Housing market glass half full - BoE Financial Stability Report

Financial Stability Summary

The Bank of England’s latest Financial Stability Report contained good news for the UK economy and the UK housing market, painting a picture of a glass more than half full. The outlook for economic growth is improving, mortgage availability is increasing and the households with high debt servicing levels remains significantly below pre-global financial crisis levels. However, the Bank of England does also sound a note of caution pointing out that rising COVID Case numbers or a drop in vaccine effectiveness could reverse the improving trends and lead to the economic glass becoming more than half empty. A case of we can see the edge of the woods, but we are not out of them yet.

Where we are now?

The outlook for economic growth has improved since the Bank of England’s December 2020 Financial Stability Report, but risks to the recovery remain. The UK financial system has provided support to households and businesses to weather the economic disruption from the pandemic.

In recent months, the rapid rollout of the UK’s vaccination programme has led to an improvement in the UK economic outlook

Should we be worried about the financial stability of house prices?

The Bank of England is mindful that house prices have been growing at their fastest rate in over a decade. The increase in house prices and housing transactions is driven by the stamp duty holiday and changing preferences for property due to working from home (more internal and outside space, away from urban centres).

Interestingly the Bank of England believes that these trends may continue beyond the end of the stamp duty holiday in September, suggesting that concerns of a housing cliff-edge may be overdone.

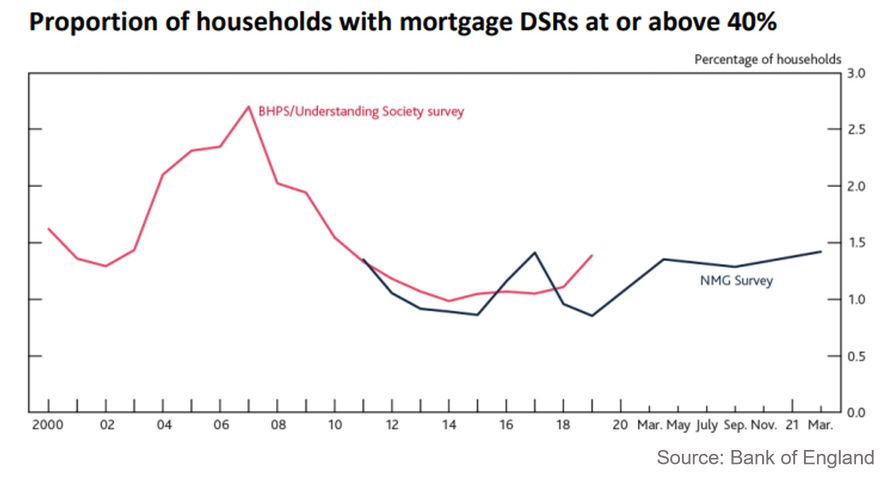

The Bank also notes that mortgage rates remain low and levels of household indebtedness remain significantly below those in the lead up to the global financial crisis.

The Bank does not, therefore, see imminent downside risks to house prices, in our view.

The Chart below shows the proportion of households where their mortgage Debt Service Ratio (DSR) is more than 40% of their income

Mortgages more available...

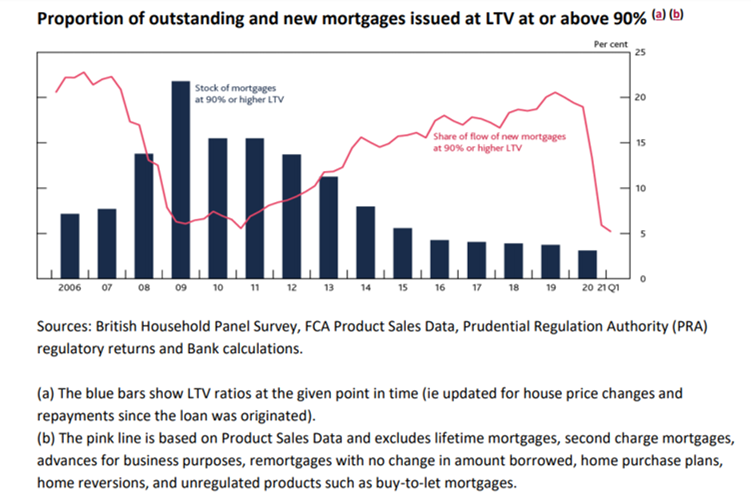

The increase in housing market activity has also been accompanied by increased mortgage availability and the number of higher loan to value mortgages (those at 90% LTV or higher) has tripled since the start of the year.

.. but the mortgage market remains disciplined

Although there has been a significant increase in the availability of high loan to value mortgages the number of high loan-to-value mortgages remains significantly lower than it was in the lead up to, during, and following the global financial crisis

This discipline was enshrined in the 2014 Mortgage Market Review, which ensures that lenders apply both an affordability test and a loan to income test before approving a new mortgage:

Affordability test

The affordability test which builds on FCA rules and specifies that lenders should assess

whether prospective borrowers could still afford their mortgage if their repayment rate rose

to be 3 percentage points higher than the reversion rate specified in their contract.

Loan-to-Income test

The LTI flow limit limits the number of mortgages that lenders can extend at LTI ratios

of 4.5 or higher at 15% of their new mortgage lending.

But we are no out of the woods yet

Despite the improved outlook, there remain downside risks to growth that could negatively impact financial stability, particularly in the short term. For example, economic activity could be curtailed following a further pickup in Covid case numbers, or a possible drop in vaccine effectiveness arising from mutations of the virus. A case of we can see the edge of the woods, but we are not out of them yet.