What does Levelling up mean for homeownership?

On Wednesday, 2 February 2022, the Department for Levelling Up, Housing and Communities published its ‘Levelling Up the United Kingdom White Paper, a bold plan to unleash opportunity and create a more equal society. In this article, we look, specifically, at What levelling up means for homeownership.

Levelling Up – the rallying call for homeownership

“By 2030, renters will have a secure path to ownership with the number of first-time buyers increasing in all areas; and the government’s ambition is for the number of non-decent rented homes to have fallen by 50%, with the biggest improvements in the lowest performing areas.”

Source: Levelling Up the United Kingdom White Paper Executive Summary

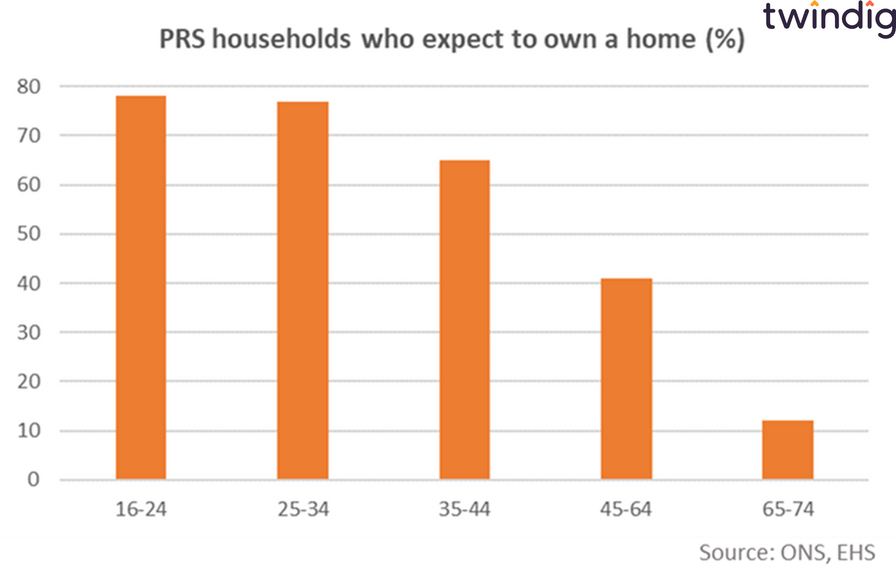

Most of us aspire to own our homes, especially those in rented accommodation as illustrated in the chart below, Brexit and COVID-19 and indeed rising house prices have done little to dent our enthusiasm or desire to own our homes.

The Levelling UP White Paper went on to say:

"We will ensure homeownership is within the reach of many more people. The Help to Buy scheme launched last year is focussing entirely on first-time buyers and we will build on the success of the Mortgage Guarantee Scheme by working with the lending industry to maximise the availability of low deposit mortgages."

We welcome the news that the Government will ensure that homeownership is within reach of many more people, but we don’t think that the existing policies, on their own, will deliver the desired results.

Help to Buy helping fewer, not more

The changes made to Help to Buy in April 2021 led to a reduction in the number of homes that qualified for Help to Buy support.

Before the rule changes in April 2021 around one in three new-build home sales used Help to Buy, this has since fallen to around one in five.

We understand why changes were made (restricting Help to Buy to first time buyers and putting regional price caps in place), but in terms of Levelling Up, the changes may lead to many families stuck in the wrong sized home at the wrong time. Without follow on assistance, the housing ladder is not fit for purpose for many who find the size of their household increase or if the family unit, regrettably, splits up.

Help to Buy is also scheduled to end in March 2023 and the Levelling Up White Paper did not suggest or hint that Help to Buy would be extended.

If the Government were serious about levelling up housing across the UK they would extend the Help to Buy scheme to include existing homes, as well as new builds, in our view.

