The truth about negative equity

In this article, we explain what negative equity is, how close you are to negative equity, why it should concern you and what you can do about it should you find yourself in negative equity.

Is negative equity making a comeback?

In July 2022 it seemed that house price growth had stalled for the first time since the start of the pandemic. The Nationwide reported that house prices had increased by 0.1% whereas the Halifax reported that house prices had fallen by 0.1%. With one index up and the other down was the house price party about to end? We also noticed that in early August some had started to talk about housing negative equity.

What is negative equity?

Negative equity is the situation where your home is worth less than the value of loans secured on it. If your home is worth £200,000 but you have a mortgage of £250,000 you have negative equity of £50,000, whereas if you purchased a home for £300,000 and have a mortgage of £250,000 you have equity of £50,000.

How do you get into negative equity?

No homeowner starts with negative equity. Most banks and building societies will only lend up to 95% of the value of the home, a 95% loan to value (LTV). This means that if you start with a 95% LTV mortgage you will have 5% equity in your home.

If house prices fall by more than 5% you will then be in a situation with negative equity.

What are the implications of negative equity?

If you want to sell your home whilst in negative equity you will have to find another source of funds to pay off your loans. If your home is worth £200,000 but your mortgage is £250,000 you will need to find £50,000 to pay off your mortgages

Re-mortgaging becomes more difficult. If you are in negative equity, most lenders won't let you switch to a new mortgage deal when your existing one ends. You will normally be switched to the lender's Standard Variable Rate (SVR) which is usually much higher than a normal mortgage rate. Your mortgage payments are therefore likely to increase.

Do I have to sell my home if I'm in negative equity?

No. As long as you can keep paying your monthly mortgage payments there is no need to sell your home or try to re-mortgage it. If you are able to service your mortgage one could argue that the value of your home is only important when you want to sell it. If you are not going to crystalise a loss, or make a loss by selling with negative equity then the negative equity you have is academic.

What are the risks of getting into negative equity today?

Homeowners are only at risk of negative equity if house prices fall. Since the start of the COVID-19 pandemic house prices across the UK have increased significantly, on average by more than £52,000 since the start of lockdown one. Following such large increases in house prices, many are starting to think that what goes up can also come down.

Rather than speculate about the future path of house prices, we thought it would be helpful to look at what happened to house prices during the last two housing recessions.

