Houselungo 25 Apr 21

A lungo length look at this week's housing market news

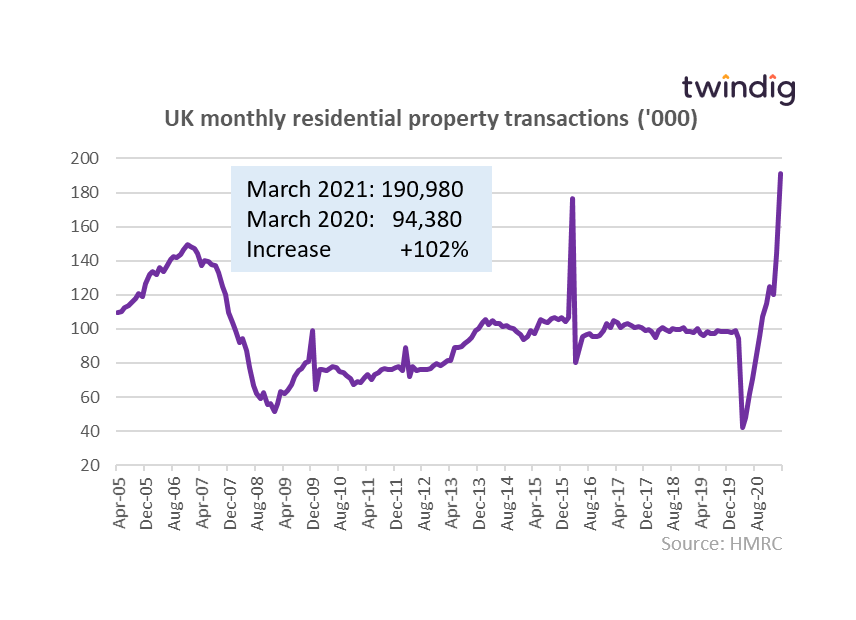

Housing transactions - can you spot the stamp duty holiday?

The Stamp Duty Holiday effect: Provisional data from HMRC indicates that housing transactions doubled in March 2021 to 190,980 compared to 94,380 a year earlier as households rushed to beat the Stamp Duty Deadline that never came...

The level of housing transactions in March 2021 is the highest monthly level on record. UK households have certainly used the time they have been staying at home to buy homes. It is incredible the impact of Government stimulus on the housing market and perhaps it is time to direct that stimulus to other sectors as the housing market appears to be in rude health.

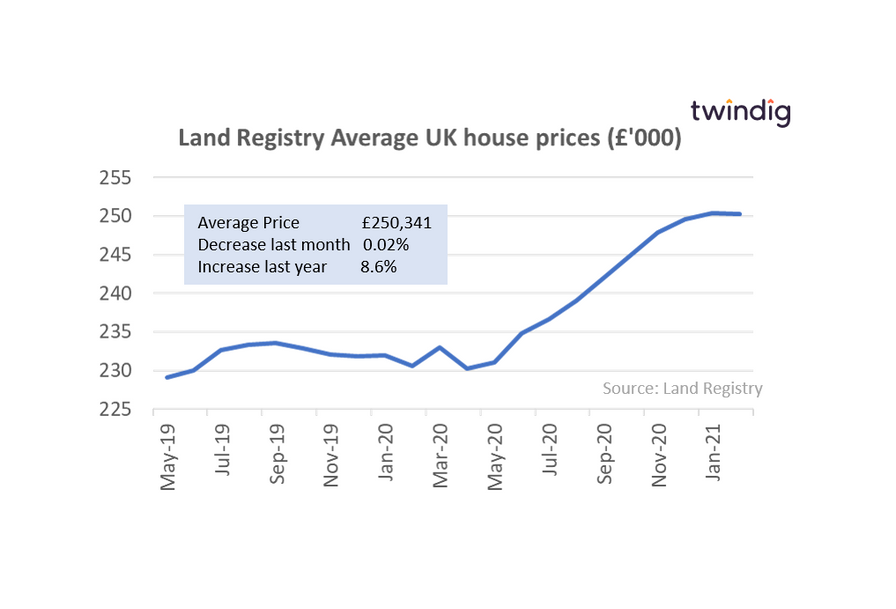

UK house prices

The average house price in the UK is £250,341, average prices have increased by 8.6% over the last year and decreased by £57 (0.02%) over the last month. House prices are riding high, but pausing for breath having increased by 8.6% (£19,732) since the start of the COVID-19 pandemic.

UK house prices decreased by £57 in February 2021, a slight decrease of 0.02%, essentially they were unchanged. In our view, this very small reduction reflected the looming end of the Stamp Duty Holiday and the realisation that those who started looking for a home in February would be unlikely to complete the purchase before the end of March when, at the time, the Stamp Duty Holiday was scheduled to end. This data was compiled before the stamp duty holiday was extended in the Budget. We expect house price inflation to return in March as the data catches up with the changes in taxation policy.

