Millions to see mortgage payments rise

More than 1.4 million households will see their mortgage costs rise in 2023, are you one of them?

The Office of National Statistics (ONS) has estimated that more than 1.4 million households in the UK will see their mortgage costs rise this year as they renew their fixed-rate mortgages. This equates to around 12% of residential mortgage holders, around a further 1.6 million are on variable rate mortgages where payments are likely to change each time the Bank of England Bank Rate moves.

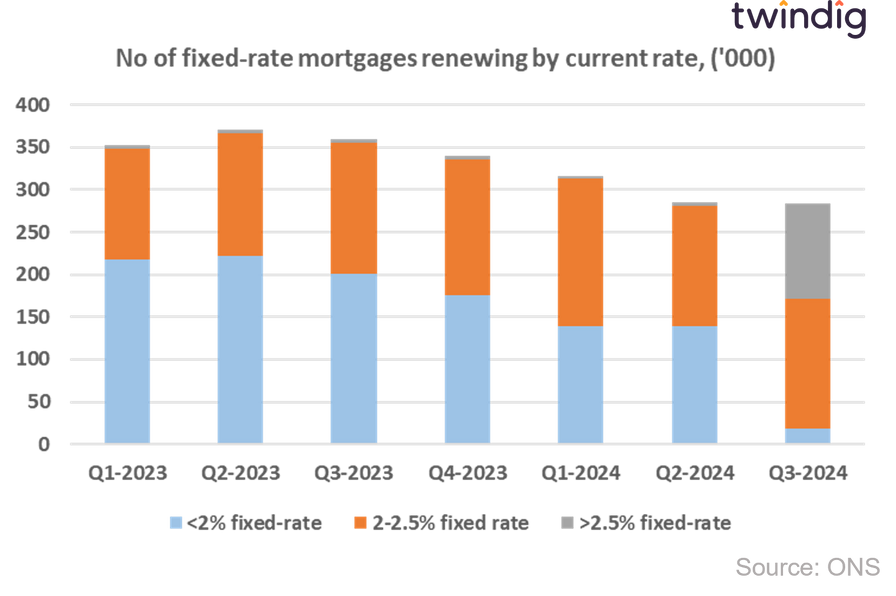

The majority of fixed-rate mortgages in the UK (57%) coming up for renewal in 2023 have fixed rates below 2%. Whereas those with either 2-year or 5-year fixed-rate mortgages due to renew in 2024 have mortgages with rates generally higher than 2%.

We show the spread of renewals in the chart below:

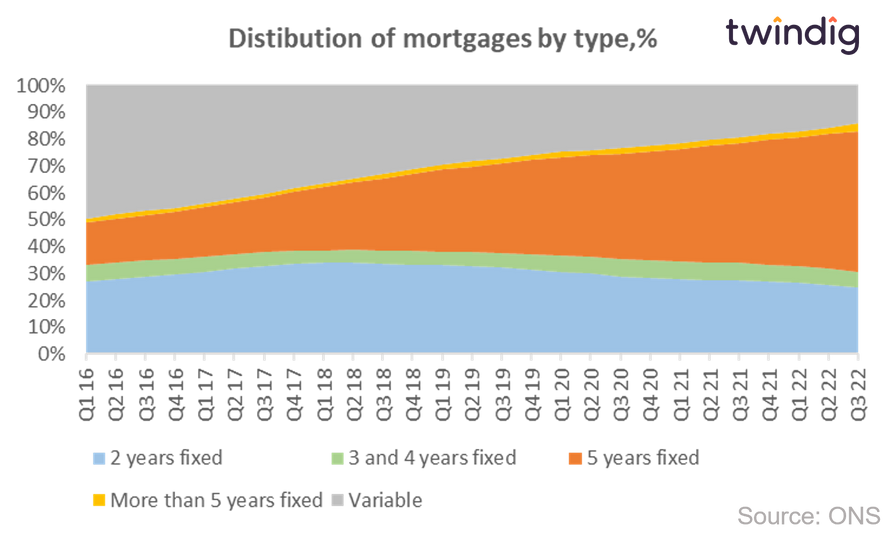

A feature of the UK Mortgage over the last six years is the increasing popularity of fixed-rate mortgages. In Q1 2016 half of all mortgages were on variable rates, but this has fallen to just 14% in Q3 2022.

The two-year fixed-rate mortgage used to be the most popular fixed-rate mortgage, accounting for just over one in four mortgages at the start of 2016.

