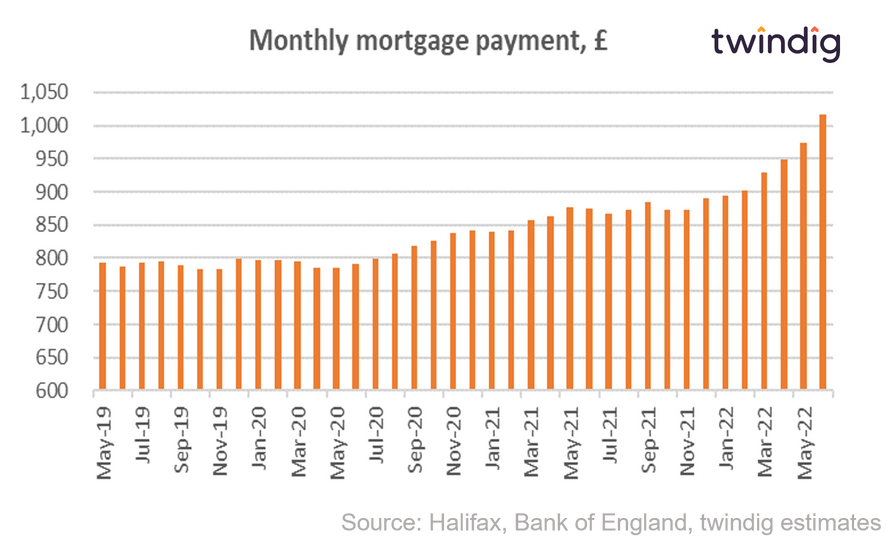

Average mortgage payment rises above £1,000 per month

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased significantly in June 2022, rising by more than 10%

What the Bank of England said

The average floating mortgage rate for new business 2.44%

The average fixed mortgage rate for new business 2.14%

The average overall mortgage rate for new business 2.6%

Twindig take

The trend in mortgage rates paints an unwelcome picture, as the cost of living rises, mortgage rates are rising at an even faster pace. The (temporary) good news is that most households have fixed-rate mortgages, but when the time comes to re-mortgage if current trends continue it is likely that their monthly mortgage payments will rise significantly.

Over the last two years the average floating rate for new mortgages has risen from, 1.53% to 2.44% - an increase of 60% and the average fixed rate has risen from 1.80% to 2.14% an increase of almost 20%.

To put these increases in context for every £100,000 borrowed the average payments on a floating rate mortgage have increased from £401 to £444 an increase of £43 (or 10.7%) per month and the average fixed rate payments have increased from £413 to £429 an increase of £16 (or 4%) per month.

The combined impact of mortgage rate and house price rises mean that the mortgage payment on the averagely priced home in the UK assuming a 80% LTV Mortgage broke the £1,000 barrier for the first time in June, rising from £974 in May 2022 to £1,016 in June