Household Budget Template

Twindig Household Budget Template

The Twindig Household Budget Template is designed to help households see how much money they have and where it is being spent.

The aim is to allow households to calculate their mortgage capacity (how much money they have available for mortgage payments) and their disposable income (how much money they have to spend each month once all their existing financial obligations and necessary expenditure has been made).

How to use the Household Budget Template

Simply fill in the tables with your income and expenditure.

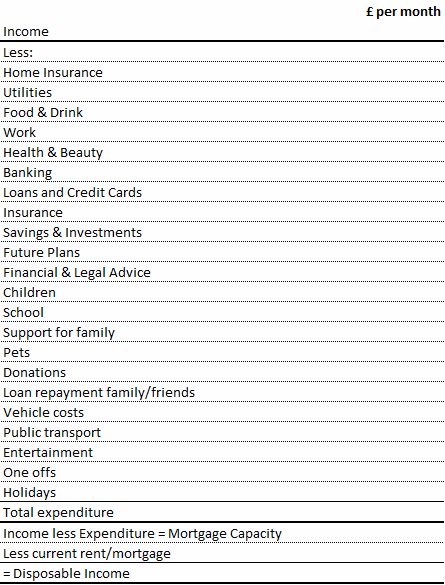

Table 1 is the summary table for all income and expenditure categories which allows households to calculate their mortgage capacity and disposable income

