UK housing market: House prices and holiday homes on the rise

When announcing the Stamp Duty Holiday in July 2020, the Chancellor of the Exchequer was worried about falling house prices and declining housing transactions. House prices finished the year at record levels. The Stamp Duty holiday helped. However, it helped the second home/holiday home market more than it helped aspiring homebuyers. We doubt that was the intention, but the Stamp Duty holiday appears to have increased the inequality of housing wealth rather than helped all to buy.

Stamp Duty Holiday - taking from the poor and giving to the rich?

Has the stamp duty holiday helped those who needed it most or has it accelerated the growing inequality of housing wealth across the country? Analysis of the HMRC stamp duty receipts reveals two fascinating themes. The number of second-home purchases has increased at a much faster rate than purchases of primary residences. In some price bands, the number of primary residences purchased has fallen during the Stamp Duty Holiday, whilst across the board, second home purchases have increased since the start of the Stamp Duty holiday. The data also revealed that higher-priced housing transactions have bounced back more quickly than the lower-priced ones. Raising questions about who was the stamp duty holiday for and who has it helped?

You can read our full report here Stamp Duty Holiday - taking from the poor and giving to the rich?

Resolution Foundation

The Resolution Foundation (the think-tank focused on improving the living standards of those on low-to-middle incomes) published a report this week examining how families have managed their housing costs over the Covid-19 period.

What they said

More than 750,000 families were behind with their housing costs in January 2021

9% of those in the social rented sector

6% of those in the private rented sector and

2% of mortgaged households

Twindig take

This is where the rubber hits the road and puts the stamp duty debate into clear focus. Missing out on a stamp duty holiday is one thing, potentially losing your home because you can no longer afford the rent or mortgage is a totally different thing. We have tough choices to make. Should we use taxpayers money to help people buy a home rather than help others keep a roof over their head? The additional Universal Credit of £20 per week is due to finish on 6 April 2021 at which points rent and mortgage arrears are likely to increase. To put this figure in context the £15,000 maximum Stamp Duty saving could instead be used to pay 14 families in need an additional £20 a week for a whole year to help keep their existing roof over their heads rather than help one family pay for a bigger roof. You can read the full Resolution Foundation Report here Getting ahead on falling behind

Land Registry House Price Data

The Land Registry issued its house price data for December 2020 this week

What they said

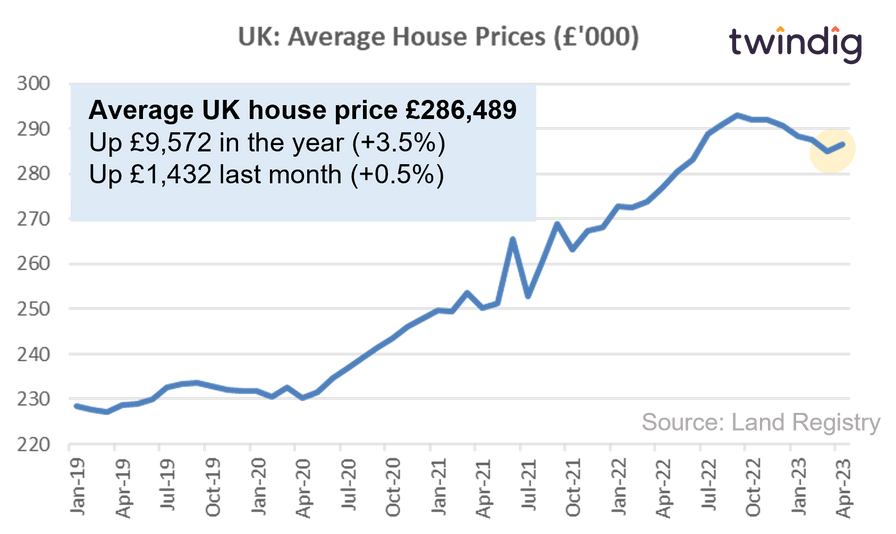

Average UK house price £251,500

House price inflation 8.5% over the last year

House price inflation 1.2% over the last month

Twindig take

UK average house prices are currently at their highest level on record and have risen by 9.0% or £20,800 since the start of the COVID-19 pandemic. This reflects a combination of pent up demand, the stimulus of the Stamp Duty Holiday and the fact that many of those in jobs, particularly the higher paid, are awash with cash as opportunities to spend (holidays, flights, hotels, restaurants etc) are limited and the excess cash is finding its way into the housing market. This is hardly surprising as most in the UK are largely confined to their homes so they become the natural outlet for spending. A full analysis of regional house price trends.

House Prices in London

Average house prices in London fell by 1.1% or £5,421 to £496,066 in December 2020. Last month house prices rose in 18 of the 34 London boroughs. Pricing was finely balanced but overall hose prices in London fell slightly. The biggest falls were in Kensington and Chelsea where average house prices fell by £40,219, followed by Camden down £33,180 and Islington by £24,482. The biggest London house price gains last month were to be found in Hackney up £24,061, Waltham Forest up £13,020 and Barking & Dagenham up £10,960. A full analysis of London house price trends

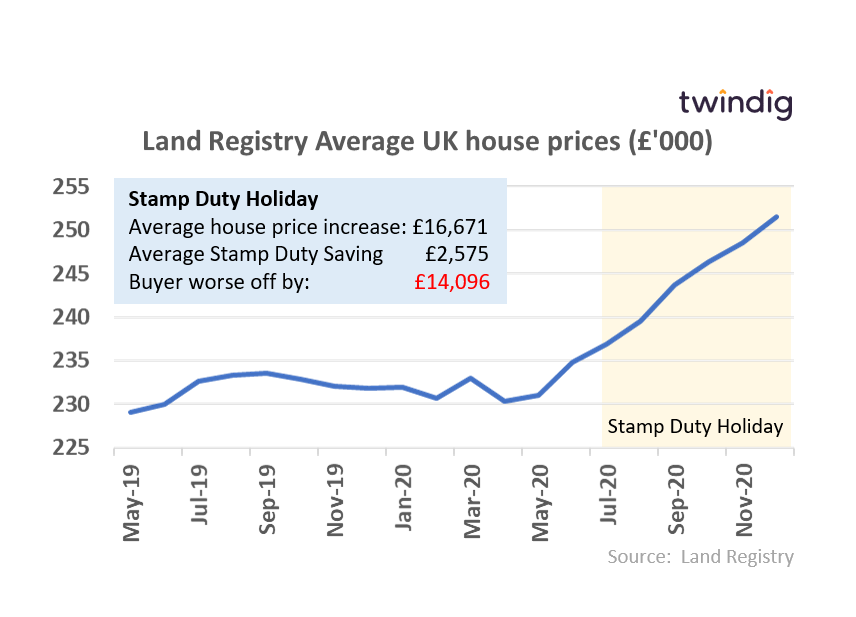

Stamp Duty Holiday has made homebuyers worse off

Aside from accelerating the inequality of housing wealth, the Stamp Duty Holiday has also made buyers worse off across the country. On average house prices have increased by almost £17,000 since the start of the Stamp Duty Holiday, compared to an average Stamp Duty saving of £2,575, which means the homebuyer is more than £14,000 worse off...

To see how the price of your house (and those in your street) have changed visit twindig.com enter your street name or postcode and select your home. If you sign up we will send you a free monthly valuation report for your home.