Average UK mortgage rates

Latest average mortgage rates

75% LTV 2-year fixed-rate mortgage 4.73%

90% LTV 2-year fixed-rate mortgage 5.15%

95% LTV 2-year fixed-rate mortgage 5.71%

Average mortgage rates ticked up in May

Average mortgage rates for many of the most popular mortgage products ticked up in May 2023, rising for the first time this year and we expect rates to increase further as the impact of stubborn inflation is likely to lead to further rises in Bank Rate.

Average mortgage rates and Rishi Sunak

The financial markets have reacted warmly to Rishi Sunak's appointment as UK Prime Minister. Following the expansionist stance of Liz Truss, Mr Sunak is seen as a safer pair of hands to be in charge of the UK economy, and whilst it is early days, so far he has done more good than harm. Mr Sunak and the Chancellor Mr Hunt also appear to be working with rather than against the Bank of England. This is good news for those with mortgages as it is likely that mortgage rates will not have to rise as much as we had feared following the Kwasi Kwarteng mini-budget in September.

Average mortgage rates and the mini-budget

On Friday 23rd September 2022, the newly appointed Chancellor of the Exchequer, Kwasi Kwarteng, delivered the so-called 'mini-budget'. This mini-budget has had major ramifications for mortgage rates. Mr Kwarteng's budget set out the UK Government's plan to stimulate economic growth putting it on course for a head-on collision with the Bank of England which is seeking to soften demand in order to control inflation and the cost of living crisis by raising interest rates. The financial markets did not react well to the ensuing Mexican stand off, and mortgage rate expectations shot up. the reversal of the mini-budget policies and proposals has since calmed the financial markets considerably.

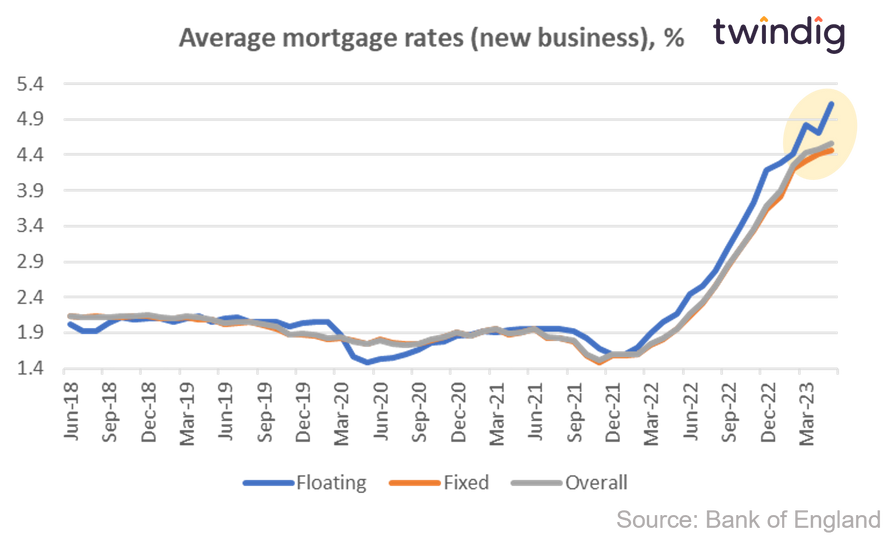

Average mortgage rate for new business

We show in the chart below the average mortgage rates for new business. These are the average rates charged on mortgages that were arranged this month.

The average mortgage rate for floating rate mortgages increased significantly in May, rising almost 10% to 5.11% and we expect further increases in the coming months. Average mortgage rates for new business are on the rise and are likely to continue rising as the Bank of England increases its underlying Bank Rate, which has been on an upward trend since December 2021. We have witnessed a number of record rises in Bank Rate as the Bank of England seeks to control inflation. On 15 December 2022 we saw Bank Rate rise from 3.00% to 3.50%, which came off the back of the biggest rise in interest rates for 33 years when the Bank of England raised Bank Rate from 2.25% to 3.00% in November 2022. That increase came off the back of two 50 basis point rate rises in August 2022 and September 2022. At the time the interest rate rise in August was the largest rise for 27 years. Bank Rate rose again in December to 3.50% and once more in February 2023 when it increased by a further 50 basis points to 4.0%. The increases continued in March when Bank Rate rose to 4.25% and again in May when Bank Rate was raised to 4.50%. The most recent increase in Bank Rate was in June when the rate increased by 50 basis points to 5.0% its highest level since September 2008.

