Cost of living bites housing

HMRC released provisional housing transaction data for June 2022 this morning

What they said

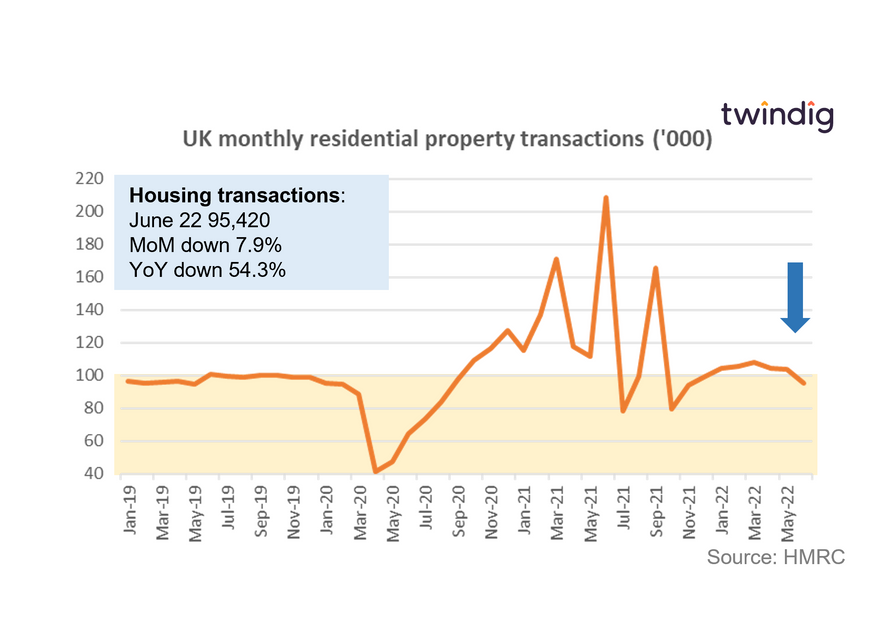

Housing transactions in June 2022 were 95,420

This is 7.9% lower than in May 2022

This is 54.3% lower than in June 2021

Twindig take

It is significant that housing transactions fell by almost 8% in June, the first time this year that housing transactions have fallen below the long-run average of 97,943, perhaps this is the first sign for the housing market that the cost of living crisis is starting to bite.

The revised data from HMRC now shows that housing transactions have fallen for three months in a row and this trend is in line with our favourite lead indicator (mortgage approvals).

Meanwhile, as we reported yesterday, house prices continue to rise in most parts of the country, which, in our view, demonstrates that housing transactions act as a buffer to house prices in a challenging housing market. As the outlook weakens fewer households choose to move, this reduces the supply of homes for sale, which in turn helps to underpin house prices.

Fortunately, we can take a pinch of salt with the year-on-year comparison of a fall in housing transactions of 54.3%, as this is merely the lapping of the end of the £500,000 Stamp Duty Holiday, which lead to an unusually high number of housing transactions completing.

The outlook for the UK housing market still remains robust, the levels of both mortgage approvals and housing transactions are close to their long-run averages, but, after a period of unusually high housing market activity, the trend is starting to point downwards. It is too early to worry just yet and the summer may throw up some unusual data points, we will hold judgement until the 'back to school' autumn selling season. The strength of the autumn selling season may point to the strength or not of the housing market for the year ahead.

If you are thinking of moving, now is a good time to secure a low interest rate mortgage, mortgage rates are on the up, and the current low rates will not last forever.