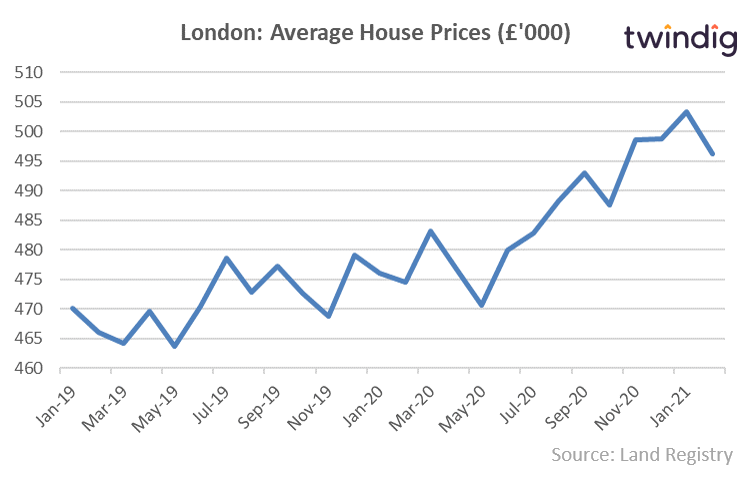

London house prices lose £7,000

The latest data from the Land Registry shows that the average house price in London fell by 1.4% or £7,039 to £496,269 in February 2021. In February 2021 house prices rose in 21 of the 34 London boroughs. Pricing was finely balanced but overall house prices in London fell slightly.

The biggest falls were in Kensington and Chelsea where average house prices fell by £122,315 the City of London down £96,332, followed Hammersmith & Fulham down £80,408.

The biggest London house price gains last month were to be found in the City of Westminster up £53,974, Newham up £26,755 and Sutton up £19,109.

Low deposit mortgage guarantee scheme launched

The UK Government launched a 95% loan to value (LTV) mortgage guarantee scheme on 19 April 202.

The mortgage guarantee scheme has been launched by the UK Government to help stimulate or increase the supply of low deposit mortgages. As at 20 April 2021, according to Moneyfacts, there were 6,375 mortgage products on offer across the UK of which only 21 were 95% loan to value or 5% deposit mortgages.

Helping hand mortgage multiples rise to 5.5x income

The Nationwide Building Society has launched a 'helping hand' mortgage for First Time Buyers. Qualifying first-time buyers can borrow up to 5.5 x their income provided they have at least a 10% deposit. Previously Nationwide lent up to 4.5x a borrowers income.

The ‘helping hand’ mortgage will be in limited supply because since the Mortgage Market Review in 2014 the Financial Conduct Authority (FCA) limits the number of mortgages that can be sold above a 4.5x lending multiple to no more than 15% of mortgages issued. The limit is in place because research revealed that lending above 4.5x income and lending where the mortgage payments were above 40% of household income significantly increased the chances that a borrower might default should they experience financial stress. More of what you want is not necessarily good for you.

For a First Time Buyer earning £40,000 and assuming a 3.5% Mortgage rate, the repayments on a 4.5x income mortgage would be £896 per month, rising to £1,095 if £220,000 of 5.5x income was borrowed.

The 4.5x income lending multiple repayments of £896 per month works out at 34.9% of take-home pay, the £1,095 42.6% of take-home pay, taking it into the ‘danger zone’ outlined by the regulator.

As ever the launch of this mortgage has split opinion between those who think it a great idea as it helps them realise their homeownership dreams to those who worry that this will add further upward pressure on house prices and exacerbate the problem it is trying to solve.

Taylor Wimpey – Jam today and jam tomorrow

Taylor Wimpey one of the UK’s largest housebuilders issued a trading update this week

What they said

The UK housing market continues to be resilient

Year to date private sales rate was strong at 1.0 (2020: 0.90)

Order book c.£2.8bn (2020: £2.6bn)

Twindig take

Taylor Wimpey has had a strong start to the year, sales rates and cancellation rates are down: they are selling more homes today, and the orderbook is up and landbank has grown: they will be selling more homes tomorrow. In my view, Taylor Wimpey offers investors both jam today and jam tomorrow.

Taylor Wimpey has had a strong start to the year, sales rates and cancellation rates are down: they are selling more homes today, and the orderbooks and landbanks have grown: they will be selling more homes tomorrow. In my view, Taylor Wimpey offers investors both jam today and jam tomorrow and is performing well in a robust and Government supported housing market.

Be more Chris

Congratulations to Chris from Chertsey who won this week's £100 Prize Draw for registering his home on Twindig and claiming his FREE monthly home valuation report. Well done Chris