Housepresso 18 July 21

All you need to know about the housing market this week in one quick hit

Housing market glass half full, but is it leaking?

The Bank of England’s latest Financial Stability Report contained good news for the UK economy and the UK housing market, painting a picture of a glass more than half full. The outlook for economic growth is improving, mortgage availability is increasing and the households with high debt servicing levels remains significantly below pre-global financial crisis levels. However, the Bank of England does also sound a note of caution pointing out that rising COVID Case numbers or a drop in vaccine effectiveness could reverse the improving trends and lead to the economic glass being more than half empty. A case of we can see the edge of the woods, but we are not out of them yet.

Has your wealth increased during the COVID Crisis?

The COVID induced recession has been an unusual recession. It is the first in living memory where wealth has gone up rather than down as households have to a large extent not been able to spend any money as shops were closed and holidays taken off the calendar as a result savings have increased and debts decreased.

But the tide wealth has not risen at the same rate for all…

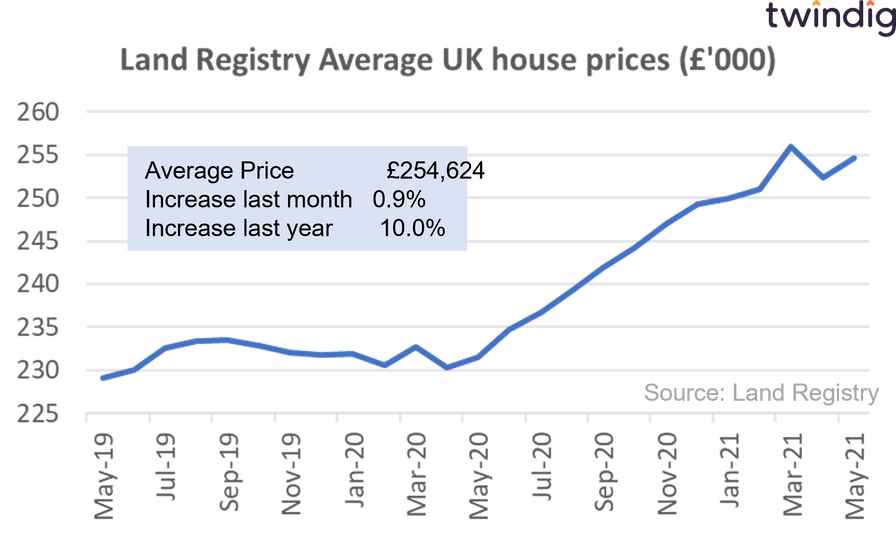

UK average house prices up £23,000....

The average house price in the UK is £254,624, average prices have increased by 10.0% or (£23,116) over the last year, and increased by 0.9% or (£2,241) last month, following a lull in activity in April after homebuyers rushed to meet the first of two Stamp Duty Holiday dedalines at the end of March 2021.

UK average house prices have increased by 10.4% (£24,137) since the start of the COVID-19 pandemic.

The price rises in May reflect a continued shortage of supply in the number of homes currently for sale. In most areas across the UK demand is greater than supply and this is putting further upward pressure on house prices

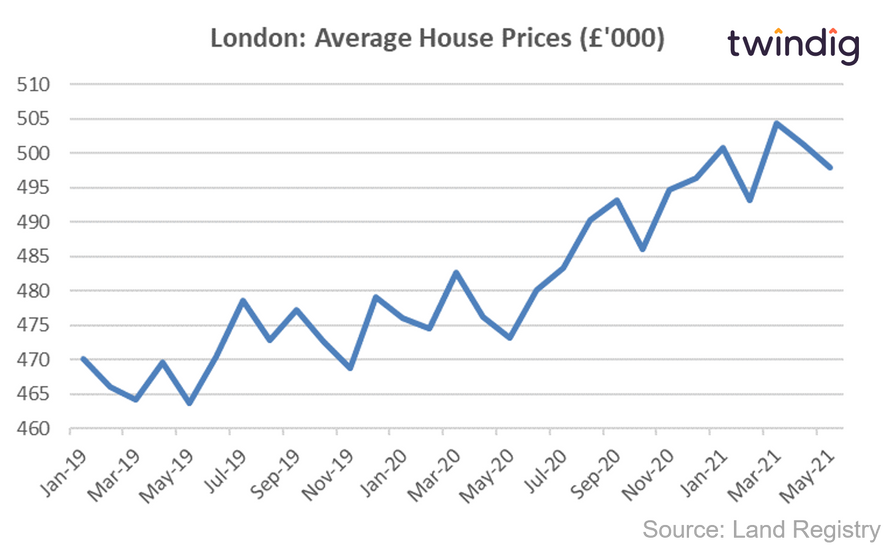

..But London house prices fell by more than £3000

The latest data from the Land Registry shows that the average house price in London fell by 0.7% or £3,262 to £497,948 in May 2021. However, during May 2021 house prices rose in 24 of the 34 London boroughs. House price falls in some of the more expensive boroughs weighed on the overall average and as the economy continues to open up we would expect house prices in London to rise in the coming months.

The biggest falls were in the City of Westminster down 2.9% or £29,087, followed by Hackney down £25,474 and Islington down £17,041.

The biggest London house price gains last month were to be found in the City of London up £52,728, Hammersmith & Fulham up £35,048 and Kensington & Chelsea up £28,188.

Mortgage market: Supply speeding up as demand starts to slow

The Bank of England reported some very interesting dynamics in the mortgage market in its latest Credit Conditions Survey today. The supply of mortgages is expected to increase and the price of mortgages (mortgage rates) continue to decrease in the coming months, which should stimulate demand. However, demand for house purchase mortgages is expected to decrease as the stamp duty holiday draws to a close. Could it be that as we start to see the wider economy open up the housing market starts to slow down?

Barratt strong finish and a stronger start

Barratt delivered a strong finish to FY2021 and has started FY2022 stronger still, whilst many of us will be staycationing this year, there is no hint of a stamp duty holiday cliff for Barratt as forward sales for the coming year are ahead of their levels last year and the year before. Investment in land is also up, suggesting that Barratt is also confident about the longer-term prospects for the UK housing market and the cover-based dividend will be the icing on the cake for investors.