Low deposit mortgage guarantee scheme - all you need to know

The UK Government launched a 95% loan to value (LTV) mortgage guarantee scheme on 19 April 2021

What is the 95% LTV mortgage guarantee scheme?

The mortgage guarantee scheme has been launched by the UK Government to help stimulate or increase the supply of low deposit mortgages. As at 20 April 2021, according to Moneyfacts, there were 6,375 mortgage products on offer across the UK of which only 21 were 95% loan to value or 5% deposit mortgages.

Why are 5% deposit mortgages important?

For first time buyers, the biggest barrier to homeownership is the deposit. The Halifax recently reported that in 2020 the average first-time buyer deposit was £59,000, however, the average mean full-time wage is only around £35,000. A wage of £35,000 equates to a monthly take-home pay of around £2,290. A £59,000 is equivalent to more than two year’s take-home pay (26 months) months. Even if you were able to save £500 per month it would take 10 years to accumulate a £59,000 deposit.

During 2020 the average first-time buyer deposit of £59,000 accounted for 23% of the house price (a 23% deposit). If only a 5% deposit were required the deposit amount falls by almost 80% from £59,000 to £12,800, a reduction of £46,200. Hopefully, it is clear why the availability of a 5% deposit or 95% LTV mortgage is important to savings strapped first-time buyers.

Why are 5% deposit mortgages in short supply?

Low deposit mortgages are much higher risk than those with larger deposits from the lenders perspective. If house prices fall the homebuyer loses out before the lender.

Consider a situation where house prices fall 20%:

With a 95% LTV mortgage the homebuyer would lose their 5% deposit and the lender the next 15%. With a 60% LTV mortgage the homebuyer would lose 20% of their equity, but the lenders 60% would remain intact.

How does the Government mortgage guarantee work?

Under the 95% mortgage guarantee scheme the lender lends as usual, but the Government takes the risk of the loss from 95% down to 80%. In our example above where house prices fall by 20%, the homebuyer would lose their 5% and the UK Government would cover the next 15% of the loss and therefore the lender would not lose any money.

From a risk perspective, the risk profile of the 5% deposit mortgage looks more like that of a 20% deposit mortgage to the lender. With the mortgage guarantee in place, the UK Government hopes that it will encourage more lenders to offer a greater range of 5% deposit or 95% Loan to value mortgages

Empirically, house prices rarely fall by 20% and when house prices do fall, they have tended to recover over time.

Who can use the Mortgage Guarantee scheme?

The Mortgage Guarantee scheme is open to any homebuyer (first-time buyers and current homeowners) looking to buy their primary residence with a 5% deposit for homes costing up to £600,000. The aim is to provide an affordable route to homeownership for all aspiring homeowners.

Which banks are supporting the Mortgage Guarantee scheme?

At its launch in April 2021, many of the UK’s largest mortgage lenders were supporting the scheme: Lloyds, Santander, Barclays, HSBC and NatWest. Virgin Money had plans to launch a 95% LTV mortgage under the scheme in May 2022.

How much do Mortgage Guarantee scheme mortgages cost?

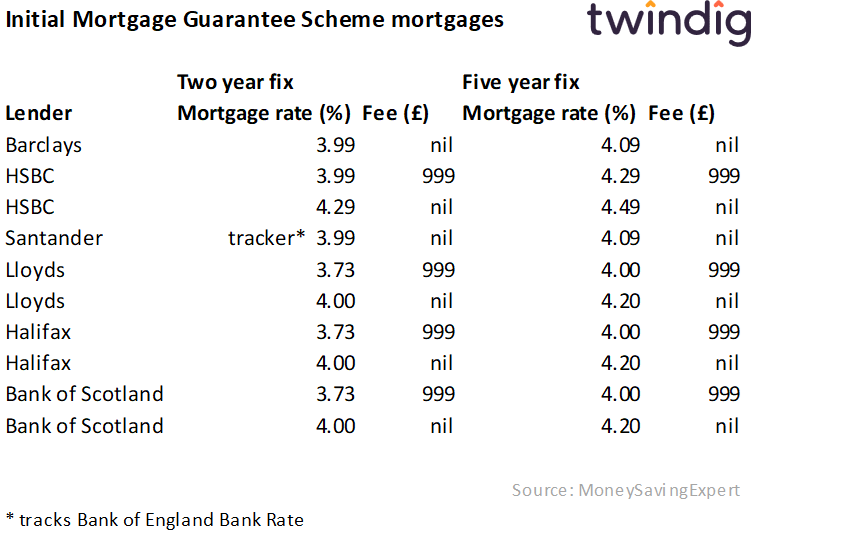

We show in the table below the 5% deposit mortgages available through the mortgage guarantee scheme when it launched on 19 April 2021 as reported by MoneySavingExpert

How much will my mortgage payments be?

To calculate your mortgage payments you will need to know:

- how much you are borrowing

- the mortgage rate, and

- the length in years of your mortgage

Remember that a 'two-year fixed-rate' mortgage is not a mortgage lasting only two years, rather the mortgage rate is fixed for two years. The length of your mortgage is likely to be between 25 and 30 years. Increasingly the length will lower the monthly repayments (you will be paying less capital each month), but will mean that you are paying more interest overall because you are borrowing the money over a longer period.

Can I get an interest-only mortgage through the mortgage guarantee scheme?

No, you can only get a repayment mortgage through the mortgage guarantee scheme. We would suggest that you seek professional mortgage and financial planning advice before choosing an interest-only mortgage. With an interest-only mortgage at the end of the term, you still have to pay back the amount you originally borrowed. Whereas with a repayment mortgage, although the payments are higher than for a similarly priced interest-only mortgage, you will have nothing left to pay at the end of the full term, your payments will have repaid the amount you borrowed over the full term of the mortgage.

Are mortgages through the mortgage guarantee scheme better than those outside of it?

Not necessarily, the aim of the Government Mortgage Guarantee scheme is to kick start or increase the supply of low deposit high loan to value mortgages. Whilst there were 10 mortgages available through the scheme at launch, according to Moneyfacts on 20 April 2021 there were 21 mortgages available at a 95% loan to value. Some of those mortgages were more expensive than those available under the mortgage guarantee scheme and some were cheaper.

We would advise homebuyers to look carefully at the products available and to seek advice from a trained and qualified mortgage adviser.

How long will the Mortgage Guarantee scheme last?

The mortgage guarantee scheme will be open for new mortgage applications from 19 April 2021 until December 2022.

Why will the Mortgage Guarantee scheme end in December 2022?

The UK Government believes that the shortage of supply of 95% LTV mortgages is primarily due to the impact of the COVID-19 pandemic rather than a symptom of a longer-term issue. The Government hopes that the pandemic impact on the mortgage market will reduce over time as the infection rate is brought under control and as the economy returns to normal.

The Government will however keep the mortgage market conditions under review in order to determine if the mortgage guarantee scheme needs to be extended. You can read more about the Mortgage Guarantee scheme here.