Houselungo 11 Dec 22

Why house prices won't crash next year

We do not share the view that house prices will crash (fall by 20% or more) in the coming year. We do believe that house prices will fall in 2023, but not by as much as most commentators are suggesting.

We believe that house prices may fall by 10% next year, which would take them back to levels last seen in March 2021, and around 7% or £16,000 higher than they were at the start of the COVID-19 pandemic. This is not a house price crash.

Deposits underpin house prices and drive housing transactions

Deposits are the key to house prices

We believe that the issue facing the housing market is access to deposits. For those with access to large deposits the housing market remains affordable, but those without are finding themselves shut out.

It is much more likely, in our view, that the number of homes sold in 2023 will fall further than the prices of those homes.

Why deposits are the key to the housing market

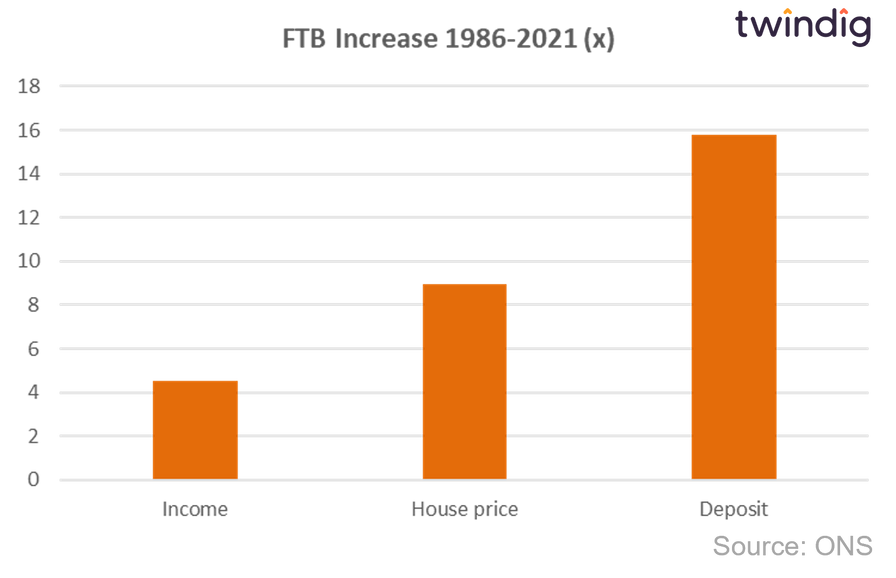

As aspiring homeowners know only too well, house prices have become divorced from wages. In 1986 the average deposit for a first-time buyer was £3,800, their income was £11,700 and the average first-time buyer house price was £27,000, but by 2021 the deposit had increased more than 15 times to £60,000, house prices by 9 times to £242,000, but incomes had only increased by 4.5 times to £53,000.

The average deposit increased from less than four months' wages to more than 13 months' wages.

The scale of the rise in deposits is very unlikely to be driven by first-time buyers saving more, but rather securing funds from other sources such as inheritances and the Bank of Mum and Dad.

We believe that access to a big enough deposit is the key factor in determining whether or not you can own your home. Increasingly first-time buyer deposits are being aided and enhanced by the Bank of Mum and Dad. Unless your parents own their home, it is unlikely that you will be able to afford one.

We do not share the view that house prices will crash (fall by 20% or more) in the coming year. We do believe that house prices will fall in 2023, but not by as much as most commentators are suggesting.

We believe that house prices may fall by 10% next year, which would take them back to levels last seen in March 2021, and around 7% or £16,000 higher than they were at the start of the COVID-19 pandemic. This is not a house price crash.

Biggest fall in house prices since October 2008

The Halifax released its house price index for November this week

What the Halifax said

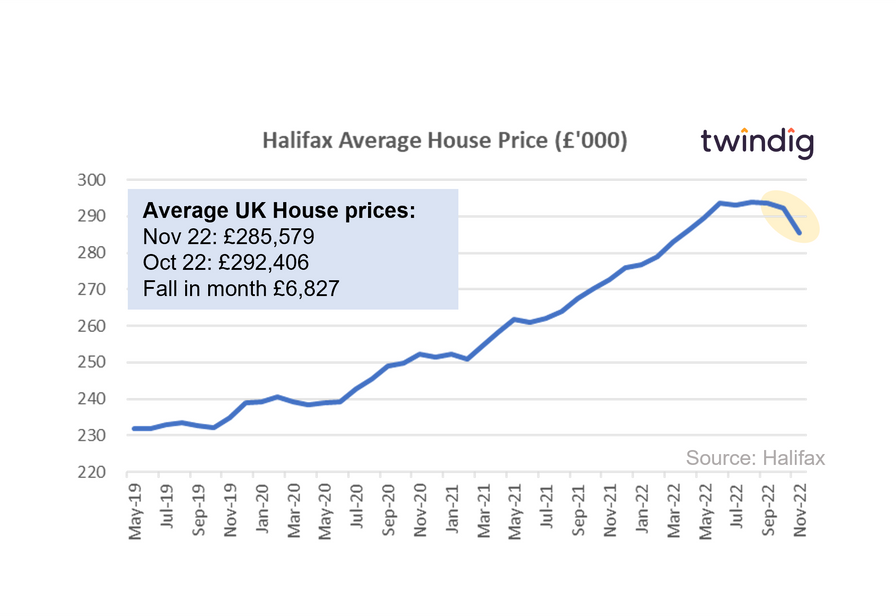

Average house price £285,579

House prices fell by 2.3% or £6,827 in November

Annual house price inflation 4.7%

Twindig Take

The fall in house prices in November is the largest since October 2008 and the third consecutive monthly fall. As we enter the Christmas party season, it seems that the house price party is well and truly over.