Low deposit mortgages are an arrow, not a silver bullet

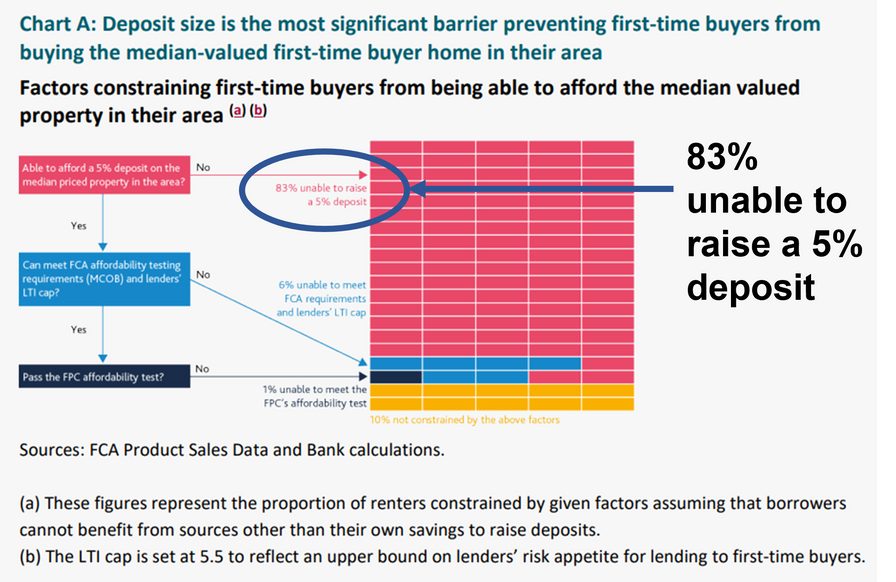

We also welcome the news that the Government is working with lenders to maximise the availability of low deposit mortgages. The Bank of England recently reported that 83% of first-time buyers are unable to raise a 5% deposit.

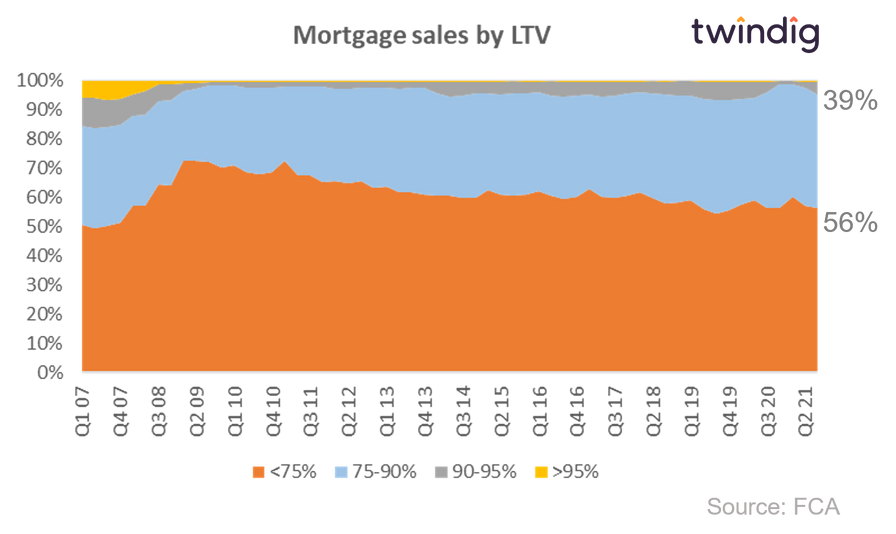

However, even if a 5% deposit is secured it is often not enough to bridge the gap between the price of the home and the mortgage secured. We show in the chart below the split of mortgages arranged by LTV. Currently, 56% of mortgages are for an LTV less than 75% and a further 39% between 75-90%. Less than 5% of mortgages are in the 90-95% range, and less than 0.35% are at 95% and above.

How do we level up the housing market?

In our view:

We won't build our way out of this crisis any time soon

5% deposits are not enough for most aspiring homebuyers to get a foot on the housing ladder

House prices are too high for many to be able to afford a home within the current system of sensible mortgage loan to income constraints

House prices are unlikely to fall significantly to address the issue of affordability

In short house prices are unlikely to come down and traditional mortgage lending will not bridge the gap between homebuyer deposits and house prices.

We remain convinced that the answer to levelling up the UK housing market is fractional homeownership, which we believe will increase the participation in the housing market and reduce the current level of housing wealth inequality, where if your parents don't own their home, you are unlikely to be able to afford a home of your own.