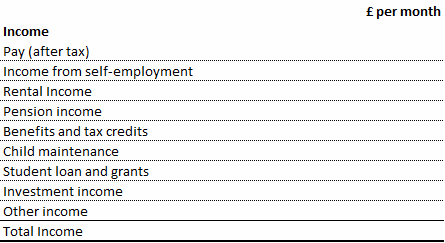

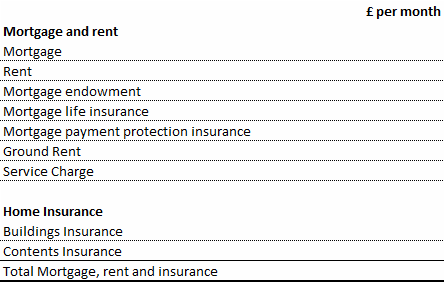

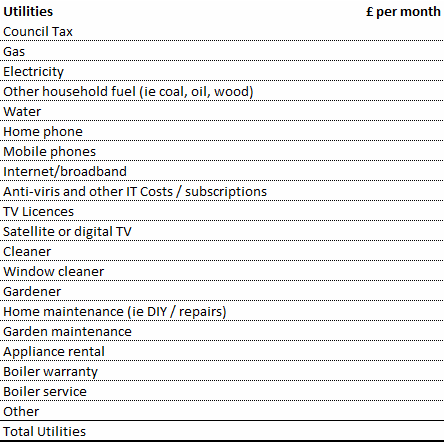

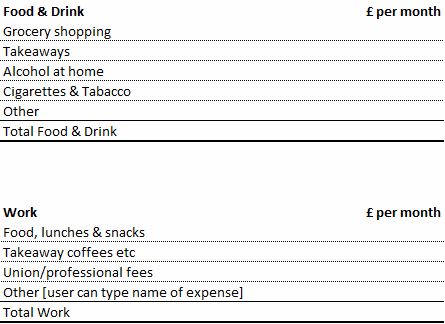

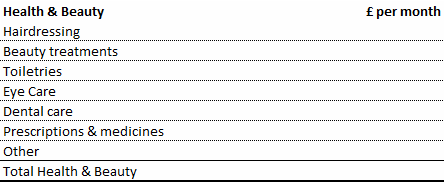

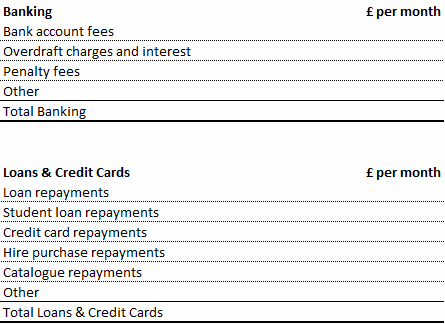

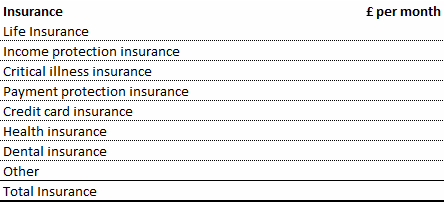

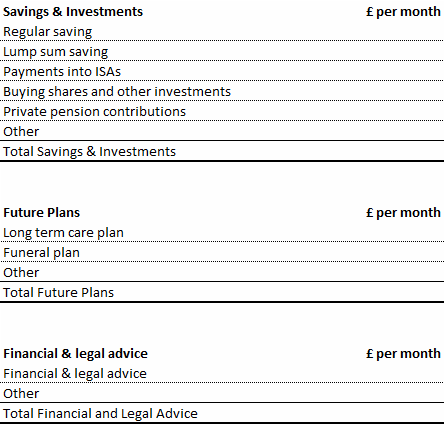

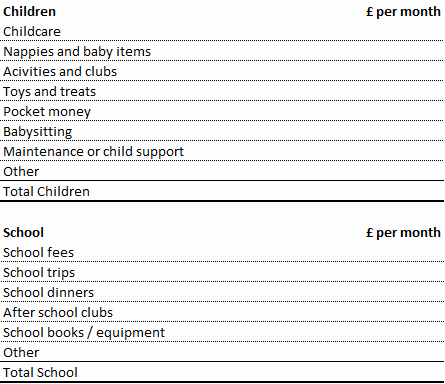

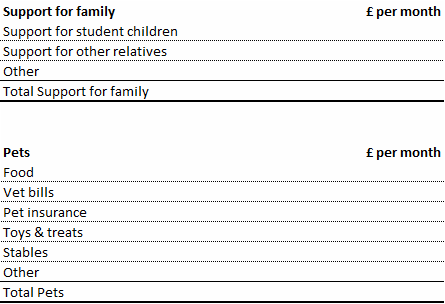

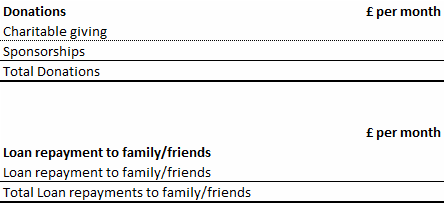

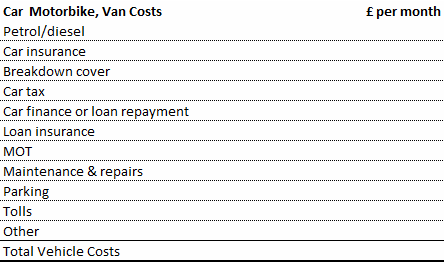

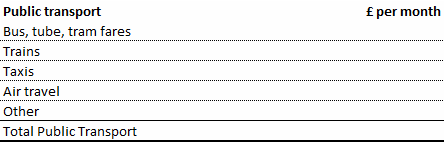

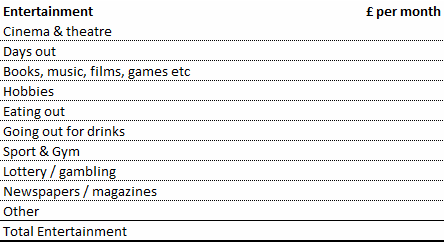

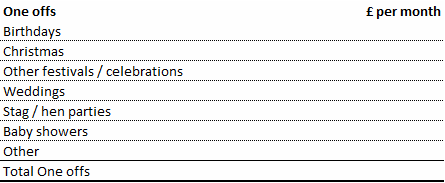

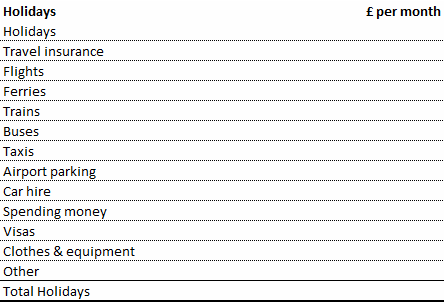

Table 2 provides detailed tables, breaking down each of the income and expenditure categories in the summary Table 1 to help households build a detailed and accurate picture of their income and expenditure.

As a rule of thumb, we suggest that in an ideal world your mortgage payment would not exceed 33% of your take-home pay. The figure on the bottom right of your payslip divided by 3.

Twindig Mortgage Calculator

We suggest that households use the Household Budget Template alongside our mortgage calculator which allows you to vary the size of the mortgage, the mortgage rate and the length of your mortgage.

You may have a fixed-rate mortgage, which means that the mortgage rate will not change for a fixed period of time usually between 2-5 years but it is worth stress testing the mortgage rate to see how you the mortgage payments may change if the mortgage rate increased at the end of the fixed-rate period.

We suggest as a minimum seeing what the mortgage payments would be using your lenders Standard Variable Rate and for a stress test 3 percentage points higher than your current mortgage rate. This means that if your current rate is 2% see what the payments would be if the mortgage rate was 5%

Twindig Stamp Duty Calculator

Stamp duty costs can come as an unwelcome surprise at a time when you are already spending a lot of money and most lenders will not allow you to add the Stamp Duty cost to your mortgage. You can prepare yourself by using our Stamp Duty Calculator to see how much Stamp Duty you will need to pay.

Twindig household budget Tables

The best way to complete these tables is to sit down with at least three months of playslips and bank statements and analyse how you spend your money. Try also to keep a note of any cash expenditures because even in these days of contactless payment those cash expenditures can soon add up. As a minimum record your cashpoint withdrawals in the tables below.

The tables may initially seem a bit daunting, but just like taking a course of nasty tasting medicine at the end of the day you will be glad you completed the task.

Table 1 Summary

Table 2 Workings for each income and expenditure category