Houselungo 24 October 21

A lungo length look at this week's housing market news

Is high multiple mortgage lending the answer to high house prices?

Halifax has increased its lending multiple on some of its mortgage products, increasing it from 5.0 to 5.5x salary. The increased loan-to-income (LTI) multiple is applied where the borrower’s income exceeds £75,000 pa and the loan-to-value (LTV) comes in below 75%.

An unexpected consequence of the COVID-19 pandemic is that house prices have increased significantly pushing homeownership out of the reach of many aspiring first-time buyers and frustrating the plans of home movers.

Why is this significant?

The Financial Policy Committee (FPC) a committee of the Bank of England stipulates that lenders should restrict the amount of lending they do at high LTI’s. The rules say that on a rolling 12 months basis, lending above 4.5x LTI must be less than 15% of the lenders business.

The FPC also has a strict affordability test, where a mortgage rate stress test must be applied to assess whether the borrower could still afford their mortgage if at any time during five years from the start of the loan Bank Rate increased by 3 percentage points.

The Bank of England also points out that the risk of mortgage payment default increases if the borrower’s LTI is more than 4.5x and their Debt Service Ratio (DSR) is above 40%. A DSR measures how much your debt payments take up of your net income.

In our view, this high LTI mortgage pushes at the boundaries set by the Bank of England. However, the mortgage is not high risk in and of itself, the risk relates to how it will be used, and how those using it perceive it.

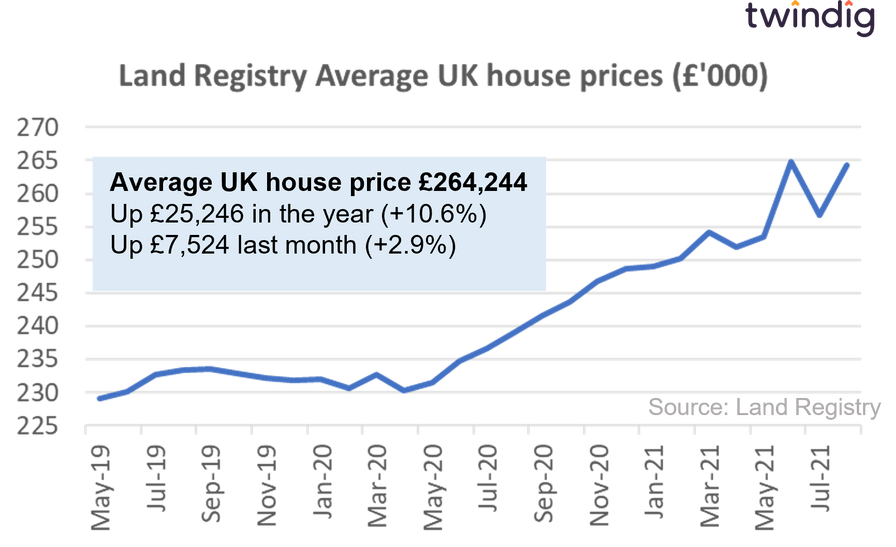

UK House prices: Rising again in August

The average house price in the UK is £264,244, average prices have increased by 10.6% or (£25,246) over the last year, and increased by 3.2% or (£7,524) last month. We note that these figures are provisional and subject to change, however, the size and the scale of this bounce back after the fall in July is surprising and perhaps reflects a second push by homeowners to complete transactions before the end of the Stamp Duty Holiday.

UK average house prices have increased by 14.6% (£33,600) since the start of the COVID-19 pandemic.

UK average house prices rise in August

UK house prices rose across all regions in August 2021, rising on average by £7,524 as homebuyers raced to beat the second stamp duty holiday deadline.

We did not expect such a large bounce back in house price in August, which suggests that homebuyers remain confident about the strength of the housing market after the stamp duty holiday comes to an end. We continue to believe that in the medium-term demand will outstrip underpinning house prices.

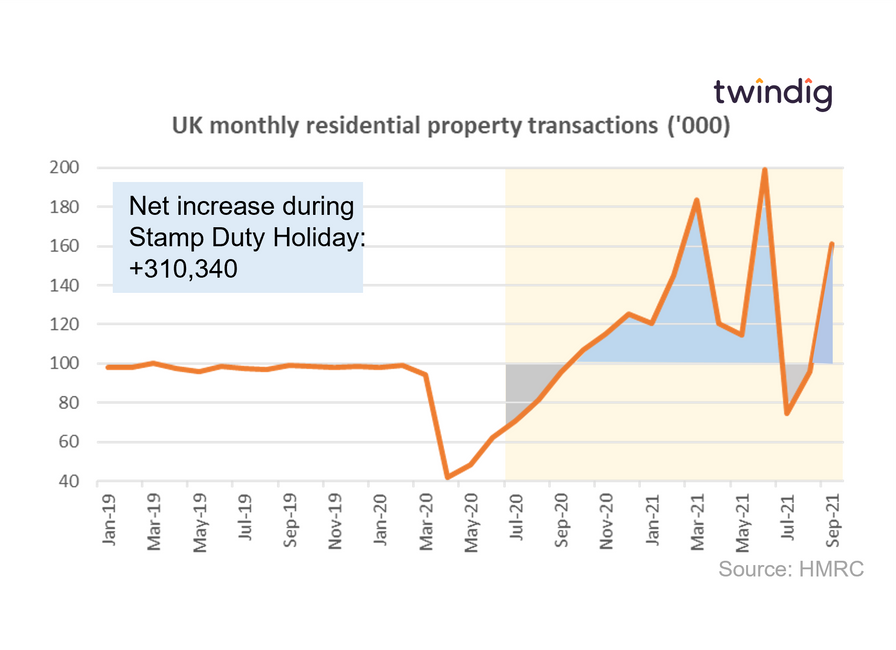

Housing transactions spike in September

Not surprisingly housing transactions spiked in September as the final stage of the Stamp Duty Holiday drew to a close. Provisional data from HMRC suggests there were 160,950 housing transactions in September 2021 which is 68% higher than both August 2021 and September last year. We estimate that there were more than 310,000 additional housing transactions completed during the Stamp Duty Holiday.