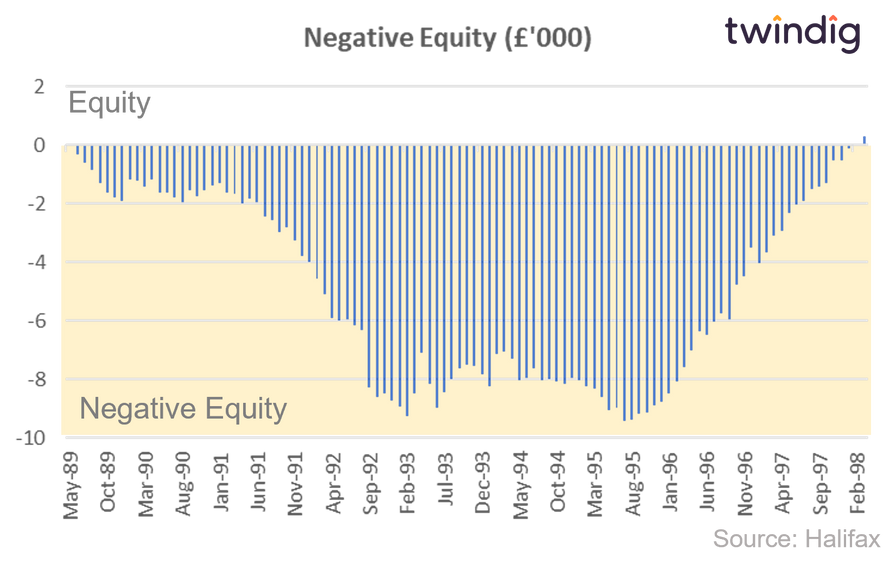

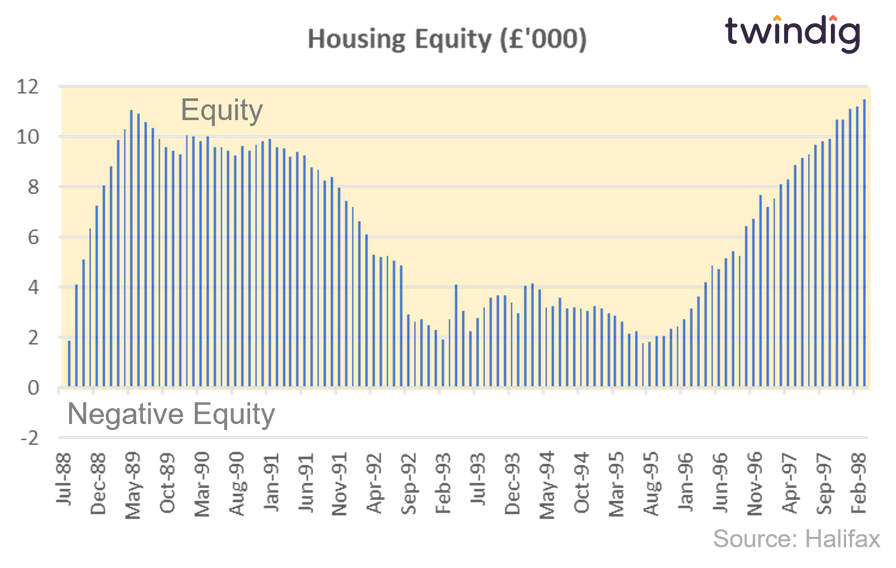

Negative equity and the 1989 housing recession

House prices peaked at £70,246 in May 1989 and troughed in February 1993, almost four years later, at £61,132 an unlucky fall of £9,300 or 13%.

If you had purchased a home with a 100% LTV mortgage in May 1989 you would have been clear of negative equity by January 1998, almost ten years later.

However, if you had purchased your home just ten months earlier in June 1988, you would have avoided negative equity altogether.

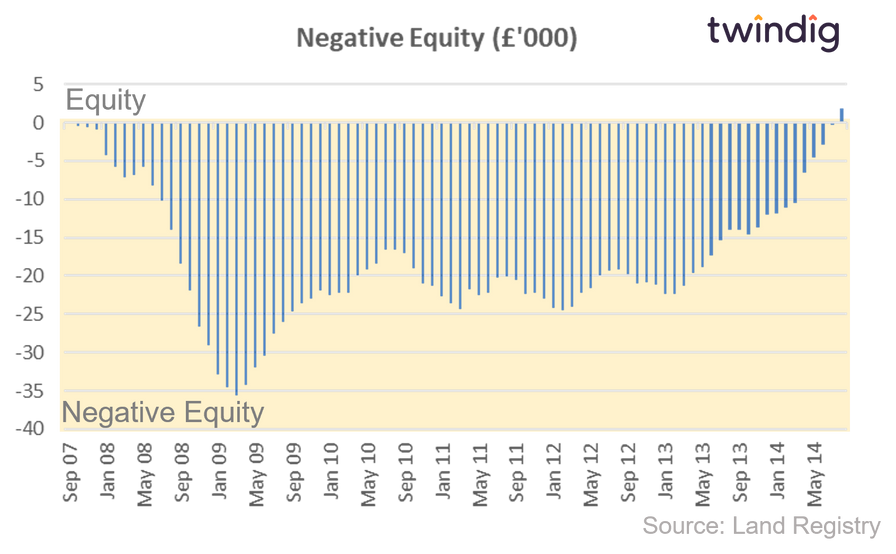

Negative equity and the Credit Crunch

House prices peaked at £190,032 in September 2007 and troughed in March 2009 at £154,452, a fall of £35,600 or 18.7%, a much larger and much steeper fall than we saw in 1989.

