Has your wealth increased during the COVID Crisis?

Think tank the Resolution Foundation reported this week that:

Total household wealth increased by almost £900bn (up 6%) during the pandemic

Asset price appreciation was the primary driver helped by rising savings and falling debt

BUT not everyone has won the same prize

An unusual recession

The COVID-19 pandemic is the first in living memory where wealth has gone up rather than down as households have, to a large extent, not been able to spend any money as shops were closed and holidays cancelled or not taken. Savings have therefore increased and debts decreased.

But the tide did not rise at the same rate for all…

The median family has gained £7,800 in wealth per adult. However, those in the richest 10 per cent of households have gained more than £50,000. Meanwhile, the poorest 30 per cent of the wealth distribution gained just £86 per adult on average in additional wealth.

The gap between the richest 10 per cent and the fifth decile of the wealth distribution has increased by over a further £40,000, and by £7,000 between the fifth decile and the poorest 10 per cent.

The typical gap in wealth per adult between the top and the middle of the distribution now stands at 55x typical household income.

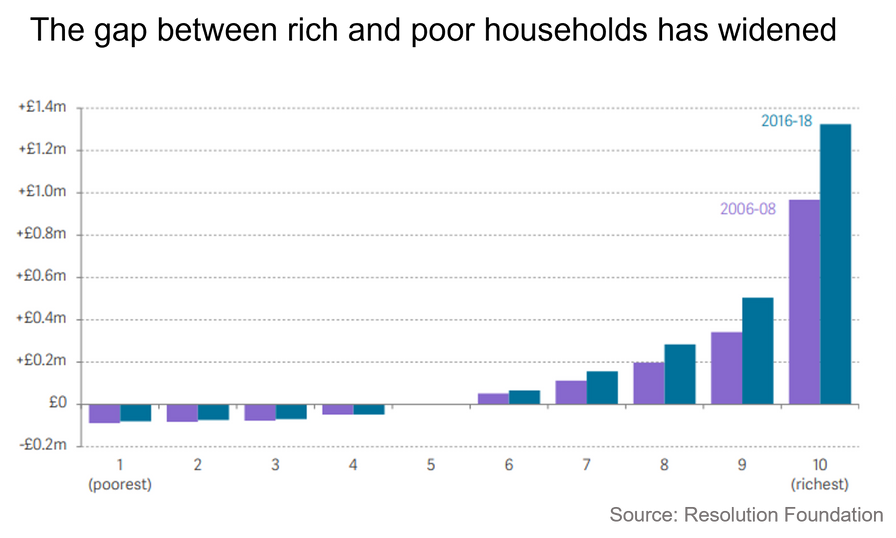

We show in the graph below the gap between mean family wealth per adult within each net wealth decile and compared to the mean wealth for the fifth decile decile.

Unfortunately, evidence from the Resolution Foundation’s research suggests that the enduring legacy of the pandemic is likely to be widening wealth gaps.

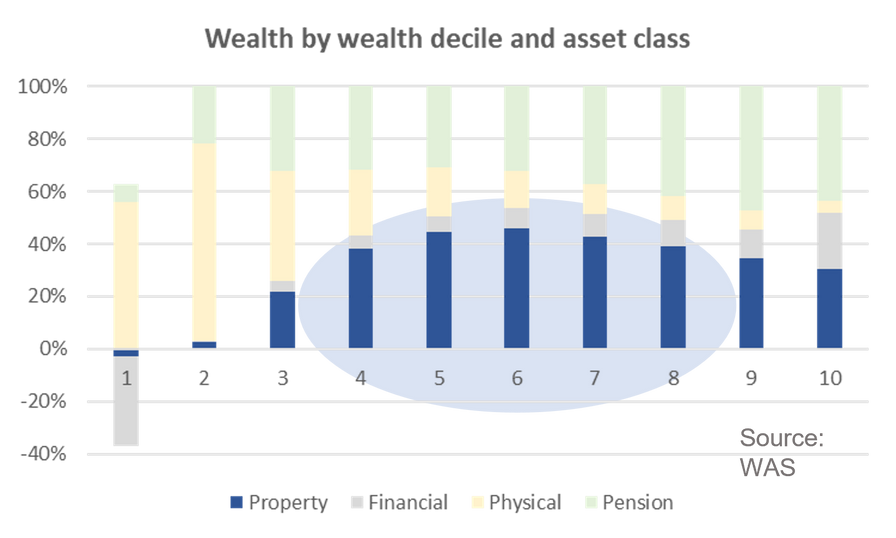

Property is key to middle England's wealth

As already widely reported, UK house prices have grown at a faster rate during the COVID pandemic than they have for more than a decade. In terms of housing wealth, the COVID Pandemic has been generous to homeowners. Housing is the biggest asset held by around 50% of households, especially those in the middle tiers. Housing wealth highest in absolute terms for the 8th, 9th and 10th richest deciles, but as a share of wealth it is smaller than their pension assets.

Those with housing assets have had a better pandemic than those without and unfortunately whilst the pandemic has increased the size of the housing pie, the pie is now more unequally shared than it was before the pandemic.

Stamp Duty Holiday: Sheriff of Nottingham rather than Robin Hood

In our view, the Stamp Duty Holiday has certainly played a leading role in pushing up house prices during the pandemic, but perhaps as we come out on the other side we need to do more to help the 'have-nots' rather than the 'already-haves' when it comes to the housing ladder.

You can read the full Resolution Foundation report (Wealth gap) year here