The case for fractional homeownership

The housing problem

It is very difficult to put money into the housing market.

It is very difficult to take money out of the housing market.

Typically, to put money into the housing market, we take on debt (a mortgage), and to take money out of the housing market (equity release) we also take on debt because traditional equity release is really taking on debt not releasing equity.

The UK is also facing a pension crisis. Too many people have too small a pension to fund their retirement.

The solution: Fractional ownership of property

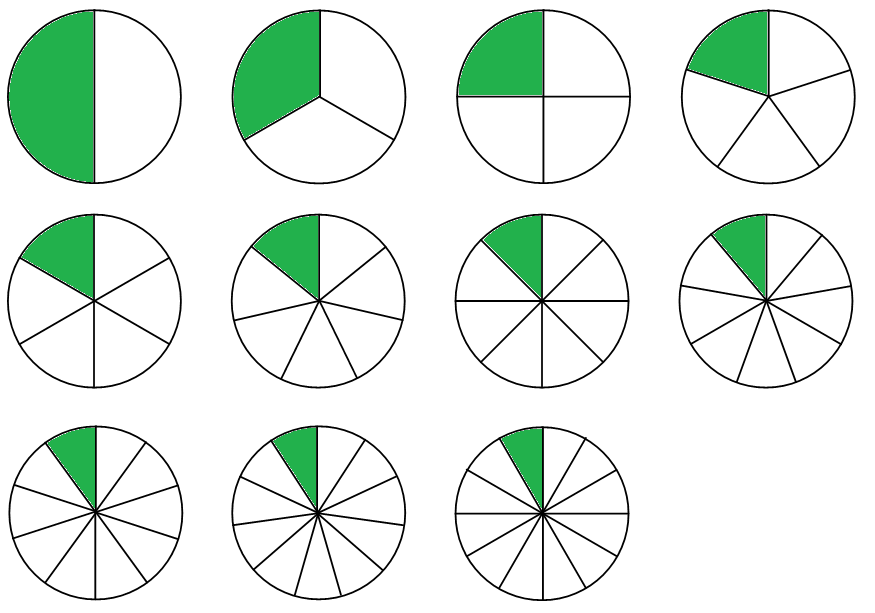

We believe that you should be able to put money into the housing market as you can afford to, and to take money out as you need it. Fractional ownership of residential property will allow it to be bought and sold one brick at a time without the need to take on debt.

Why do we believe fractional ownership is the answer?

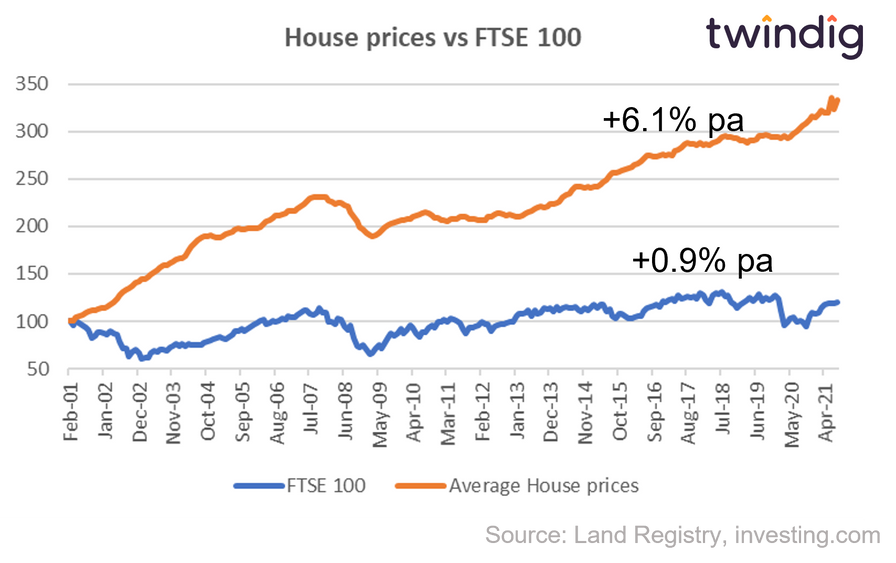

Residential property is one of the biggest, most understood and stable asset classes in the country and yet many are unable to access it to accumulate wealth. The growth in house prices consistently outperforms the performance of the FTSE 100 share price Index

We believe that greater participation in the property market will help reduce the inequality of wealth in the UK and help to solve the pension crisis. You should not need to already be wealthy to accumulate housing wealth.

Housing is one of the few products we need every day of our lives and therefore participation in the housing market should, in our view, be open to everyone.