However, context is needed, over the last 12 months, house prices have risen by more than £12,000 and are still more than £45,000 higher than they were before the start of the first COVID-19 pandemic lockdown. House prices are falling, but only after a period of unprecedented house price growth, fuelled by a stamp duty holiday we may live to regret.

The housing market headwinds (rising mortgage rates and increasing living costs) have now caught up with house prices and across the country, annual house price inflation fell in all regions apart from the North East, which is now the only area with double-digit house price inflation.

Mortgage rates also starting to fall

The Bank of England released average mortgage rates by Loan to Value this week

What they said

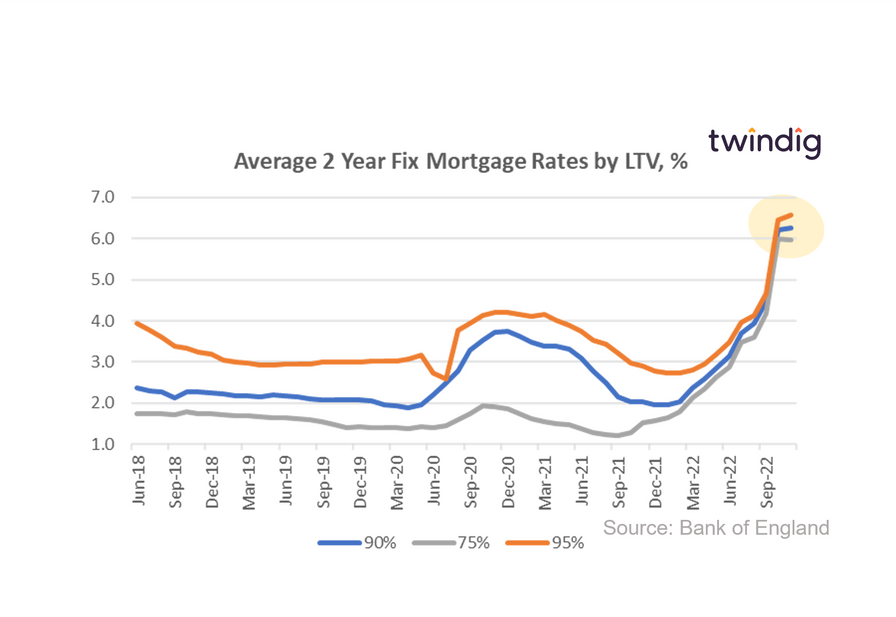

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 5.97% (down 3bp)

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 6.25% (up 3bp)

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 6.57% (up 12bp)

Twindig take

Good news for homebuyers the average rate for 75% 2-year fixed-rate mortgages fell (slightly) in November by 3 basis points from 6.00% to 5.97%.

At other key 'loan-to-value' (LTV) points, whilst mortgage rates still ticked up, the rate of increase slowed dramatically. During October 2022 the average mortgage rate for 2-year fixed rate mortgages at 90% LTV and 95% LTV increased by 40%, but in November it was just 0.5% and 1.9% respectively.

As house prices fall and mortgage rate growth slows could 2023 become a homebuyer's, rather than a home-seller's market?

RICS Survey - more Bah Humbug than Glad Tidings

RICS released their November 2022 UK Residential Market Survey on Thursday

What RICS said

National house prices begin to fall

Overall housing market activity continues to weaken

Declining housing market trend expected to continue over the near term, at least

Twindig take

There was very little Christmas cheer in the RICS latest UK Residential Market Survey which was published this morning, more a case of 'bah humbug' than 'glad tidings'

Rising interest rates and a challenging macroeconomic outlook appear to be taking their toll on home buyer sentiment. Home buyer demand was in negative territory for the seventh successive month, posting a net negative balance of -38% in November.

The picture for agreed sales was also downbeat with a net balance of 35% reporting a decline in agreed sales last month. Looking forward sales expectations on both a three-month nad twelve-month view are negative at -44% and -38% respectively suggesting that the level of housing market activity will be lower in 2023 than it was during 2022.

The average number of homes for sale in estate agency branches ticked up slightly in November, from 34 to 35 homes, but a move of 3% could be either a rounding error or due to a fall in buyer demand reducing the number of sales completed.

Looking forward a net negative balance of -54% of agents reported that the number of market appraisals (in person valuations) was lower in November 2022 than it was in November 2021, suggesting that stock levels (the number of homes for sale) will reduce in 2023.

Twindig Housing Market Index

In the week that saw the biggest fall in house prices since October 2008, the latest RICS member's residential survey was filled with bah humbugs rather than glad tidings and mortgage rates started to fall (hurrah), the Twindig Housing Market Index fell by 1.1% to 67.2, a response more muted than this week's housing headlines.

As the November Halifax House Price Index posted its most significant drop since October 2008, falling by 2.3% or just over £6,800 from £292,406 to £285,579, RICS members were feeling very gloomy about the current housing market and the outlook for 2023. It seems as we approach the end of 2022, RICS members' glasses are much more than half empty.

However, mortgage rates are in a more festive mood, currently either falling or rising at a much slower rate as we leave the Truss/Kwarteng period behind us and return to working with rather than against the Bank of England. This may of course all change next week, when the MPC makes its next decision about Bank Rate, but for now, we will take our wins where we can...