Housepresso 6 February 22

What does Levelling up mean for homeownership?

On Wednesday, the Department for Levelling Up, Housing and Communities published its ‘Levelling Up the United Kingdom White Paper, a bold plan to unleash opportunity and create a more equal society. The rallying calls were great:

We will ensure homeownership is within the reach of many more people

By 2030, renters will have a secure path to ownership with the number of first-time buyers increasing in all areas

But is it a policy built on firm foundations or is just hot air? In the article below, we look, specifically, at What levelling up means for homeownership.

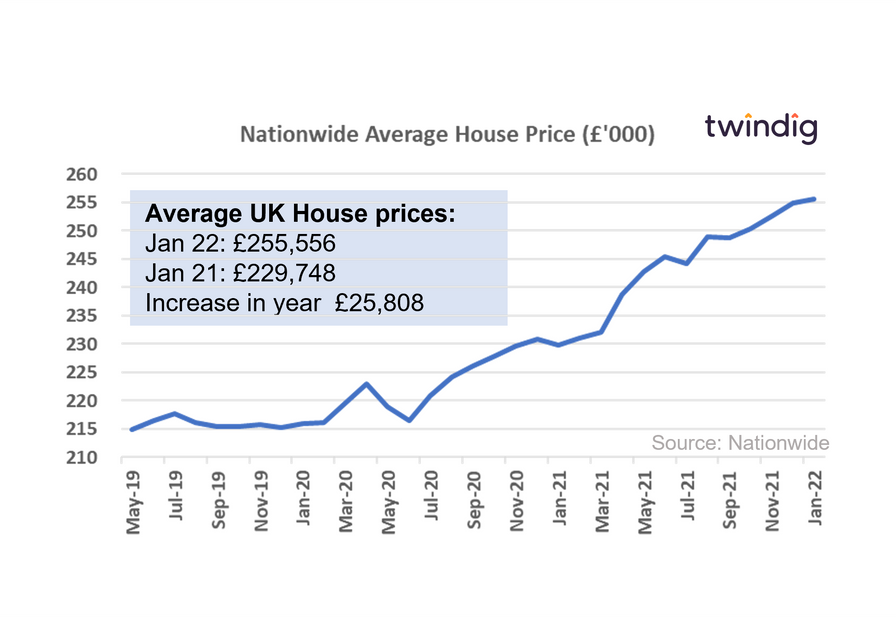

House prices rise by almost £500 per week

House prices have had a strong start to 2022, in fact, the strongest start to a year for 17 years. Over the last year UK house prices increased, on average by almost £500 per week, but the Nationwide suggests that there are headwinds on the horizon.

Nationwide believes that the housing market will slow this year for a number of factors:

House price growth has significantly outstripped earnings growth since the start of the pandemic.

The anticipated cost of living increases this year, which will stretch the already stretched housing affordability metrics

Mortgage rates are also likely to rise this year as we expect that the Bank of England raise Bank Rate this year as it tries to control inflation.

