Stamp Duty Holiday - taking from the poor and giving to the rich?

Has the stamp duty holiday helped those who needed it most or has it accelerated the growing inequality of housing wealth across the country? Analysis of the HMRC stamp duty receipts reveals two fascinating themes. The number of second-home purchases has increased at a much faster rate than purchases of primary residences. In some price bands, the number of primary residences purchased has fallen during the Stamp Duty Holiday, whilst across the board, second home purchases have increased since the start of the Stamp Duty holiday. The data also revealed that higher-priced housing transactions have bounced back more quickly than the lower-priced ones. Raising questions about who was the stamp duty holiday for and who has it helped?

Why are we having a Stamp Duty Holiday?

When announcing the Stamp Duty Holiday on 8 July 2020 Chancellor Rishi Sunak said that

“property transactions fell by 50% in May [2020]”

“House prices have fallen for the first time in eight years.

“We need people feeling confident - confident to buy, sell, renovate, move and improve.”

The Chancellor, therefore, increased the threshold of stamp duty from £125,000 to £500,000 stating that the Stamp Duty Holiday would be a temporary cut until 31 March 2021.

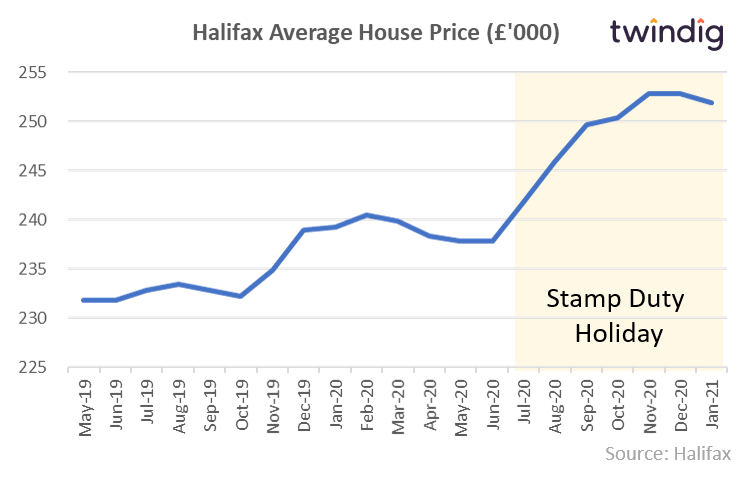

What has happened to house prices since the start of the Stamp Duty Holiday?

The latest Halifax House Price index suggests that average house prices have increased by £14,134 since the start of the Stamp Duty Holiday. Average house prices have increased by much more than the potential stamp duty saving of £2,540. This means that homebuyers are currently £11,594 worse off since the start of the Stamp Duty Holiday, whilst sellers have, on average, seen their house price increase by just over £2,000 per month.

The Stamp Duty Holiday certainly addressed the Chancellor's concerns about house prices.

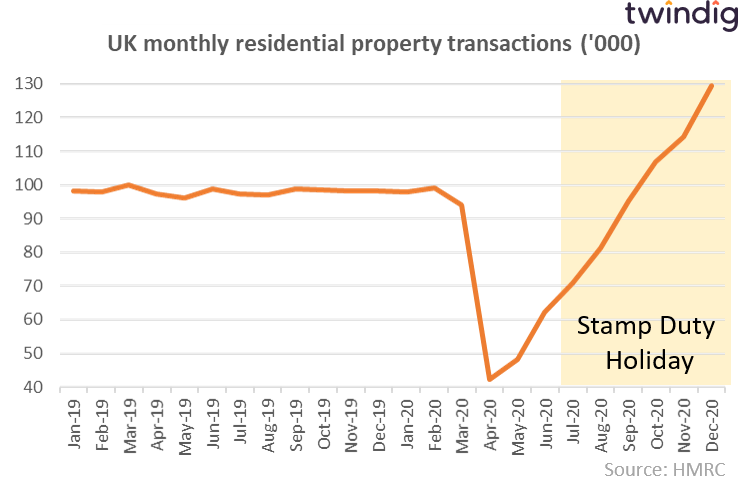

What has happened to housing transactions since the start of the Stamp Duty Holiday?

