Houselungo 22 May 22

House price growth slows

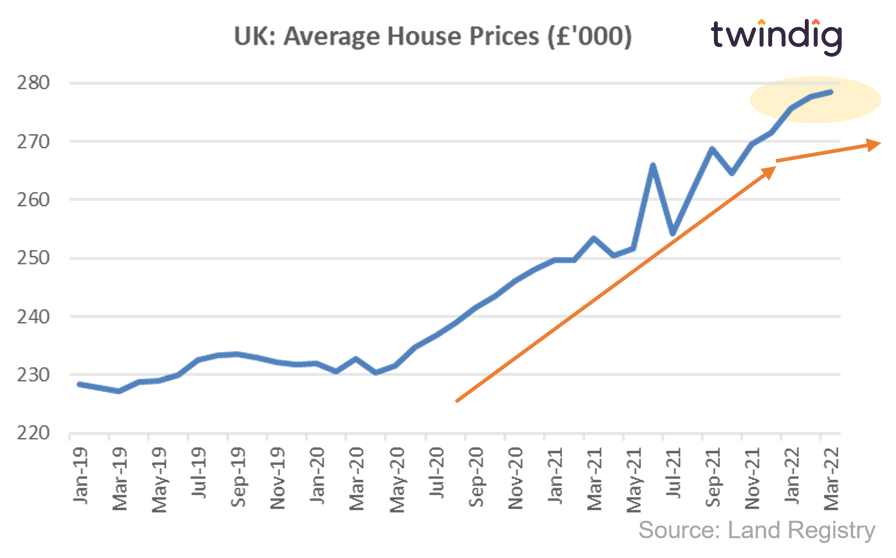

The average house price in the UK is £278,436, average prices have increased by 9.8% or (£24,931) over the last year, but increased by just 0.3% or (£748) in March. It seems that although house prices went up in March 2022 the rate of increase appears to be slowing. Is this just a spring sneeze or the start of a house price cold?

UK average house prices rise in March (just)

UK house prices rose in seven regions and fell across three regions of the country in March 2022. Overall average house prices rose by £748 across the UK, this was a significantly smaller rise than in February when average UK house prices increased by £1,946 suggesting that as the costs of living rise some of the heat may be coming out of the UK housing market.

We continue to believe that in the medium-term demand will outstrip underpinning house prices.

In the article below we look at the house price performance of each region across England and Wales.

London house price fall

The latest data from the Land Registry shows that the average house price in London fell by 0.9% or £4,745 to £523,666 in March 2022. House prices fell in 15 of the 34 London boroughs during March

The biggest rises were in the Kensington and Chelsea up £77,590 (5.7%) the City of Westminster up £24,530 (2.4%), and Ealing up £17,650 (3.3%).

The biggest London house price falls last month were to be found in the City of London down £27,420 (3.5%), Hackney down £17,990 (2.8%) and Camden down £15,620 (1.8%).

House Prices in London

The average house price in London is £523,666. This is 76% or £226,142 higher than the £297,524 average house price in England.

House prices in London have risen by 4.8% over the last twelve months compared to an average increase in house prices across England of 9.9%.

In absolute monetary terms, this translates to an average increase of £23,804 in London and £26,897 in England. House prices in England have therefore increased more in relative terms, but less in absolute terms than they have in London over the last 12 months.

To see the house prices and house price trends by London borough keep reading, you will find all that house price data in the body of this article.

London House Price Outlook

After a very hectic couple of years in the London housing market it seemed initially in 2022 that the London housing market was returning to more normal trading patterns, although a shortage of homes for sale was keeping prices keen.

However, as the cost of living crisis starts to bite it seems some of the house price momentum is starting wane. House prices actually fell in 15 of London's 34 boroughs in March 2022.

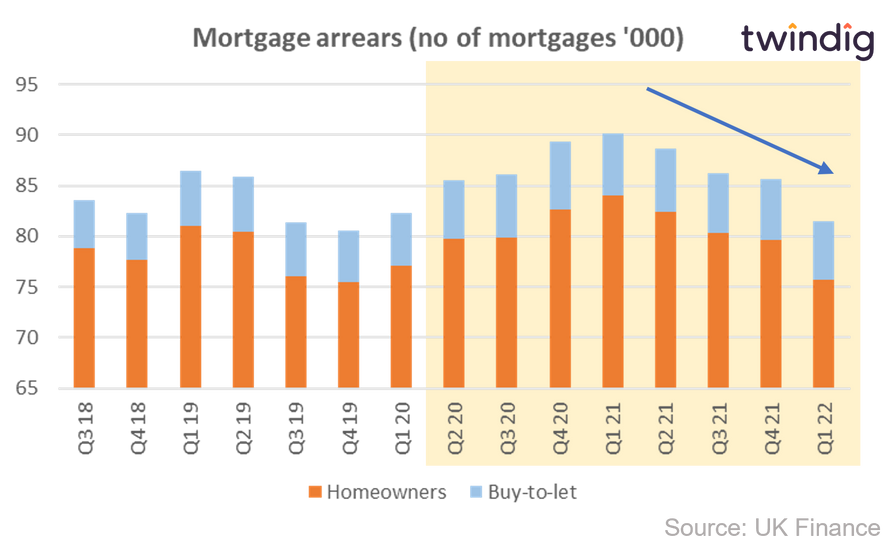

Mortgage arrears and possessions fall

UK Finance released data this week about mortgage arrears and possessions in the UK

What they said

The total number of mortgage customers in arrears fell in Q1 2022

There were 75,670 residential mortgages in arrears of 2.5% or more at the end of March 22

Overall mortgage arrears are lower than they were before the start of the COVID-19 pandemic

Possessions are increasing, but remain significantly lower than they were before the COVID-19 pandemic began.

Twindig take

It is good news that the number of households in mortgage arrears is falling and that the number of possessions, although rising remains lower than before the pandemic.

Is Keyzy the easy peasy way to buy a home?

Keyzy is the latest in a growing number of young innovative companies that is on a mission to make the home buying process easier and more affordable.

Keyzy focuses on helping to unlock the housing market for first-time buyers who are currently locked out through a rent-to-own model. They are seeking to solve the same problem, as wayhome, but in a similar, but subtly different way.

Twindig Housing Market Index

In the week that UK inflation hit a 40 year high, the Twindig Housing Market Index rose by 1.8% to 74.7. After three weeks of declining investor confidence in the housing market, we were a little surprised that the record high for inflation did not further knock that confidence.

Few are immune to the impact of inflation in our economy, and I certainly got a fright when I filled my car with fuel this week, and spending patterns will change as prices rise.

This could mean that we end up spending more time in our homes and if that is the case, the same factors that drove the housing market during lockdown may once again come into play. Spending more time within the same four walls may increase the desire for a bigger home and going out less may increase the attractions of a bigger garden.

However, are we starting to see not a race for space, but a 'race for savings' in home buying patterns?