Interestingly the third spike was the lowest (the others being March 2021 (the original holiday end date) and June 2021 (the end of the £500,000 Stamp Duty Threshold). In our view the spike was lower than the previous two for three reasons:

The amount of the tax benefit had been reduced

House price increases since the start of the stamp duty holiday had more than outweighed the benefit of the tax saved

The rush to beat the deadline was less intense because the end date of the stamp duty holiday had been very clearly communicated.

Is a long term fixed-rate mortgage right for you?

The price of certainty

Research from Kensington Mortgages found that more than 80% of homeowners and those looking to buy a home would consider paying a £1,200 premium for a long-term fixed-rate mortgage.

Kensington polled 2,000 renters and 2,000 homeowners and called the extra cash people were willing to pay a ‘certainty premium’

The research found that there was a lack of awareness among homeowners and homebuyers about long-term fixed-rate mortgages with around one in four (26%) believing that the longest fixed-term fixed-rate mortgage is between two and five years, with just over one in ten (12%) saying a long term mortgage could last up to 40 years.

Not surprisingly among renters and aspiring homeowners seven out of ten (70%) would consider a long-term fixed-rate mortgage if it meant that they could afford to buy a home instead of rent one. Among homeowners, three quarters would consider a long-term fixed-rate mortgage if it allowed them to borrow more and buy a bigger home.

However, there are pros and cons to long-term fixed-rate mortgages

London house prices by borough

The latest data from the Land Registry shows that the average house price in London rose by 5.6% or £27,810 to £525,893 in August 2021. House prices rose in 29 of the 34 London boroughs during August.

The biggest London house price gains last month were to be found in the City of Westminster up £93,112 (10.3%), Camden up £79,246 (9.1%) and Kensington and Chelsea up £65,040 (4.7%)

The biggest falls were Harrow down £16,566 (3.5%) Lambeth down £13,369 (2.7%) and Brent down £5,957 (1.1%).

House Prices in London

The average house price in London is £525,893. This is 87% or £244,972 higher than the £280,921 average house price in England.

House prices in London have risen by 7.5% over the last twelve months compared to an average increase in house prices across England of 12.0%.

In absolute monetary terms, this translates to an average increase of £36,469 in London and £25,119 in England. House prices in England have therefore increased more in relative, but less in absolute terms than they have in London over the last 12 months.

To see the house prices and house price trends by London borough click Read more below:

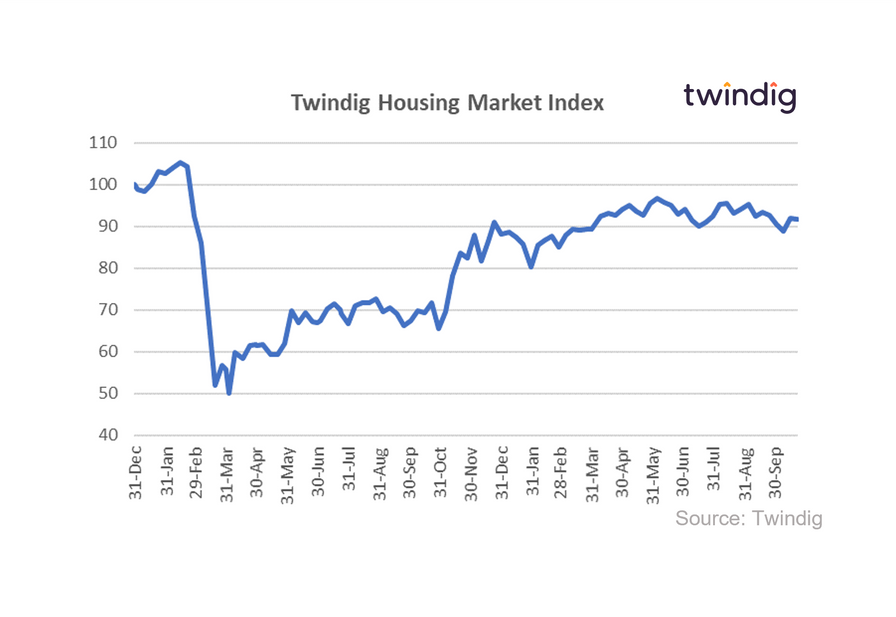

The Twindig Housing Market Index

In a week where the Land Registry reported rising house prices, the Halifax raised mortgage loan-to-income lending multiples, and HMRC reported a rise in housing transactions, the Twindig Housing Market Index fell slightly by 0.3% to 91.6 this week.

The rise in housing transactions coincided with the end of the COVID-19 Stamp Duty Holiday as homebuyers rushed to complete their transaction before the 30 September and save up to £2,500 of Stamp Duty. We expect that housing transaction levels will fall in October turning the increase last month into the 'September Stamp Duty Holiday Spike'.

There was also an interesting debate raging about the logic or 'rightness' of offering longer-term mortgages up to say 40 years and increasing lending multiples. Those in favour say they help those who couldn't otherwise afford a home to buy one, and those against suggesting that increased lending is what drove up house prices in the first place and is the cause of the problem and not the solution.