Houselungo 18 July 21

A lungo length look at this week's housing market news

Housing market glass half full, but is it leaking?

The Bank of England published its Financial Stability Report this week

What they said

The outlook for economic growth has improved since the December 2020

House price growth and housing market activity during 2021 H1 were at their highest levels in over a decade

Despite the improved outlook, there remain downside risks to growth that could negatively impact financial stability, particularly in the short term

Twindig take

The Bank of England’s latest Financial Stability Report contained good news for the UK economy and the UK housing market, painting a picture of a glass more than half full. The outlook for economic growth is improving, mortgage availability is increasing and the households with high debt servicing levels remains significantly below pre-global financial crisis levels. However, the Bank of England does also sound a note of caution pointing out that rising COVID Case numbers or a drop in vaccine effectiveness could reverse the improving trends and lead to the economic glass being more than half empty. A case of we can see the edge of the woods, but we are not out of them yet.

Has your wealth increased during the COVID Crisis?

Think tank the Resolution Foundation published a report this week that looked at how the pandemic had impacted the wealth of households across the UK

What they said

Total household wealth increased by almost £900bn (up 6%) during the pandemic

Asset price appreciation was the primary driver helped by rising savings and falling debt

BUT not everyone was a winner

Twindig take

The COVID induced recession has been an unusual recession. It is the first in living memory where wealth has gone up rather than down as households have to a large extent not been able to spend any money as shops were closed and holidays taken off the calendar as a result savings have increased and debts decreased.

But the tide wealth has not risen at the same rate for all…

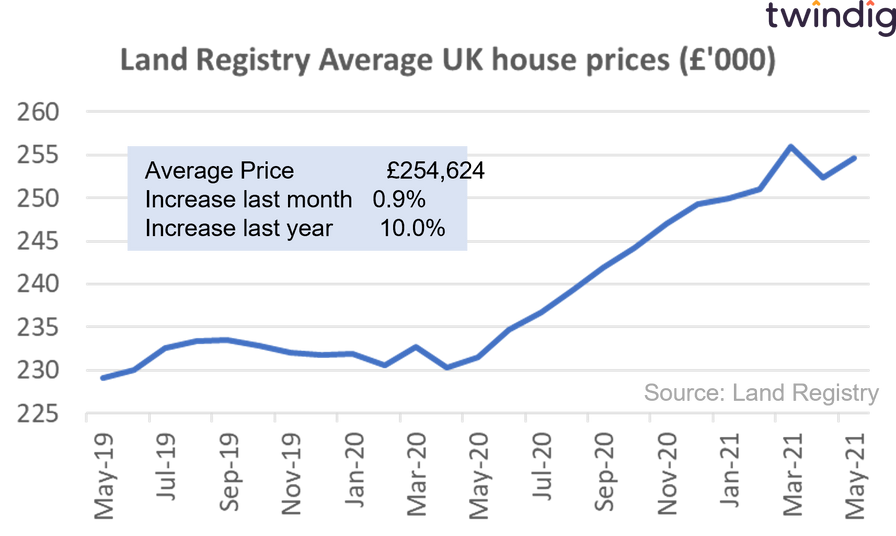

UK average house prices up more than £23,000...

The Land Registry published its House Price Index for May 2021 this week

What they said

Average UK house price £254,624

Annual House Price Inflation 10%

House prices have increased by more than £23,000 in the last year as demand exceeds supply

Twindig take

After a lull in April UK house prices resume their ascendancy in May, increasing by 0.9% and up by 10% of just over £23,000 in the last year as demand continues to outstrip supply. As COVID restrictions are relaxed it will be interesting to see if supply increases to meet the demand. If not, the housing rich will get richer and whilst aspiring owners will see their homeownership goalposts moved further down the road.

To find out more about house prices in your region click the link below

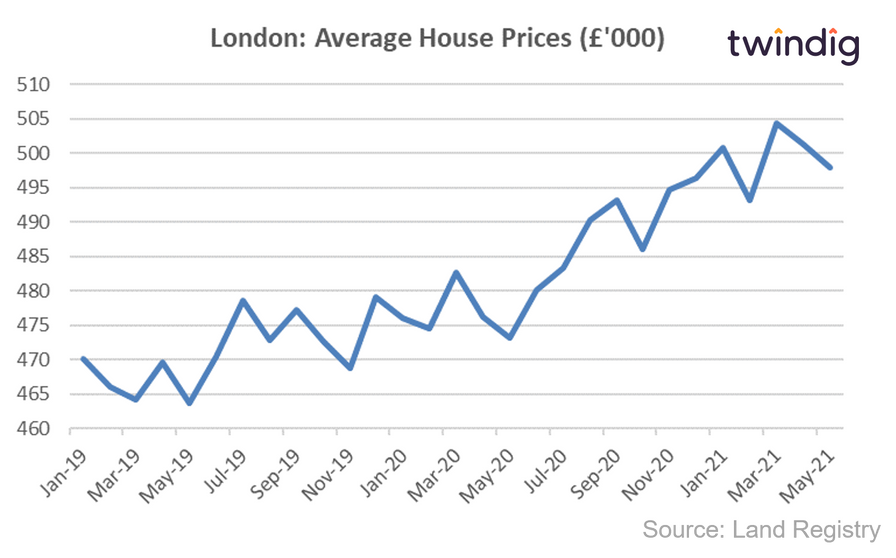

...Whilst London house prices fall by more than £3,000

The latest data from the Land Registry shows that the average house price in London fell by 0.7% or £3,262 to £497,948 in May 2021. However, during May 2021 house prices rose in 24 of the 34 London boroughs. House price falls in some of the more expensive boroughs weighed on the overall average and as the economy continues to open up we would expect house prices in London to rise in the coming months.

The biggest falls were in the City of Westminster down 2.9% or £29,087, followed by Hackney down £25,474 and Islington down £17,041.

The biggest London house price gains last month were to be found in the City of London up £52,728, Hammersmith & Fulham up £35,048 and Kensington & Chelsea up £28,188

Mortgage market: Supply speeding up as demand starts to slow

Barratt strong finish and a stronger start

FTSE 100 housebuilder Barratt released its full-year trading update this week

What they said

Completed home sales 17,243 (2020: 12,604, 2019: 17,856)

Private sales rates 0.78 net private reservations per site per week (2020: 0.60, 2019: 0.70)

Forward sales for FY22 14,334 (2020: 14,326 2019: 11,419)

Twindig take

Barratt delivered a strong finish to FY2021 and has started FY2022 stronger still, whilst many of us will be staycationing this year, there is no hint of a stamp duty holiday cliff for Barratt as forward sales for the coming year are ahead of their levels last year and the year before. Investment in land is also up, suggesting that Barratt is also confident about the longer-term prospects for the UK housing market and the cover-based dividend will be the icing on the cake for investors.