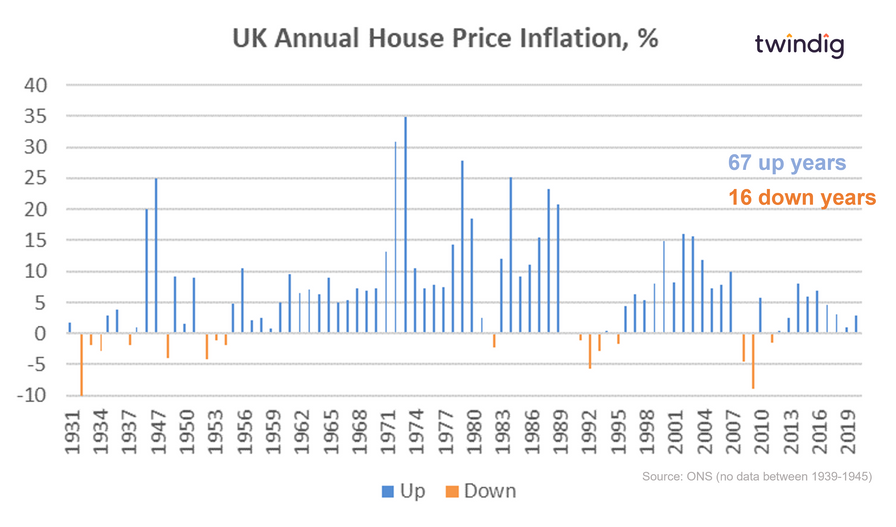

House prices are unlikely to fall

Many commentators suggest that house prices need to fall to address the current housing affordability crisis. We disagree. Whilst history is often a poor predictor of the future, history is fact-based and able to teach us lessons. House prices rarely fall.

We don't believe that house prices need to fall to solve the affordability crisis, you can read more about why we think that here: Why house prices don't need to fall to solve the housing affordability crisis

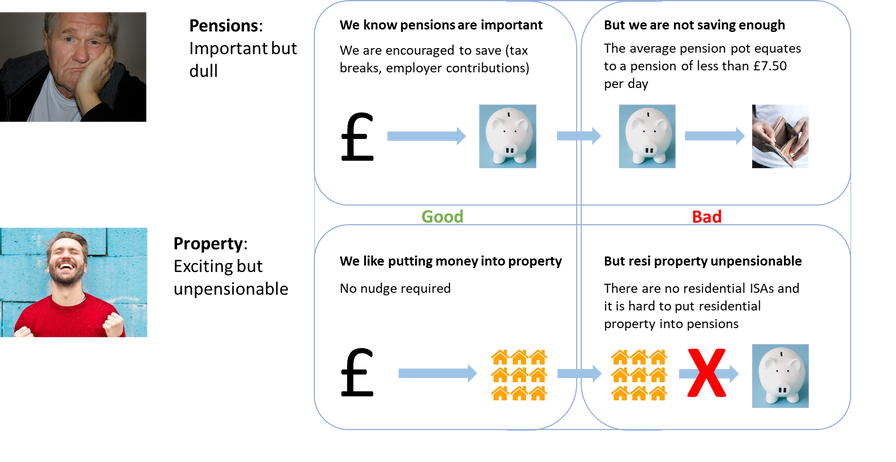

How could property help solve the pension crisis?

Whereas most of us view pensions as dull, boring and something to sort out tomorrow, we find property fun and engaging. Very few of us need to be encouraged to put money into property (or to save for a deposit).

We spend much longer talking to our friends about property than we do about pensions and whilst there are very few prime-time pension-related TV shows, the schedules are awash with so-called ‘property porn’.

We believe that if we could invest in property in a similar way to putting money into our pensions, we would all have bigger pension pots, but there is a catch, we cannot invest money into residential property without buying a whole house.