Housing transactions have increased significantly since the start of the Stamp Duty Holiday, although they had already started recovering before the stamp duty holiday was announced.

The Stamp Duty Holiday has also, therefore, addressed the Chancellor's concerns about the falling level of housing transactions. But is there another story behind the headline? The Chancellor's third concern was to help homebuyers and homeowners feel confident to buy, sell, renovate, move and improve.

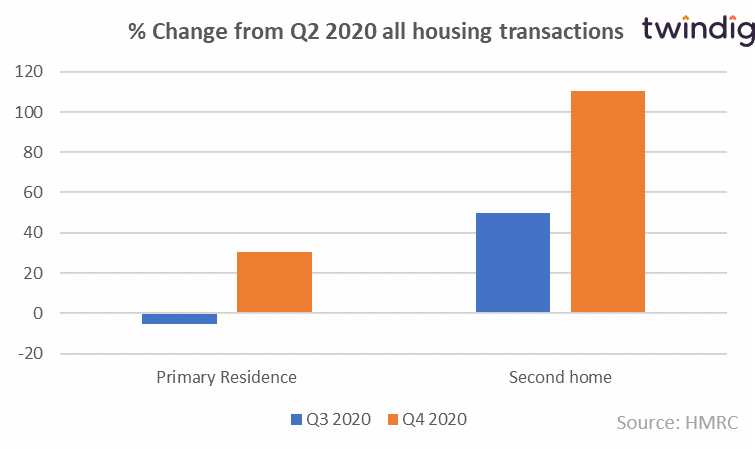

Who has the Stamp Duty Holiday helped?

At first glance, it seems that the stamp duty holiday has helped those buying a second or additional home more than those buying the home they will actually live in. In the third quarter of 2020 (the first quarter of the stamp duty holiday) the number of primary residence housing transactions actually fell by 5%. One might argue that this us due to timing delays, it takes time for the stamp duty holiday to work its magic. However, in the same quarter, second home purchases increased by 50%. In the fourth quarter, when arguably we started to see benefits of the stamp duty holiday the gap between homebuyers and second home buyers increased further: primary residence transactions were 30% higher than they were in Q2 2020, but second / holiday home transactions more than doubled rising by 110%.

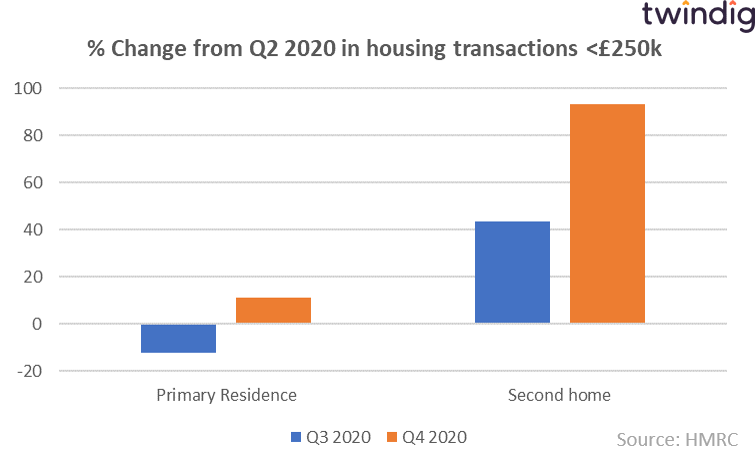

Housing transactions up to £250,000

The positive impact of the Stamp Duty Holiday is muted for homebuyers spending up to £250,000. One might argue that this is because this is where the stamp duty savings are the smallest, but there is a marked difference between the percentage changes in transactions between primary residence homebuyers and second home buyers.

