Should we be worried that First Time Buyer deposits have reached £59,000?

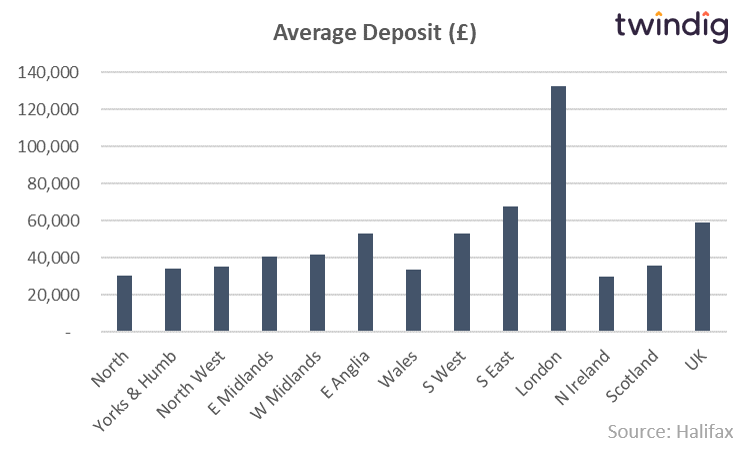

Lloyds Bank reported this week that the average first-time buyer deposit in 2020 was £58,986, up £11,677 from last year’s figure of £47,309. This is alarming for two reasons: firstly, when did deposits move from fractions of income to multiples of it and, secondly how can this possibly be sustainable?

If first time buyers are shut out of the housing market either we are moving to extreme housing wealth inequality or plodding along a path towards an almighty house price correction

First Time Buyer Deposits from fractions of income to multiples of income

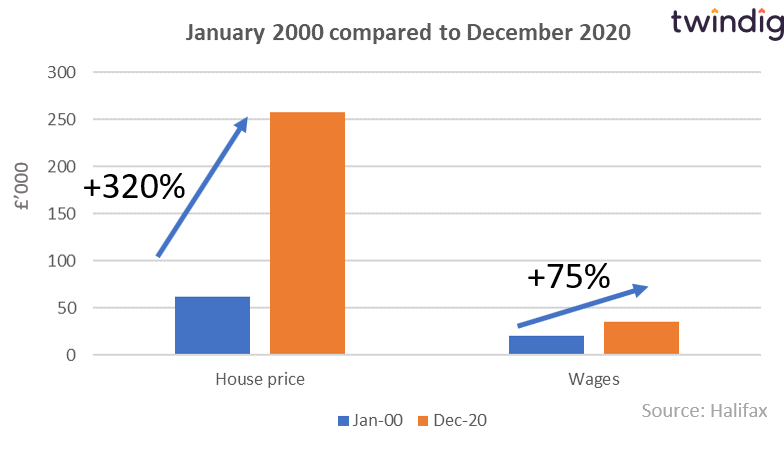

I purchased my first property around the turn of the century and when we talked about multiples of incomes we were talking about mortgages, not deposits. In January 2000 the average house price for a First Time Buyer was £61,692 and the mean full-time wage was around £20,000. By the close of 2020, the mean full-time wage had risen to around £35,000, and the average home purchased by a first-time buyer cost £257,934.

House prices have become divorced from earnings. Wages have risen by around 75%, but house prices by more than four times….

Without the bank of mum and dad, it is difficult to see how aspiring first-time buyers will be able to get a foot on the first rung of the housing ladder