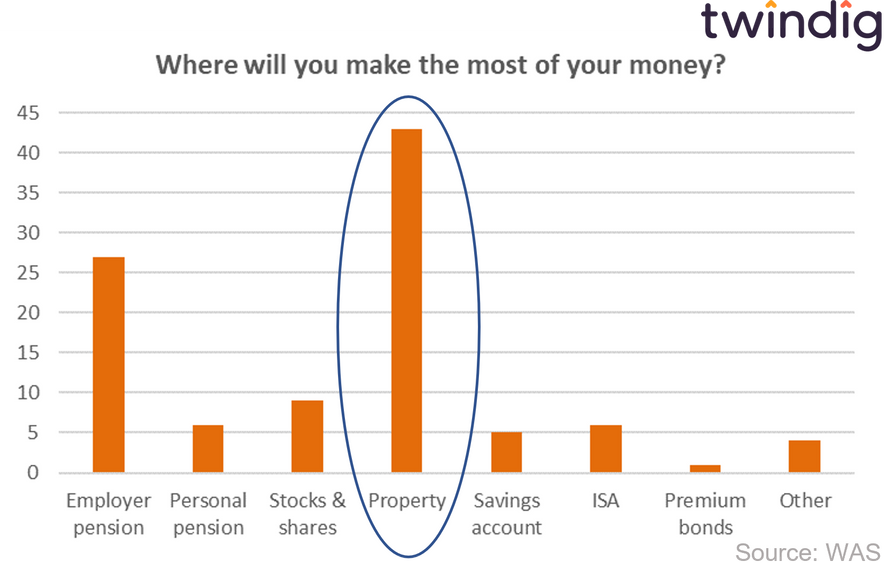

Property is consistently viewed by UK adults as the second safest way to save for your retirement

Property is also consistently viewed by UK Adults as the place, by a clear margin, where they expect to make the biggest financial returns.

We, therefore, believe that if there was an easier way to invest in UK Property that pension savings would rise and participation in the UK housing market would increase.

How can we make investing in residential property easier?

We believe that you should be able to buy and sell residential property one brick at a time, just as you can buy and sell companies listed on the stock market one share at a time.

It seems crazy to us that to invest in residential property you have to buy a whole house.

It also seems crazy to us that to release equity in your home, you have to take on debt, which is the exact opposite of releasing equity, in our view.

How can you buy residential property one brick at a time?

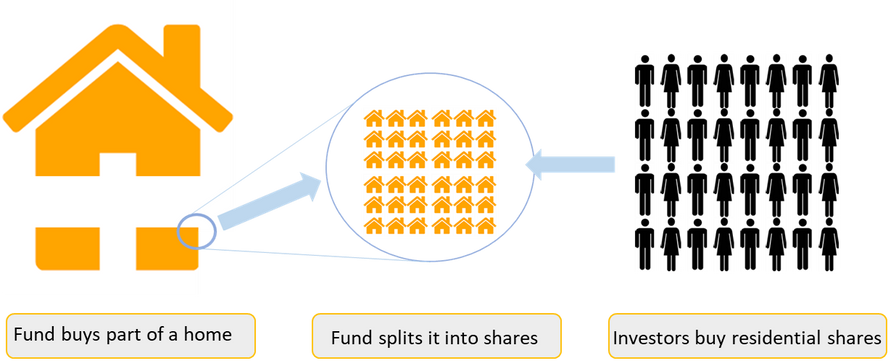

Just as the ownership of companies listed on the London Stock Market is split up into hundreds and thousands (if not millions) of shares, a housing stock market would split the ownership of homes into hundreds and thousands of bricks. This allows you to ‘buy as you go’, to start accumulating wealth in residential property without having to take on a lot of mortgage debt to buy a whole home.

It provides an opportunity for you to save for your deposit by actually investing in the housing market so that the value of your investment moves in line with the underlying housing market.

A housing stock market would also provide an opportunity for investors and homeowners to diversify their risk by spreading investment across many homes rather than putting it all on one (or a small number) of properties

Finally, a housing stock market would offer those who own their homes to sell a part of their home, to release equity without taking on the traditional debt of equity release.

In a nutshell, creating a marketplace where shares in residential properties can be bought and sold would allow property to be bought and sold one brick at a time without the need for debt.

What are the benefits of a housing stock market?

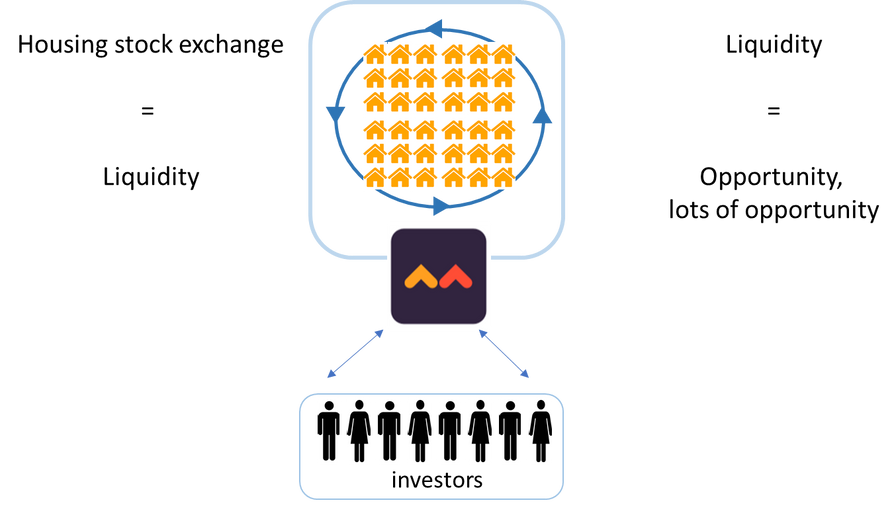

The main benefit is that a housing stock market will facilitate liquidity in what has until now been a very illiquid market. In our view, increased housing market liquidity brings many benefits:

Societal Goods of fractional homeownership:

Defusing the ticking pension time bomb

Helping more people to fund and enjoy their retirement and reducing the call on the public purse

Increased participation in the housing market

Helping first-time buyers build their deposits brick by brick

Helping those without access to the Bank of Mum and Dad accumulate housing market wealth

Reducing the level of housing wealth inequality

Economic goods of fractional homeownership

Putting up to £6 trillion of housing wealth back to work in the economy rather than sitting idly around in bricks. We estimate that the level of unmortgaged housing assets across the UK is in the region of £6 trillion.

Financial goods of fractional homeownership

Housing wealth is currently a prisoner in our own homes. It is a mirage, you can see it, but not touch it, to release housing equity today you have to take on debt that will need to be paid back (with interest) tomorrow

Fractional homeownership would allow you easy access to your housing wealth as and when you need it. No debt. No interest.

Investor goods of fractional homeownership

A new asset class with a potential market size around three times more than the London Stock Market.

Disruption of the mortgage market

Fractional homeownership and a housing stock market would provide a new way to buy your home and a new debt-free way to finance repairs, maintenance and enhancements without taking on debt. Just as a company issues shares to raise capital, a homeowner could sell shares in their home to pay for home improvements such as an extension or the installation of a climate-friendly boiler.

Is fractional ownership of residential property likely in the future?

Yes, it is. The Land Registry has already completed a pilot scheme to tokenise the ownership of property. In this case, ‘tokenisation’ is the process where the ownership rights of a property are split into hundreds and thousands of tokens (much like fractions or shares). The Land Registry’s demonstration illustrates how tokens could be bought and sold. Whilst the pilot scheme has not been rolled out, it is clear, in our view, the way things are heading and that it is a question of ‘when’ rather than ‘if’ fractional ownership rights to property in the UK will be recognized.

Is Help to Buy a form of fractional homeownership?

Yes. Help to Buy is a form of fractional ownership, but the fractions are large (Help to buy’s fraction is up to 20% of the value of the home being purchased). However, the home buyer still needs to put down a 5% deposit and secure a traditional mortgage for the remaining 75% of the cost of the home.

Help to Buy is only available for first-time buyers

Help to Buy is only available on new build properties

Help to Buy is constrained by regional price caps

Is shared ownership a form of fractional homeownership?

Yes, housing associations, local authorities and several private companies offer a range of shared ownership products which are a form of fractional ownership. As with Help to Buy the fractions tend to be large. Typically, you need to initially buy at least a 25% stake in the home although the private sector company Wayhome allows you to start with as little as 5%.

You can increase your stake by a process called staircasing, but in most cases in the public sector, you will need to buy a large chunk of the home for it to make financial sense, otherwise the fees may cost more than the additional part of the home you are buying. However, some housing associations such as Metropolitan Thames Valley allow you to staircase up by 1% each year. Wayhome allows you to buy additional stakes by making overpayments on your rent.

What is the pension crisis?

In simple terms, the average UK adult has a pension pot of around £62,000 at the time of their retirement and they expect to enjoy 23 years of retirement.

This equates to less than £7.50 per day, more than 6x lower than the UK minimum wage of £47.50 per day.

Doesn’t the UK Government encourage us to save for our pension?

Yes. There are attractive tax breaks for pension contributions, employers have to operate auto-enrolment schemes and employers have to pay money into your pension. In addition, many employers also match your contributions. Effectively there is free money on offer to encourage us to save for our pensions, but, we still don’t save enough.

Why do we have a pension crisis?

Good question. We all know that pensions are important, the Government knows they are important, and the Government incentivises us to save for our pension, but we don’t save enough.

Psychologists tell us we don’t save enough for three key reasons:

Hyperbolic discounting – jam today. We tend to choose immediate rewards over larger rewards that are deferred. This is the classic ‘marshmallow test’ first carried out at Stanford in 1972. Children tended to choose an immediate reward even though they knew if they waited, they would get a much bigger reward. It seems that our behaviour as children stays with us into adulthood. The problem of delayed gratification is that it is, delayed.

Status Quo Bias – procrastination. We know pension planning is important and we will start tomorrow, tomorrow becomes next week, next week becomes next month, next month becomes next year…

Planning fallacy – optimism. We underestimate how big a pension we will need, how long it will take to build, and how much we need to invest each month