In the third quarter of 2020, the number of primary residence transactions fell by 12% whilst second home transactions increased by 44%. In the fourth quarter of 2020 primary residence transactions were 11% higher than they were in Q2 2020, but second / holiday home transaction almost doubled rising by 94%. Given the profile of the UK's private rented sector, it is likely, in our view, that a significant proportion of these second home purchases are actually buy-to-let investments.

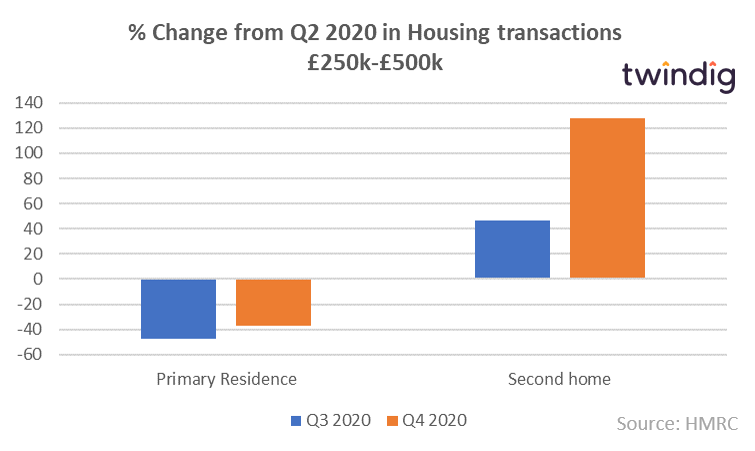

Housing transactions £250,000 to £500,000

In the £250,000 to £500,000 house price segment primary residence homebuyer volumes have actually decreased since the start of the Stamp Duty Holiday. This is very surprising as this is where the largest relative stamp duty savings can be made. This is the sweet spot of the Stamp Duty Holiday. Whilst it hasn't had the intended effect for homebuyers, holiday home buyers have certainly been making the most of the Stamp Duty Holiday.

During Q3 2020 primary residence transactions fell by almost half (47%) when compared to Q2 2020 whilst second and holiday home purchases increased by half (47%). In the fourth quarter, primary residence purchases were 37% lower than in Q2 2020, but second and holiday home purchases more than doubled, increasing by 127%.

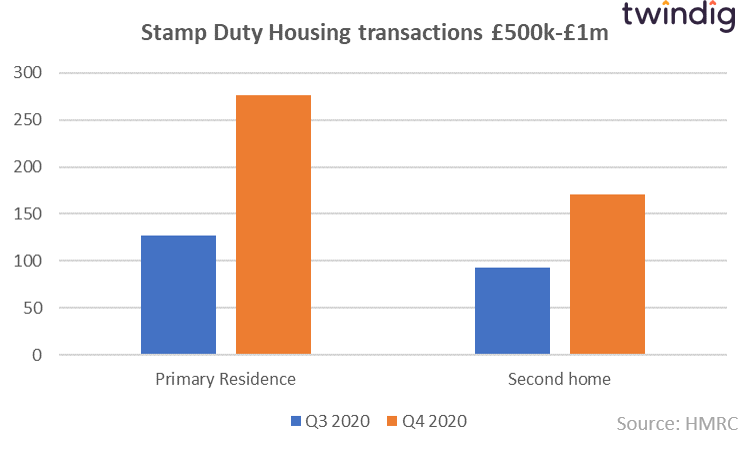

Housing transactions £500,000 to £1,000,000

The maximum stamp duty holiday benefit is for a house costing £500,000, where a saving of £15,000 can be made. As the price rises above £500,000, the benefit is capped at £15,000, therefore, the relative benefit or saving decreases from hereon in.

It is interesting therefore that at the point at which the relative benefit starts to decline we see the biggest increase in homebuyer activity with transactions in Q4 2020 276% ahead of their level before the Stamp Duty Holiday (Q2 2020).