Average mortgage rates for new business increased by 2.0% during May 2023 and were 133% higher (more than double) than they were one year ago. The period of very low mortgage rates is officially over as the mortgage market reacted violently to the mini-budget. Rates are likely to continue to increase whilst we are living in a period of economic uncertainty and as the Bank of England continues to raise Bank Rate to fight inflation.

Average mortgage rates were falling steadily until the start of the global COVID-19 pandemic. The fall in floating mortgage rates accelerated as the pandemic took hold. Mortgage rates initially increased as the UK was engulfed by the COVID-19 pandemic, but, in the main, fell throughout 2021. However, following a rise in Bank Rate in December 2021, mortgage rates started to increase in 2022 and rising mortgage rates are likely to be the theme of the first half of 2023.

The latest mortgage rate data from the Bank of England shows that average mortgage rates increased during April 2023, although the rate of increase appears to be slowing. Although most of the measures announced in the mini-budget on the 23 September 22 have been reversed, we still expect the Bank of England to significantly increase the Bank Rate in the coming months. Since the appointment of Jeremy Hunt as Chancellor of the Exchequer and Rishi Sunak as the leader of the Conservative and Unionist Party (and hence the Prime Minister) the financial markets have become less agitated. The Government's approach to managing the UK economy no longer seems to be at odds with the efforts of the Bank of England. It is likely therefore that Bank Rate will not have to increase by as much as we had feared immediately following the mini-budget, however, they will continue to rise.

Why the Bank of England Bank Rate impacts mortgage rates

The media and newspapers place a lot of emphasis on what the Bank of England is doing with Bank Rate. Most commentary links the Bank of England's Bank Rate decisions with reference to controlling inflation (the Bank of England seeks to use monetary policy to meet the UK Government's inflation target of 2%. However, Bank Rate is the interest rate which impacts or sets the tone for all other interest rates from credit cards to mortgages to savings accounts. One could think of it as a lender's cost of borrowing, the level of Bank Rate is one of the factors that determines how much it costs a bank, building society or credit card provider to lend us money. Therefore if Bank Rate rises (or falls) mortgage rates are likely to move in the same direction as Bank Rate.

The latest average mortgage rates are

- Floating rate mortgages: 5.11%

- Fixed rate mortgages 4.47%

- Overall mortgage rates 4.57%

The changes to average mortgage rates for new business are as follows:

| Floating Rate | Fixed Rate | Overall | |

| Last month | +8.5% | +1.4% | +2.0% |

| Last 12 months | +136.6% | +129.2% | +133.2% |

The full data used in the graphs can be found at the bottom of this article

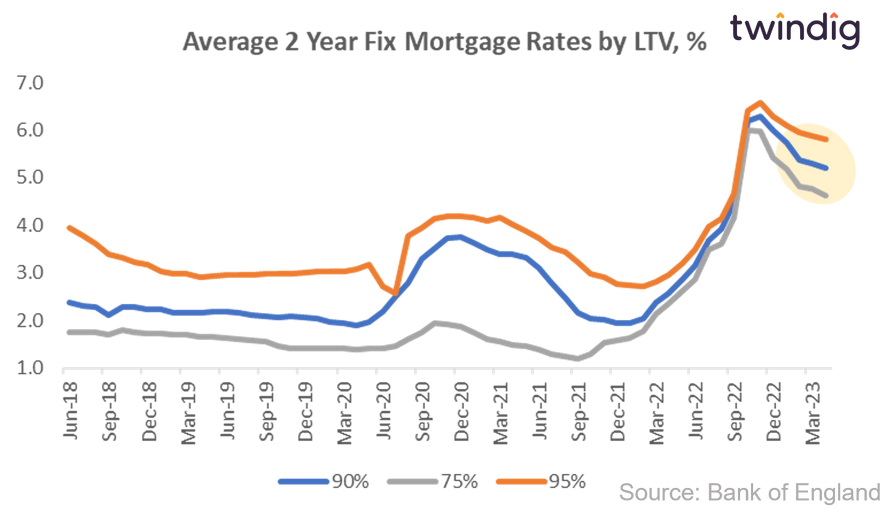

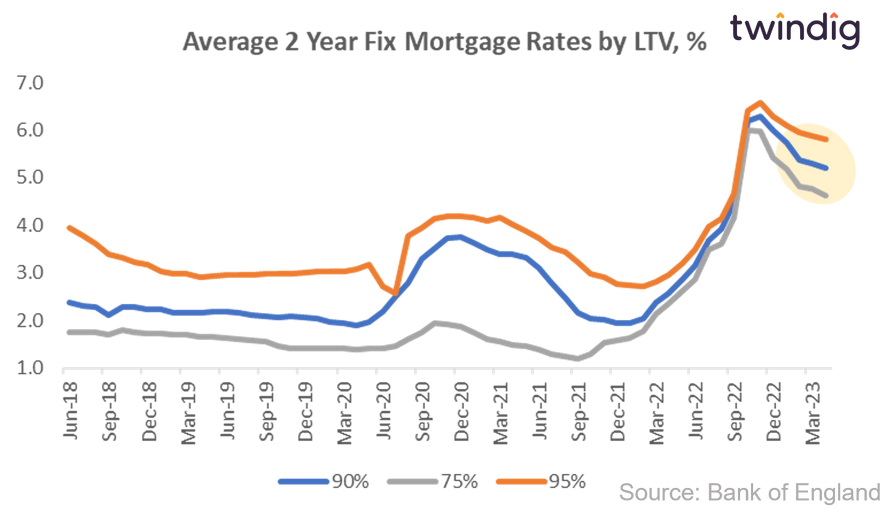

Average 2 year-fixed rate mortgage rates by LTV

95% LTV mortgages

Average 2-year fixed rate 95% LTV mortgage rates have risen by 78% over the last year, and rose by 0.4% in the last month to 5.69% from 5.71%.

Mortgage rates for 2-year fixed rate 95% LTV mortgages by were broadly flat in the year leading up to the COVID-19 pandemic. During the early stages of the pandemic, 95% LTV mortgage rates fell, but in the summer of 2020 2-year fixed-rate 95% LTV mortgage rates increased significantly. The rates fell throughout 2021, but started to rise in March 2022 as the Bank Rate increases started to feed through into mortgage rates. we believe that the increases which started in March 2022 were the start of a medium-term upward mortgage rate journey. However, these rates started to fall in December 2022 and fell for five months in a row until their rise in May 2023.

90% LTV mortgages

Average 2-year fixed rate 90% LTV mortgage rates have increased by 81% over the last year, and rose by 0.2% to 5.15% last month.

The same mortgage rates fell by around 20% from June 2018 to the start of the COVID-19 pandemic. They have also increased significantly since the first UK COVID-19 lockdown almost doubling between April 2020 and December 2020. However, like the 95% LTV mortgage rates, the 90% LTV rates fell throughout 2021, and after bottoming out in January 2022, 90% LTV mortgage rates started to rise in February 2022 as the Bank of England raises Bank Rate to combat inflation. However, these rates which had been falling since December 2022 rose in May 2023.

As of May 2023 average mortgage rates for a 2-year fixed rate 90% LTV mortgage have risen to 5.15% from a low of 1.95% in January 2022.

75% LTV mortgages

Average 2 year fixed rate 75% LTV mortgage rates have risen 80% over the last year as the Bank of England has raised Bank Rate to combat inflation, and rose by 2.2% in May 2023 to 4.73% and have now fallen for seven months in a row.

The mortgage rates for 75% LTV 2-year fixed-rate mortgages fell by around 20% from June 2018 to the start of the COVID-19 pandemic. They increased during the early stages of Lockdown I, but started to fall towards the end of last year. Mortgage rates for 75% LTV mortgages are now lower than their pre-pandemic levels. Average mortgage rates for 75% LTV mortgages have been rising since October 2021 when mortgage rates nudged up from 1.20% to 1.29% bucking the trend of the mortgage rates for higher LTV mortgages and they continued to rise up until October 2022 and started to fall in November 2022.

In May 2023 we saw the average mortgage rates for 2 year-fixed rate 75% LTV mortgages rise for the first time since Ocober 2022 .

