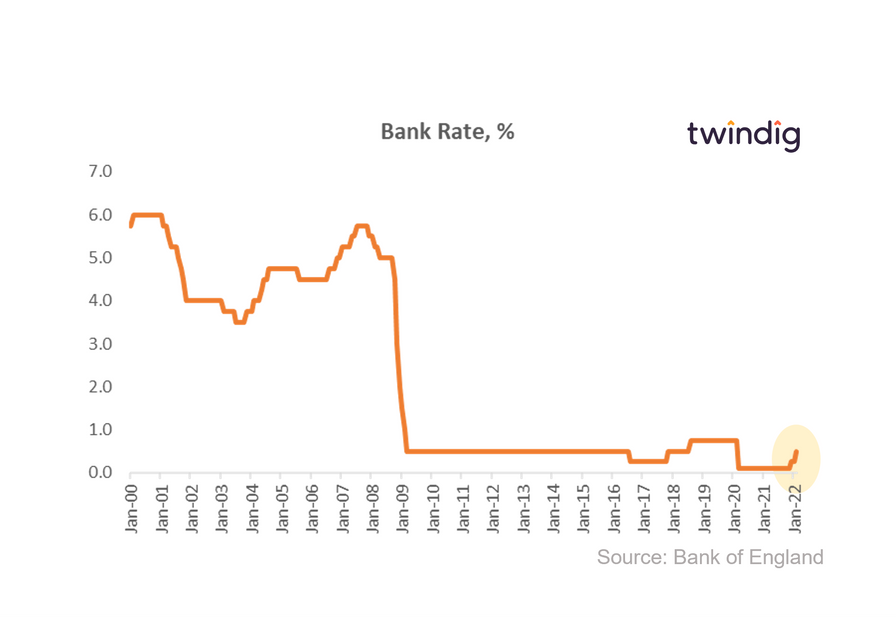

Bank Rate doubles

The Bank of England voted 5-4 in favour of doubling the Bank Rate to 0.5% today and expect more increases to come.

Twindig take

Bank Rate doubles with more to come

With inflation at record levels and expected to rise further it is no surprise that the MPC voted to increase Bank Rate today and the doubling to 0.5% is certainly worthy of grabbing a few headlines if there are any left to grab after the energy price hike stories fill the column inches.

However, the vote to double was a close run thing 5-4 in favour, although those in the minority had voted for a 0.5% rise to 0.75% a rise of 200%.

The prospect of further Bank Rate rises are therefore a racing certainty, in our view as the Bank of England looks to curb the rise of inflation, which it expects to increase further in coming months, from 5.4% to close to 6% in February and March, before peaking at around 7¼% in April.

It is certainly unfortunate timing to announce the rise in Bank rate on the same day as households received the hammer blow of energy price increases and will squeeze further already squeezed costs of living.

A grey if not a silver lining?

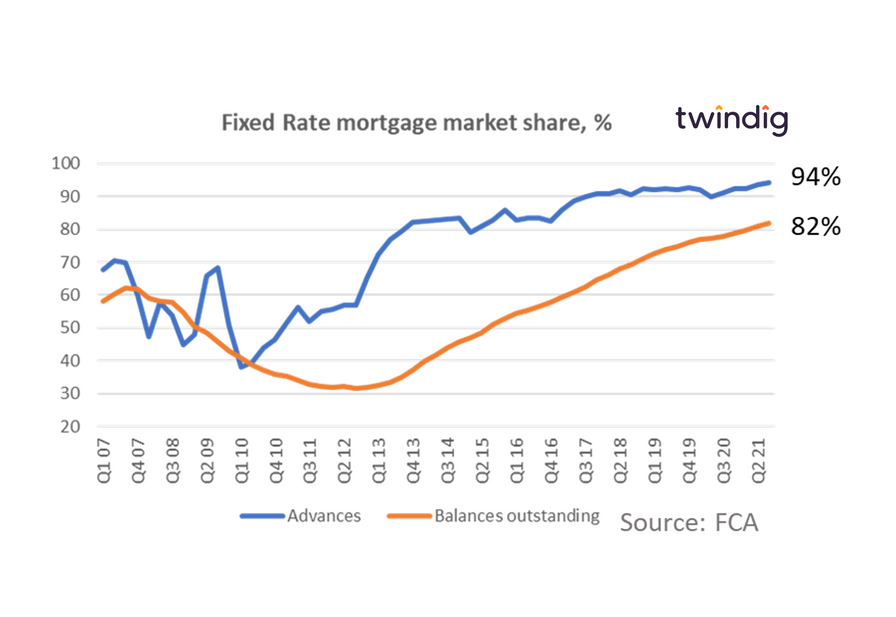

Unlike the rise in energy costs which will be immediate, for many the Bank Rate increase will take time to hit household budgets. Latest data from the FCA suggests that in Q4 2021 94% of gross mortgage advances were fixed-rate mortgages and 82% (just over 4 out of 5) of all mortgages are on fixed-rate deals which means that the mortgage rate will not change until the current mortgage deal expires.

What does the Bank Rate rise mean for me?

The average floating mortgage rate is currently 2.23%. The 0.25% rise in Bank Rate is likely to be passed on moving the mortgage rate to 2.48%.

For a £100,000 repayment mortgage the increase in mortgage rate from 2.23% to 2.48% will lead to an increased mortgage payment of £12.19 per month taking the monthly payment from £434 to £446 per month.