It is also in this price bracket where the percentage increase in homebuyer housing transactions is larger than that of second-home buyers.

Whilst we cannot draw firm conclusions it appears that those with higher levels of wealth have been more able to take advantage of the Stamp Duty holiday, a holiday which was not specifically designed to meet their needs and desires.

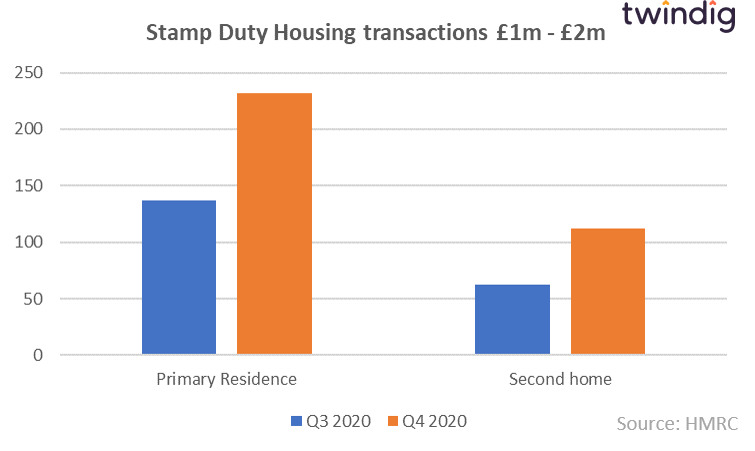

Housing transactions £1 to £2 million

A similar story emerges for housing transactions in the £1 to £2 million price bracket primary residence purchases increased by significantly more than second home purchases, more than doubling in Q3 2020 and up by more than 200% in Q4 2020 compared to Q2 2020. However, second home purchases did also increase significantly, up by more than 50% in Q3 2020 and more than doubled in Q4 2020 compared to their pre-stamp duty holiday levels in Q2 2020.

One of the side effects of the COVID-19 lockdowns is that for those with significant amounts of money it is increasingly difficult to spend it through normal channels. With expensive holidays and restaurants off the table and social lives significantly curtailed it seems that the wealthy are channelling more money into property, investing in their homes and buying second homes.

At these price points, the relative Stamp Duty savings diminish and we question whether the Stamp Duty Holiday would have been a critical factor in the decision making process behind these transactions. Does the Stamp Duty Holiday at these levels merely represent a taxpayer subsidy to the already cash-rich and wealthy?

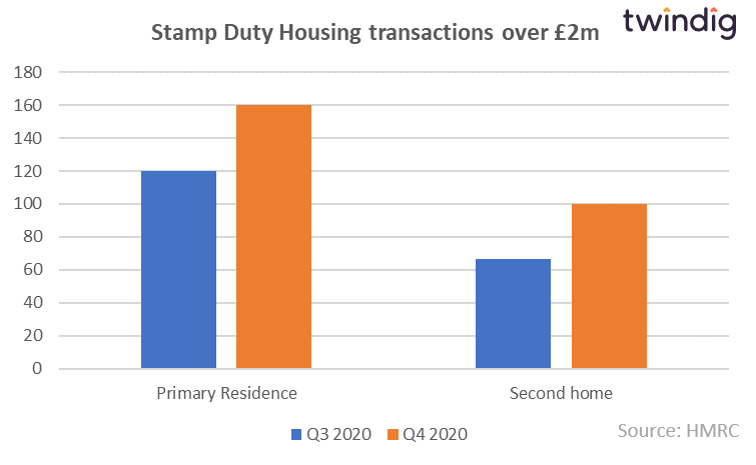

Housing transactions over £2 million

Housing transactions above £2 million more than doubled in Q3 2020 and increased again in Q4 2020. Second-home purchases above £2 million increased by more than 60% in Q3 2020 and were twice their Q2 2020 levels in Q4 2020.