The latest average 2 year fixed rate mortgage rates

- 75% LTV 2 year fixed rate mortgages 4.73%

- 90% LTV 2 year fixed rate mortgages 5.15%

- 95% LTV 2 year fixed rate mortgages 5.71%

The most recent changes to average 2 year fixed rate mortgage rates are as follows:

| 75% LTV | 90% LTV | 95% LTV | |

| Last month | +2.2% | +0.2% | +0.4% |

| Last 12 month | +80% | +71% | +78% |

The full data used in the graphs can be found at the bottom of this article

Table 1: Average mortgage rates for new buiness

We show in the table below the average mortgage rates for fixed rate mortgages, floating rate mortgages and the overall average mortgage rates;

| Date | Floating (%) | Fixed (%) | Overall (%) |

| Jun 18 | 2.02 | 2.13 | 2.13 |

| Jul 18 | 1.92 | 2.12 | 2.11 |

| Aug 18 | 1.93 | 2.13 | 2.12 |

| Sep 18 | 2.03 | 2.12 | 2.13 |

| Oct 18 | 2.12 | 2.12 | 2.13 |

| Nov 18 | 2.09 | 2.14 | 2.14 |

| Dec 18 | 2.10 | 2.14 | 2.15 |

| Jan 19 | 2.10 | 2.10 | 2.11 |

| Feb 19 | 2.05 | 2.10 | 2.10 |

| Mar 19 | 2.10 | 2.11 | 2.13 |

| Apr 19 | 2.13 | 2.09 | 2.11 |

| May 19 | 2.05 | 2.08 | 2.09 |

| Jun 19 | 2.10 | 2.02 | 2.03 |

| Jul 19 | 2.12 | 2.04 | 2.06 |

| Aug 19 | 2.05 | 2.05 | 2.06 |

| Sep 19 | 2.06 | 2.01 | 2.02 |

| Oct 19 | 2.05 | 1.96 | 1.98 |

| Nov 19 | 1.99 | 1.87 | 1.88 |

| Dec 19 | 2.03 | 1.87 | 1.89 |

| Jan 20 | 2.05 | 1.85 | 1.87 |

| Feb 20 | 2.06 | 1.80 | 1.82 |

| Mar 20 | 1.88 | 1.83 | 1.84 |

| Apr 20 | 1.56 | 1.79 | 1.77 |

| May 20 | 1.48 | 1.75 | 1.74 |

| Jun 20 | 1.53 | 1.80 | 1.79 |

| Jul 20 | 1.54 | 1.76 | 1.75 |

| Aug 20 | 1.59 | 1.74 | 1.73 |

| Sep 20 | 1.66 | 1.75 | 1.75 |

| Oct 20 | 1.76 | 1.79 | 1.80 |

| Nov 20 | 1.78 | 1.84 | 1.84 |

| Dec 20 | 1.86 | 1.91 | 1.91 |

| Jan 21 | 1.87 | 1.85 | 1.85 |

| Feb 21 | 1.92 | 1.92 | 1.92 |

| Mar 21 | 1.91 | 1.96 | 1.96 |

| Apr 21 | 1.94 | 1.88 | 1.89 |

| May 21 | 1.96 | 1.90 | 1.91 |

| June 21 | 1.95 | 1.95 | 1.95 |

| July 21 | 1.96 | 1.83 | 1.84 |

| August 21 | 1.95 | 1.82 | 1.83 |

| September 21 | 1.92 | 1.78 | 1.79 |

| October 21 | 1.82 | 1.58 | 1.60 |

| November 21 | 1.68 | 1.49 | 1.51 |

| December 21 | 1.60 | 1.58 | 1.59 |

| January 22 | 1.60 | 1.58 | 1.59 |

| February 22 | 1.69 | 1.59 | 1.60 |

| March 22 | 1.89 | 1.73 | 1.74 |

| April 22 | 2.05 | 1.81 | 1.83 |

| May 22 | 2.16 | 1.95 | 1.96 |

| June 22 | 2.44 | 2.14 | 2.16 |

| July 22 | 2.56 | 2.32 | 2.34 |

| August 22 | 2.77 | 2.55 | 2.56 |

| September 22 | 3.09 | 2.83 | 2.85 |

| October 22 | 3.40 | 3.09 | 3.10 |

| November 22 | 3.73 | 3.34 | 3.36 |

| December 22 | 4.19 | 3.63 | 3.68 |

| January 23 | 4.29 | 3.82 | 3.89 |

| Feb 23 | 4.41 | 4.20 | 4.26 |

| March 23 | 4.82 | 4.32 | 4.44 |

| April 23 | 4.71 | 4.41 | 4.48 |

| May 23 | 5.11 | 4.47 | 4.57 |

Table 2: 2 year-fixed rate mortgage rates by LTV

We show in the table below the average mortgage rates for two-year fixed rate mortgages for 75%, 90% and 95% LTV ratios