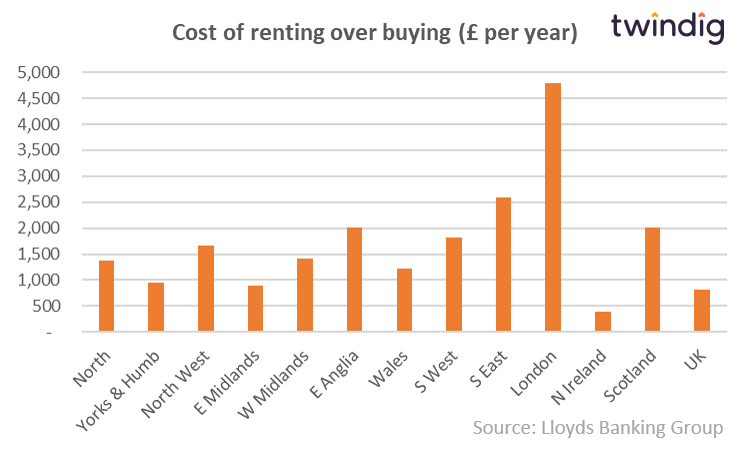

To make matters worse, renting is more expensive than buying

Earlier this week, the Halifax Building Society released a report which said that ‘lockdown leaves first-time buyers £800 a year better off than renters. They compared the costs of homeownership with the rental cost of a similar property. To make a fair comparison fair they did not just compare rent to mortgage costs but also added to the mortgage cost allowances for household maintenance, repair, minor alterations and insurance costs and income lost by funding a deposit rather than saving.

This will be a bitter pill for aspiring first-time buyers to swallow, they are paying more than their homeowning peers, whilst also trying to save for a deposit in an environment where savings rates have scarcely been lower.

How do you solve a problem like deposits?

We show in the chart below the average deposit paid by First Time Buyers in 2020 by region. First Time Buyers are between a rock and a hard place. Interest rates are low which means that mortgage rates are low so homebuyers can borrow more than they could if mortgage rates were higher. Low interest rates also means low savings rates making it harder for First Time Buyers to save for a deposit. Meanwhile, house price growth has significantly outpaced wage inflation.

First Time Buyers without access to the bank of mum and dad are going to find it increasingly difficult to get on the housing ladder. If homeownership in one generation becomes a prerequisite for homeownership in the next then the UK will experience an accelerating rate of housing wealth inequality with the housing stock owned by a smaller and smaller percentage of the population and the end game could be like the end game of the board game monopoly.

However, first-time buyers are often found at the start of housing transaction chains and are sought after buyers due to their chain free status. If enough of them are priced out the housing market will grind to a halt, not through lack of home for sale, but due to lack of active homebuyers. At this point, potential home sellers will need to reduce their asking prices to encourage the scarcely seen common or garden first time buyers back into the housing market.

Carrots and sticks

Is taxation the answer?

Taxation is rarely popular, but it can be used a form of nudge theory (some would argue that it is already). Increased taxation on landlords could lead to an increase in the supply of homes priced appropriately for first-time buyers and punitive capital gains tax rates on property could calm house price inflation.

Is the answer enhanced first-time buyer incentives?

The Government could open up the second-hand housing market for help to buy this would solve the deposit issue, but critics would argue that such a policy would add fuel to the existing house price growth fire.

When it comes to the housing market we seem to want our cake and eat it, we don't want house prices to come down, but we also don't want policies that would fan the flames of further house price inflation.

The tipping point will come when renters make up the majority of the voting public, this will provide little solace to aspiring homeowners today, but will maybe cause some homeowners to worry about tomorrow.

Is Professional PRS a wolf in sheep's clothing?

Some politicians in every party appear happy to knock the amateur landlord and sing the praises of the professional landlord. The argument is often made along the lines of higher quality of housing stock, better-managed properties and better outcomes for tenants. However, the majority of landlords do a good job and are keen to supply homes that people want to live in and an unconsolidated market is a competitive one, which is good for tenants and rewards the best landlords.

We would however do well to remember that we are questioning the logic of a few big companies controlling our digital lives: what we buy online, and what we see online. Housing may seem terribly analogue compared to shiny IT and technology companies, but with homeownership in decline do we really want to cede control to our biggest assets to what may become the biggest corporations? Let us not forget that the UK housing stock is worth much more than the combined value of all the companies listed on the London Stock Exchange.

Isn't it better for all of us to aspire to belong to a homeowning majority than live in a world where corporations control, influence and perhaps manipulate the value of our biggest assets?