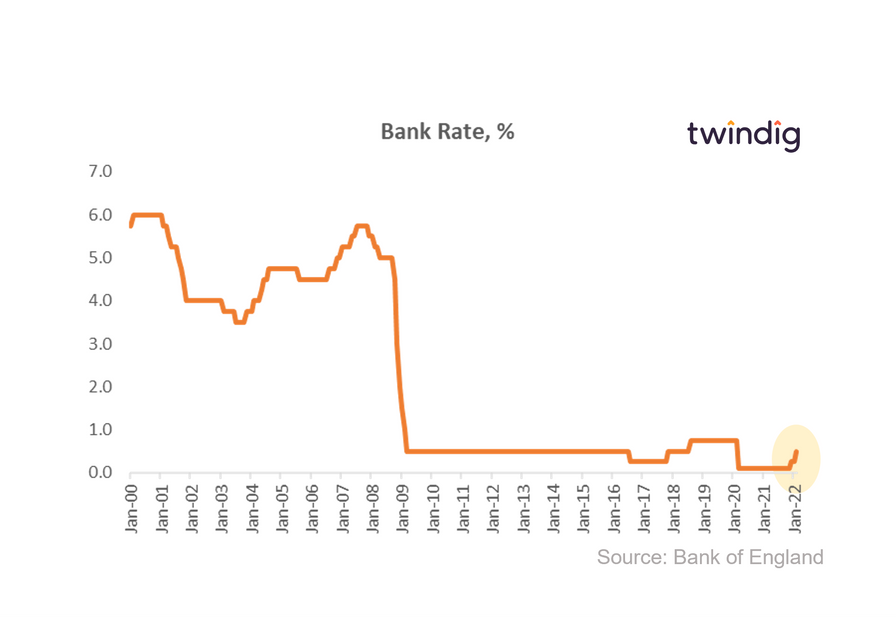

Bank Rate doubles

With inflation at record levels and expected to rise further it is no surprise that the MPC voted to increase Bank Rate this week and the doubling to 0.5% is certainly worthy of grabbing a few headlines, if there are any left to grab after the energy price hike stories fill the column inches.

However, the vote to double was a close run thing 5-4 in favour, although those in the minority had voted for a 0.5% rise to 0.75% a rise of 200%.

The prospect of further Bank Rate rises are therefore a racing certainty

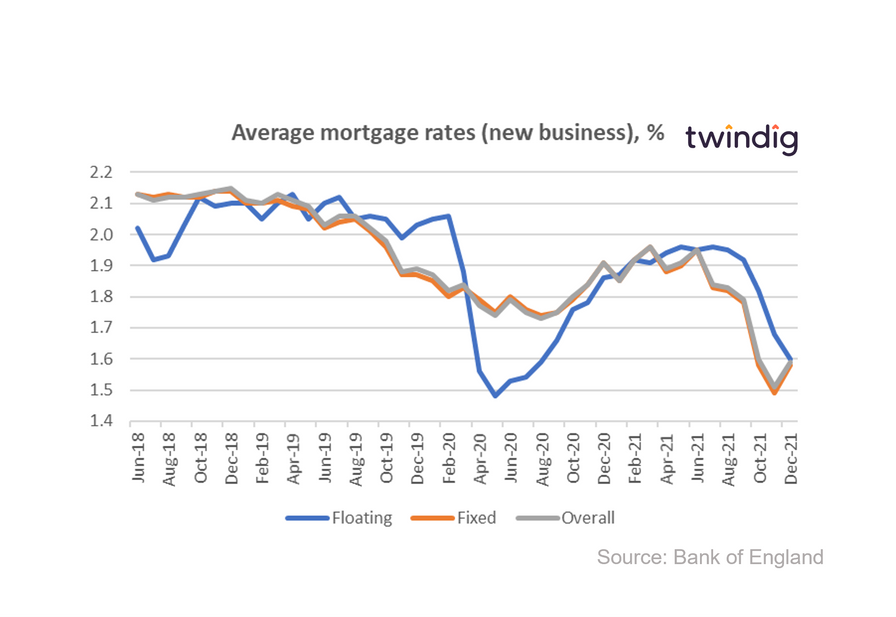

Average Mortgage Rates on the turn

The Bank of England raised Bank Rate in December from its all-time low of 0.1% to 0.25% in part as a response to rising consumer price inflation. It is perhaps a surprise therefore that on new business, floating mortgage rates (which are typically linked to Bank Rate) actually fell.

It was not a surprise that fixed rates rose as lenders need to consider their funding costs over the fixed-rate period and the trends in loan pricing. Most commentators including ourselves expect Bank Rate to rise further in 2022 and we, therefore, believe lenders are factoring in the impact of future rate rises.

Twindig Housing Market Index

As the UK Government launched its White Paper explaining how it would seek to level up the UK economy, the Twindig Housing Market Index nudged up by 0.8% to 86.2.

We were surprised that housing market investors did not react more strongly to the news that energy prices will increase significantly, a story that appeared to us to garner more headlines than the Levelling Up White Paper and the doubling of Bank Rate seemed to pass without comment.

Perhaps both stories highlight the fact that we live in an economy that needs levelling up. Some can participate in the housing market, whilst others can't and the impact of rising energy bills and interest rates does not appear to negatively impact those who can.