| 75% LTV | 90% LTV | 95% LTV | |

| Jun 18 | 1.74 | 2.37 | 3.95 |

| Jul 18 | 1.75 | 2.30 | 3.78 |

| Aug 18 | 1.75 | 2.28 | 3.61 |

| Sep 18 | 1.71 | 2.12 | 3.38 |

| Oct 18 | 1.80 | 2.27 | 3.33 |

| Nov 18 | 1.75 | 2.28 | 3.23 |

| Dec 18 | 1.73 | 2.24 | 3.18 |

| Jan 19 | 1.72 | 2.23 | 3.04 |

| Feb 19 | 1.70 | 2.17 | 2.99 |

| Mar 19 | 1.70 | 2.17 | 2.97 |

| Apr 19 | 1.66 | 2.15 | 2.92 |

| May 19 | 1.65 | 2.19 | 2.93 |

| Jun 19 | 1.64 | 2.18 | 2.95 |

| Jul 19 | 1.61 | 2.15 | 2.96 |

| Aug 19 | 1.59 | 2.10 | 2.96 |

| Sep 19 | 1.55 | 2.09 | 2.99 |

| Oct 19 | 1.47 | 2.07 | 2.99 |

| Nov 19 | 1.41 | 2.08 | 2.99 |

| Dec 19 | 1.42 | 2.07 | 3.00 |

| Jan 20 | 1.41 | 2.05 | 3.02 |

| Feb 20 | 1.40 | 1.97 | 3.02 |

| Mar 20 | 1.40 | 1.94 | 3.02 |

| Apr 20 | 1.38 | 1.89 | 3.07 |

| May 20 | 1.42 | 1.96 | 3.17 |

| Jun 20 | 1.41 | 2.19 | 2.72 |

| Jul 20 | 1.45 | 2.50 | 2.58 |

| Aug 20 | 1.60 | 2.78 | 3.78 |

| Sep 20 | 1.75 | 3.29 | 3.95 |

| Oct 20 | 1.94 | 3.52 | 4.13 |

| Nov 20 | 1.92 | 3.72 | 4.20 |

| Dec 20 | 1.86 | 3.75 | 4.20 |

| Jan 21 | 1.71 | 3.63 | 4.16 |

| Feb 21 | 1.61 | 3.49 | 4.10 |

| Mar 21 | 1.56 | 3.38 | 4.16 |

| Apr 21 | 1.49 | 3.38 | 4.01 |

| May 21 | 1.47 | 3.31 | 3.88 |

| June 21 | 1.39 | 3.09 | 3.74 |

| July 21 | 1.29 | 2.79 | 3.53 |

| August 21 | 1.23 | 2.48 | 3.43 |

| September 21 | 1.20 | 2.16 | 3.22 |

| Oct 21 | 1.30 | 2.03 | 2.97 |

| Nov 21 | 1.52 | 2.02 | 2.91 |

| Dec 21 | 1.56 | 1.95 | 2.77 |

| Jan 22 | 1.64 | 1.95 | 2.77 |

| Feb 22 | 1.78 | 2.03 | 2.72 |

| March 22 | 2.14 | 2.38 | 2.80 |

| April 22 | 2.35 | 2.58 | 2.95 |

| May 22 | 2.63 | 2.85 | 3.20 |

| June 22 | 2.87 | 3.15 | 3.48 |

| July 22 | 3.48 | 3.69 | 3.96 |

| Aug 22 | 3.60 | 3.93 | 4.14 |

| Sep 22 | 4.17 | 4.48 | 4.67 |

| Oct 22 | 5.99 | 6.20 | 6.42 |

| Nov 22 | 5.98 | 6.28 | 6.59 |

| Dec 22 | 5.43 | 6.00 | 6.30 |

| Jan 23 | 5.14 | 5.66 | 6.02 |

| Feb 23 | 4.79 | 5.35 | 5.86 |

| Mar 23 | 4.74 | 5.23 | 5.77 |

| Apr 23 | 4.63 | 5.14 | 5.69 |

| May 23 | 4.73 | 5.15 | 5.71 |