Housepresso 25 Apr 21

All you need to know about the housing market this week in one quick hit

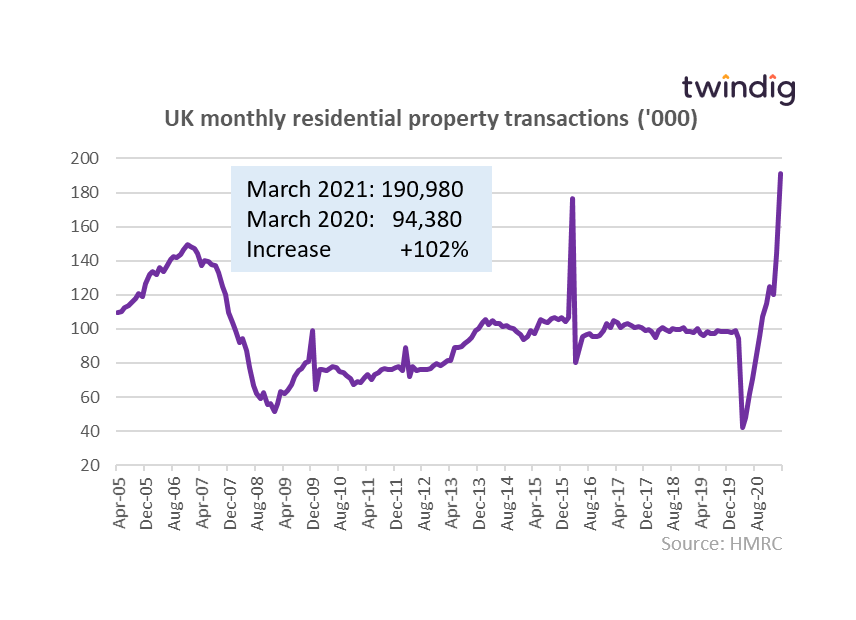

Housing transactions - can you spot the stamp duty holiday?

The Stamp Duty Holiday effect: Provisional data from HMRC indicates that housing transactions doubled in March 2021 to 190,980 compared to 94,380 a year earlier as households rushed to beat the Stamp Duty Deadline that never came...

The level of housing transactions in March 2021 is the highest monthly level on record. UK households have certainly used the time they have been staying at home to buy homes. It is incredible the impact of Government stimulus on the housing market and perhaps it is time to direct that stimulus to other sectors as the housing market appears to be in rude health.

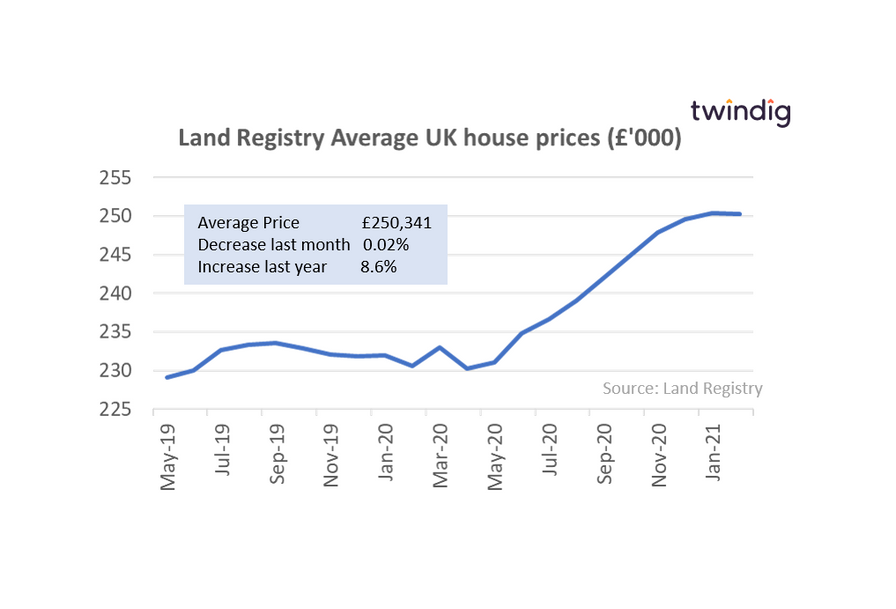

UK house prices

The average house price in the UK is £250,341, average prices have increased by 8.6% over the last year and decreased by £57 (0.02%) over the last month. House prices are riding high, but pausing for breath having increased by 8.6% (£19,732) since the start of the COVID-19 pandemic.

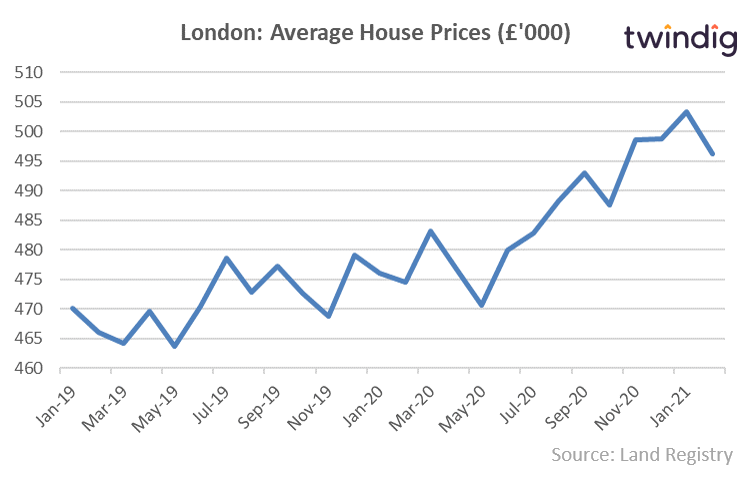

London house prices lose £7,000

The latest data from the Land Registry shows that the average house price in London fell by 1.4% or £7,039 to £496,269 in February 2021. In February 2021 house prices rose in 21 of the 34 London boroughs. Pricing was finely balanced but overall house prices in London fell slightly.

Low deposit mortgage guarantee scheme launched

The UK Government launched a 95% loan to value (LTV) mortgage guarantee scheme on 19 April 202.

The mortgage guarantee scheme has been launched by the UK Government to help stimulate or increase the supply of low deposit mortgages. As at 20 April 2021, according to Moneyfacts, there were 6,375 mortgage products on offer across the UK of which only 21 were 95% loan to value or 5% deposit mortgages.

Helping Hand mortgage multiples rise to 5.5x income

The Nationwide Building Society has launched a helping hand mortgage for First Time Buyers. Qualifying first-time buyers can borrow up to 5.5 x their income provided they have at least a 10% deposit. Previously Nationwide lent up to 4.5x a borrowers income.

Be more Chris

Congratulations to Chris from Chertsey who won this week's £100 Prize Draw for registering his home on Twindig and claiming his FREE monthly home valuation report. Well done Chris

You can claim your FREE home valuation report by clicking on the link below