Houselungo 15 Jan 23

Millions to see mortgage payments rise

More than 1.4 million households will see their mortgage costs rise in 2023, are you one of them?

The majority of fixed-rate mortgages in the UK (57%) coming up for renewal in 2023 have fixed rates below 2%. Whereas those with either 2-year or 5-year fixed-rate mortgages due to renew in 2024 have mortgages with rates generally higher than 2%.

But mortgage rates starting to fall

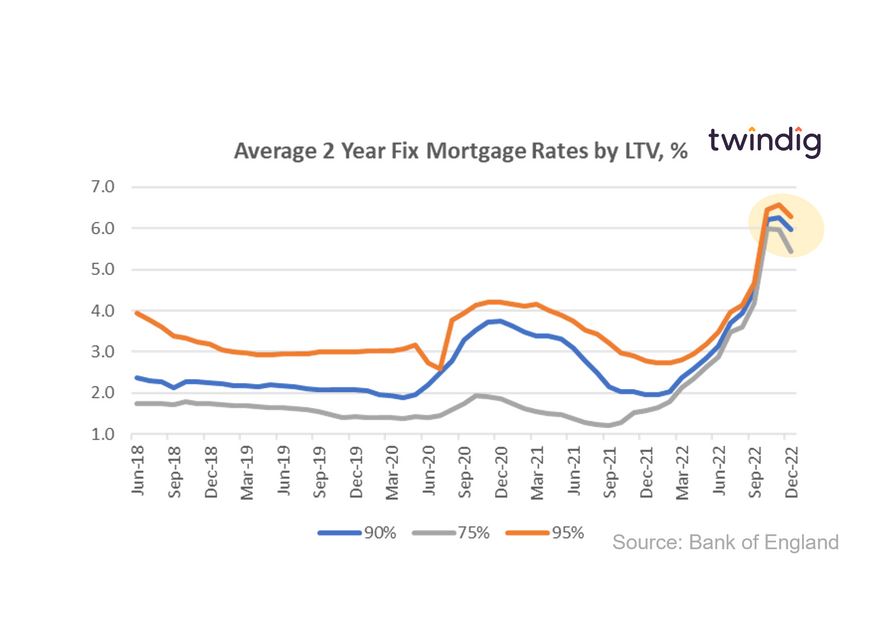

The Bank of England released average mortgage rates by Loan to Value (LTV) this week

What the Bank of England said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 5.43% (down 54bp)

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 5.96% (down 29bp)

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 6.29% (down 28bp)

Twindig take

Average mortgage rates fell in December 2022 as financial markets continued stabilising following the Autumn Statement in November. This is the first tangible sign that some of the damage caused to the housing market by the September mini-budget is being reversed.

At a time of rising living costs the reduction in mortgage rates will be welcomed by homebuyers across the country, and if we combine the impact of lower mortgage rates with falling house prices the good news gets even better.

Average mortgage rates fell in December 2022 as financial markets continued stabilising following the Autumn Statement in November. This is the first tangible sign that some of the damage caused to the housing market by the September mini-budget is being reversed.

What we learnt from housebuilders this week

This week saw several housebuilders reporting trading updates for the period ended 31 December 2022 and providing an early look at UK housing market conditions so far in 2023

Here are the key themes:

- A year of two halves

- Sales rates and order books down

- Mortgage market starting to return to normal

- First-time buyers in short supply

- Bye bye Help to Buy

A year of two halves

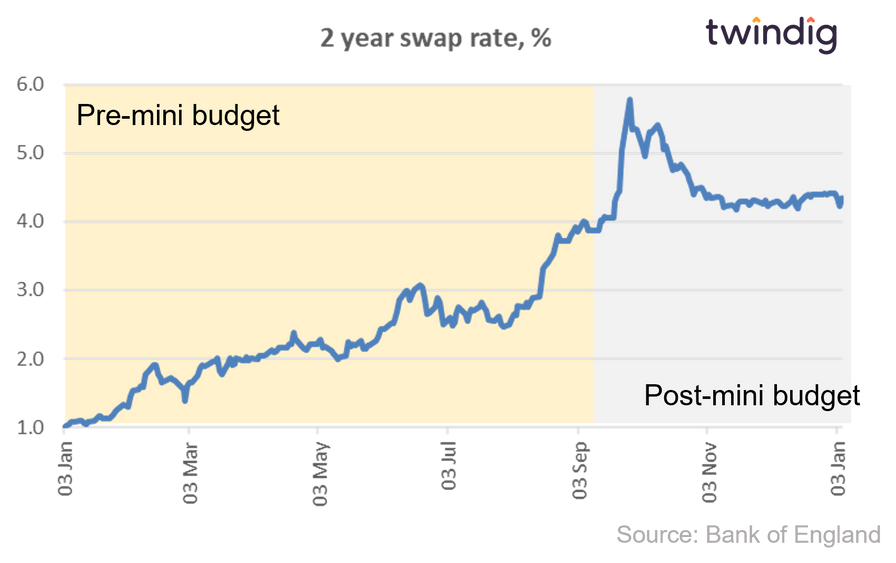

We can look at the housing market in 2022 as pre-mini-budget and after-mini-budget.

The mortgage market (and indeed the whole UK financial system) was spooked by the Kwarteng/Truss mini-budget. For a while, it looked like we might have a total collapse of the UK financial system as the £:US$ exchange rate hit a 40-year low.

The impact on the mortgage market was huge as illustrated in the graph below which shows the overnight swap rates - a proxy for offered mortgage rates.

The concern was that the UK Government choose an economic policy which was completely at odds with the policy objectives of the Bank of England. Truss /Kwarteng wanted to grow our way out of inflation, whereas the Bank of England wanted to slow our way out of inflation.

What we learnt from estate agents this week

Two of the UK's largest estate agents Savills and Winkworth issued trading updates this week and in this note, we look at what they told us about trading conditions and what it means for homebuyers and home sellers today

Key takeaways

Overall, 2022 was a strong year for the UK housing market

2023 will be much more challenging

Those markets less reliant on mortgage finance are likely to be the strongest performers in 2023

Twindig take

Both Savills and Winkworth had a good 2022. However, after three surprisingly strong years, 2023 will be much harder.

It is too early for either Savills or Winkworth to comment on the outturn of 2023, and interestingly neither commented on their pipeline of potential future activity.

Twindig Housing Market Index

In the week that saw three big housebuilders and two large estate agents issue trading updates to investors the Twindig Housing Market Index continued its upward momentum rising by 4.5% to 73.7 this week.

Housebuilders up

Despite housebuilders (Barratt Persimmon and Taylor Wimpey) painting a subdued picture about the conditions in the UK housing market residential investors' confidence in the housebuilders was strong this week, perhaps they had been expecting worse. All have met the expectations of the market for the period ending 31 December 2022, although sales rates fell following the September mini-budget and have yet to recover. Fewer new build homes will be built and sold this year.

Estate agents also up

Investor confidence in estate agents also nudged up this week as Savills and Winkworth reported that 2022 had ended well and that, so far, 2023 is not as gloomy as some say.