Mortgage market: Supply speeding up as demand starts to slow

The Bank of England reported some very interesting dynamics in the mortgage market in its latest Credit Conditions Survey today. The supply of mortgages is expected to increase and the price of mortgages (mortgage rates) continue to decrease in the coming months, which should stimulate demand.

However, demand for house purchase mortgages is expected to decrease as the stamp duty holiday draws to a close. We may therefore start to see the housing market slow down as the wider economy opens up.

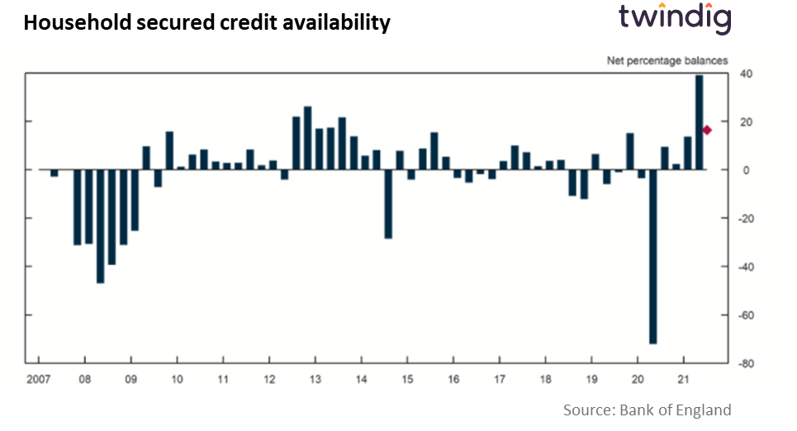

Mortgage supply speeding up

We show in the graph below the survey results from the Bank of England's latest Credit Condition Survey. Mortgage supply increased significantly last quarter and is expected to increase again in the current quarter.

More mortgage for less money

It isn't often that you are offered more for less, but this is currently the case in the mortgage market. Mortgage rates are expected to continue to fall in the current quarter, so we have a situation where there will be a greater choice of mortgages for a lower price - a win win.

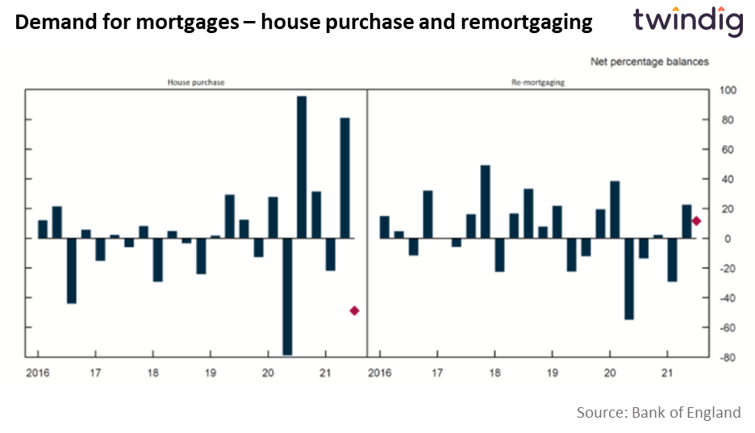

Mortgage Demand slowing down

Whilst increasing supply and falling prices should, in theory, stimulate demand, lenders expect demand for house purchase mortgages to fall in the current quarter (as shown in the left-hand side of the graph below). In our view, this reduction in demand will be due to the ending of the Stamp Duty Holiday on 30 September 2021. However those remortgaging are expected to be more active as they are able to take advantage of lower mortgage rates

Is falling mortgage demand a bad thing?

Not necessarily. The Stamp Duty Holiday has led to unusually high demand for mortgages in the housing market. Many will have pulled forward their purchase plans, especially those who have seen their wealth increase during the pandemic and others will have purchased speculatively to take advantage of the tax break. We expect a lull in demand to match those pulled forward transactions followed by a return to a more normal market. It is not time to worry about a housing market crash just yet in our view.