Twindig Housing Market Index (HMI) - 5 February 22

As the UK Government launched its White Paper explaining how it would seek to level up the UK economy, the Twindig Housing Market Index nudged up by 0.8% to 86.2.

We were surprised that housing market investors did not react more strongly to the news that energy prices will increase significantly, a story that appeared to us to garner more headlines than the Levelling Up White Paper and the doubling of Bank Rate seemed to pass without comment.

Significantly rising energy prices will impact households ability to save for a deposit and the reduction in disposable income will trim a homebuyers mortgage capacity, which, in theory, should impact house prices.

The doubling of Bank Rate, albeit from a very low base, will feed into mortgage costs and most, including ourselves, expect several more rate rises before the year is out.

Perhaps both stories highlight the fact that we live in an economy that needs levelling up. Some can participate in the housing market, whilst others can't and the impact of rising energy bills and interest rates does not appear to negatively impact those who can. Housing market investors judged that the pool of active participants in the housing market would not be materially impacted by the news of rising costs this week.

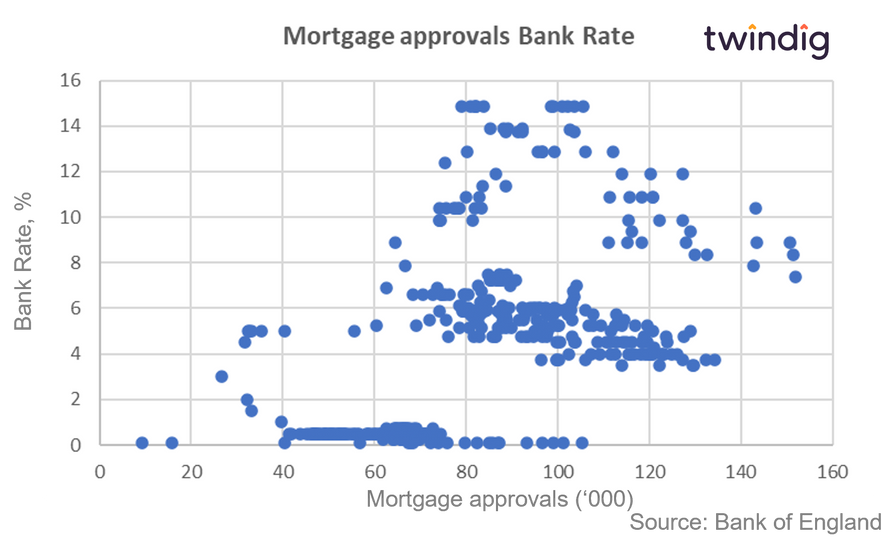

Historically Bank Rate has very little correlation to the number of mortgage approvals for house purchase, with mortgage approvals reaching a peak of 151,800 in May 1988 when Bank Rate was 7.38% (for context, in December 2021 mortgage approvals were 71,000 and Bank Rates was 0.25%. Yes, house prices were different, but so were wages. However, we estimate that the mortgage cost as a share of take-home pay was surprisingly similar 44.8% in May 1988 and 43% in December 2021. A similar relative cost but vastly different mortgage approvals.