However, over the last five years, we have seen the growing importance of the 5-year fixed-rate mortgage growing from about 1 in 6 mortgages (15%) in 2016 to just over half of all mortgages (52.3%) at the end of the third quarter in 2022 and homeowners sought to lock in the historically low mortgage rates that were available.

Mortgage rates are rising

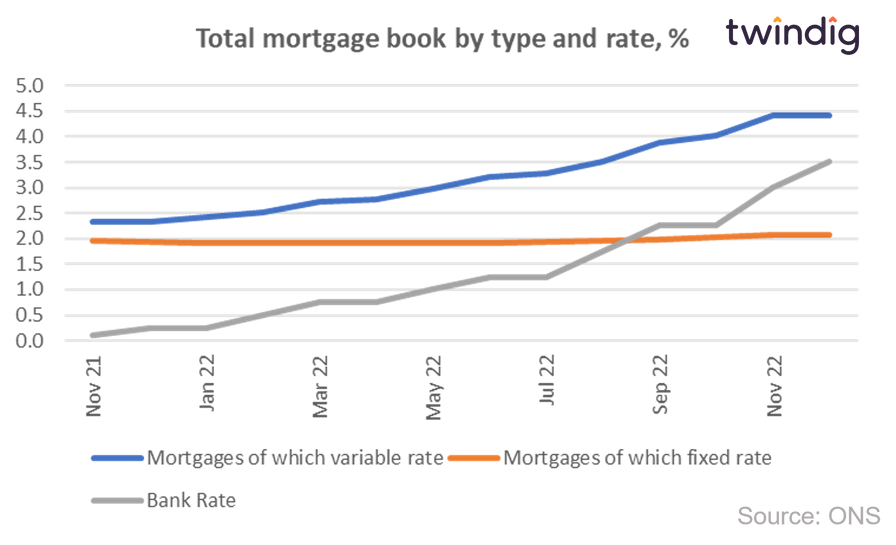

The Bank of England started to raise Bank Rate (the underlying interest rate which impacts all other interest rates in December 2021 as it sought to control inflation.

We can see the impact of the rising Bank Rate on variable mortgage rates in the chart below, as Bank Rate (the grey line) moves up, so do variable rate mortgage rates (the blue line). The impact on fixed rates is much more muted (the orange line)

How much will my mortgage payments increase?

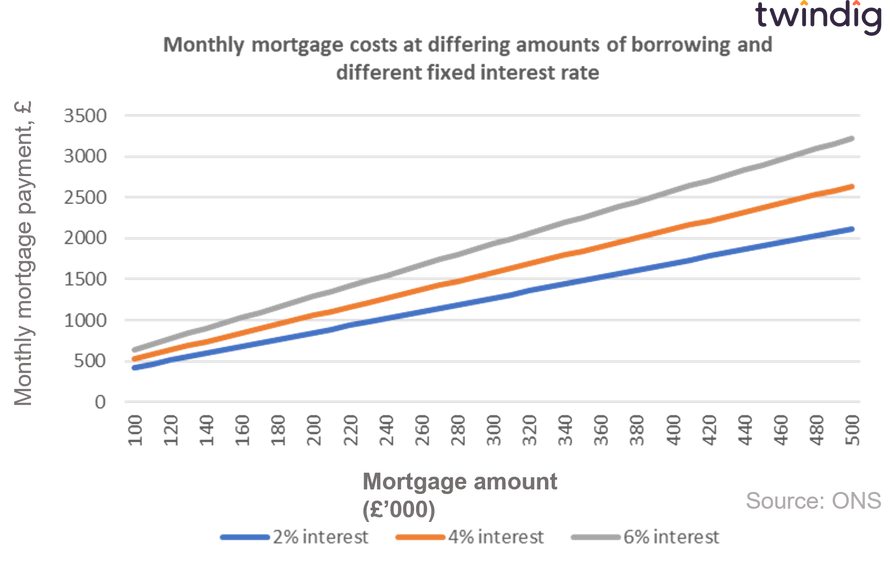

The graph below provides a rough guide to show how much your mortgage payment may be once you remortgage. The size of your mortgage in thousands of pounds along the bottom and the implied mortgage payment on the left-hand side for a 2%, 4% and 6% interest rate.

The calculations are based on a 25-year capital repayment mortgage.

For a more detailed look at your potential mortgage payments, you can use our mortgage calculator below.

For a more detailed look at mortgage rates click read more below