Mortgage arrears and possessions

UK Finance released data today about mortgage arrears and possessions in the UK

What they said

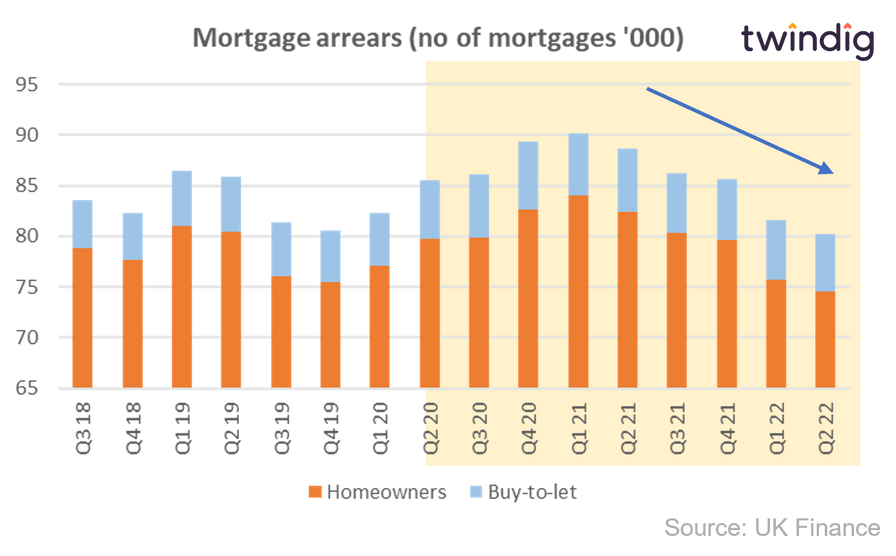

The total number of mortgage customers in arrears fell in the second quarter of 2022

There were 74,540 residential mortgages in arrears of 2.5% or more at the end of June 2022

Overall mortgage arrears are lower than they were before the start of the COVID-19 pandemic

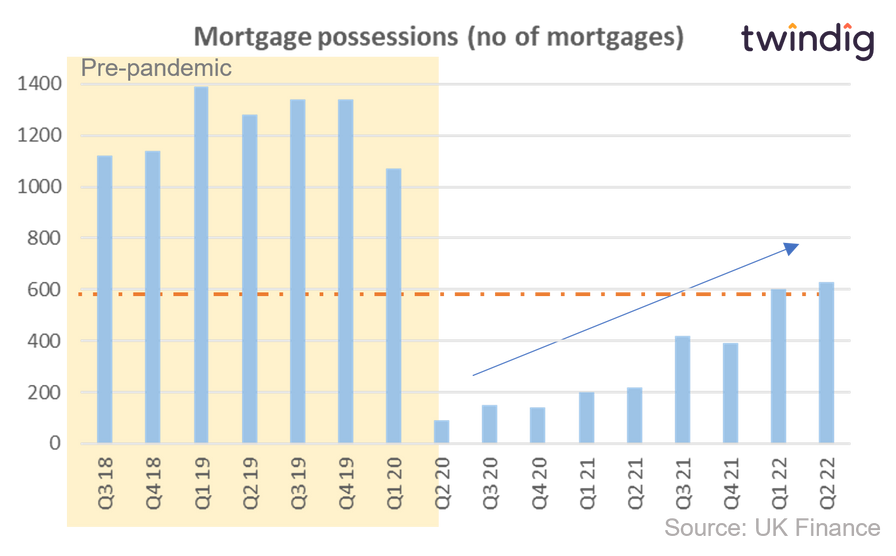

There were 530 more possessions in the second quarter of 2022 compared to the same period last year

Twindig take

It is good news that the number of households in mortgage arrears is falling and that the number of possessions, although rising remains significantly lower than before the pandemic.

Mortgage Arrears

The balance of 74,540 in mortgage arrears at the end of June 2022 is around 1,000 fewer than in the previous quarter and 7,840 fewer than in June 2021.

Among those mortgages in arrears are 25,160 mortgages with between 2.5% and 5.0% in arrears, so-called early mortgage arrears. This is 1% lower than the previous quarter and 14% lower than in June 2021.

Those with significant mortgage arrears (10% or more) number 28,840 (39% of the total), which is 2% lower than the previous quarter and 2% lower than in June 2021.

Mortgage Possessions

The number of mortgage possessions, although rising, remains low, however, the voluntary possessions moratorium, which ran from 1 March 2020, came to an end on 4 January 2022, and the number of cases has been increasing as the courts work through a backlog of cases. There were 530 more possessions in the second quarter of 2022 than in the same period last year, but this is still around half of the number seen during the second quarter of 2019 (pre-pandemic).

UK Finance points out that many of these borrowers would have been in financial difficulty before the pandemic and the number of possessions is likely to rise in the coming month, in our view.

What should I do if I am struggling to pay my mortgage?

If you are facing financial difficulties or struggling to pay your mortgage, it is important to speak with your lender as soon as possible. All lenders have policies and procedures in place to help those in need and are willing to work with you to help you.

Workout your budget

One of the first things to do is to work out your budget (the money coming in and the money going out). Write down all your income each month and all the money you spend. If that seems very daunting or if you are not sure where to start, you can use our budget template

It will be very helpful to work out what you can afford to pay even if it isn't the full mortgage amount. Your lender will work with you to agree a payment plan

Check if you are eligible for Breathing Space

Breathing Space is a legally enforced UK Government scheme designed to give you time to seek professional debt advice. Whilst you are using Breathing Space your mortgage lender and other people you owe money to are unable to force you to pay or take legal action to recover the money you owe them. Breathing Space will provide you upto 60 days protection from the people and companies you owe money to

Where to turn for mortgage arrears help

There are also several organisations that can help you manage your mortgage arrears

Citizens Advice is a network of charities which offer free confidential advice on whatever problems you are facing or dealing with, including financial difficulties and mortgage arrears.

Stepchange provides free confidential and expert advice and money guidance and has a team on hand to help you with your mortgage issues

Shelter is a housing charity which believes that home is a human right, they have teams on hand to help you with all your housing related problems and this includes help for those in mortgage arrears and those facing possession