Housepresso 31 July 22

Will house prices fall as interest rates rise?

Received wisdom suggests that as interest rates rise, house prices will fall. At first glance, this makes sense as the cost of mortgages rises, the size of mortgages will fall, putting downward pressure on house prices.

Since 1983 there have been 13 periods of either rising or falling interest rates. We have looked at each, in turn, to see if a pattern emerges. A pattern does emerge, but not the one received wisdom suggests.

Is Kettel Homes your cup of tea?

Kettel Home's mission is to help you ‘move in without a mortgage'. It is the latest in a growing number of rent-to-buy companies seeking to help aspiring first-time buyers without access to a large deposit to get a foot on the housing ladder, but is it your cup of tea?

Mortgage approvals fall five months in a row

The writing appears to be on the wall that the UK housing market is cooling, the downward trend in mortgage approvals, and therefore housing market activity, is clearly illustrated in the graph above, but is this mean reversion or the start of a housing recession?

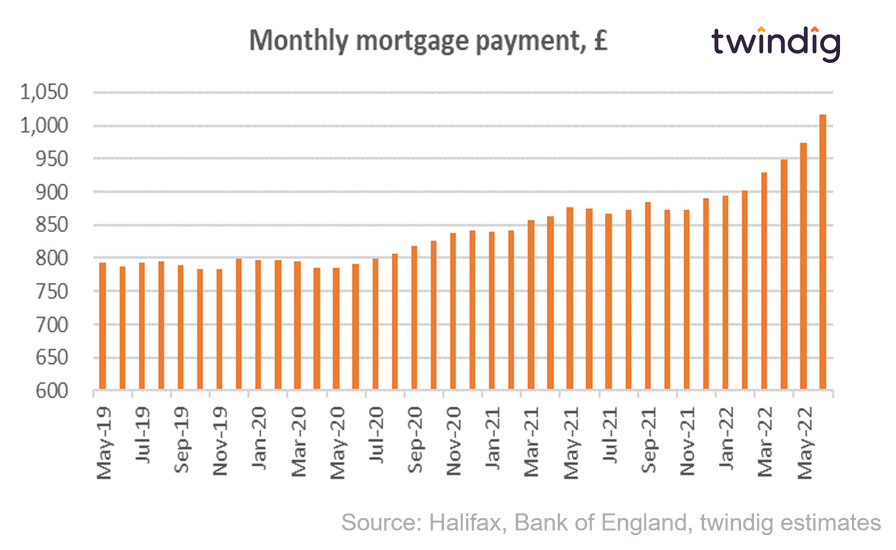

Average mortgage now more than £1,000 per month

According to the Bank of England, average mortgage rates rose by more than 10% in June. The combined impact of mortgage rate and house price rises means that the mortgage payment on the averagely priced home in the UK assuming an 80% LTV Mortgage broke the £1,000 barrier for the first time in June, rising from £974 in May 2022 to £1,016 in June.

Twindig Housing Market Index

In the week that saw mortgage approvals fall and mortgage rates rise the Twindig Housing Market Index rose by 3.4% to 77.4 as residential investors brushed off concerns about rising mortgage rates and slowing housing market activity. Most felt that the decline in mortgage approvals was a return to normality rather than a step into the unknown and the upward passage of mortgage rates was already baked into expectations, with more expected to come.