Housepresso 21 August 22

The truth about Negative Equity

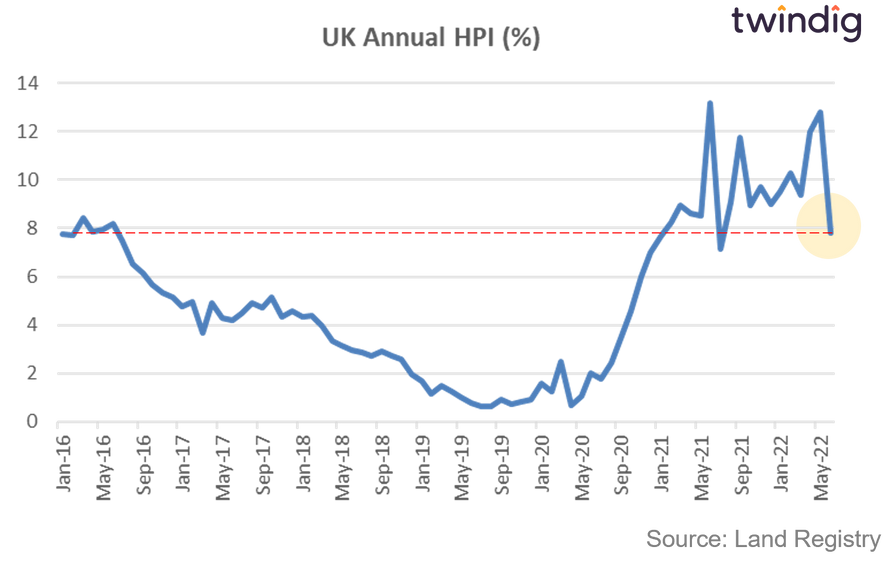

In July 2022 it seemed that for the first time since the start of the pandemic house price growth had stalled. The Nationwide reported that house prices had increased by 0.1% whereas the Halifax reported that house prices had fallen by 0.1%. With one index up and the other down was the house price party about to end and is negative equity going to be the next big thing?

House prices up, but on the way down?

House prices continued to rise in June according to the latest data from the Land Registry, but many were alarmed that the rate of growth was slowing. It is slowing, but still remains at elevated levels. House price growth is likely to slow as inflation rages and mortgage rates rise, but are we now at the beginning of the end?

Average house prices rising in London

The latest data from the Land Registry shows that the average house price in London rose by 1.9% or £9,846 to £537,920 in June 2022. House prices rose in 27 of the 34 London boroughs during June.

The biggest rises were in Hackney up £42,250 (7.2%), the City of London up £27,880 (3.5%) and Harrow up £24,760 (3.4%).

The biggest London house price falls last month were to be found in Kensington and Chelsea down £33,220 (2.4%), Islington down £17,460 (2.4%) and Harringey down £13,050 (2.1%).

Perenna: Fixing mortgages for life

With mortgage rates rising and the cost of living surging many homebuyers and households are looking for certainty. Perenna is looking to meet those needs by offering mortgage certainty in an increasingly uncertain world. Long-term fixed-rate mortgages are popular and big business in other countries, Perenna is about to launch them in the UK and they might just shake up the whole UK mortgage market.

Twindig Housing Market Index