house price inflation' as if there is one housing market and one rate of house price inflation. Neither is true.

The UK is made up of hundreds if not thousands of tiny housing markets, which operate independently of each other. One person buying a home in Swindon does not move the housing market in Stockwell.

In this article, we look at the hottest 25 housing markets across the country. Did house prices in your area rise by 7.6% last month?

Twindig Housing Market Index