If you had purchased your home in September 2007 with a 100% LTV mortgage you would have been clear of negative equity by August 2014, just under seven years later.

However, if you had purchased your home in April 2005, just over 2 years earlier, you would have avoided negative equity altogether.

How close is my home to negative equity?

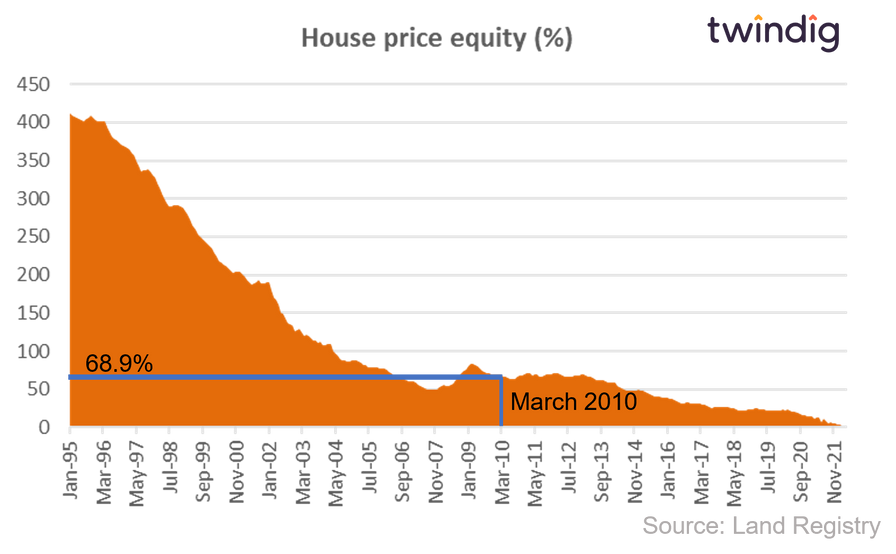

The chart below shows the percentage increase in average house prices since January 1995, this allows you to see how close (or far away) you may be from negative equity.

For instance, if you purchased your home in March 2010 the value today is around 70% higher than when it was purchased, which is a significant equity buffer.

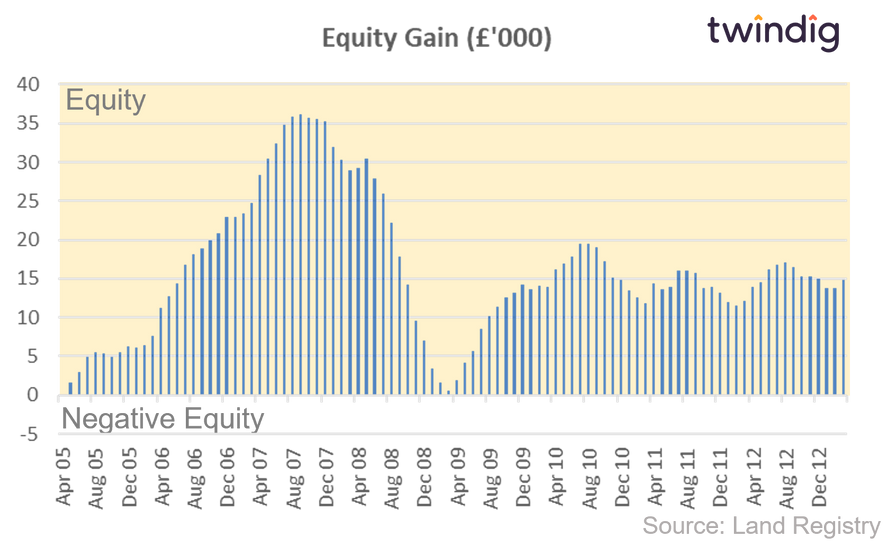

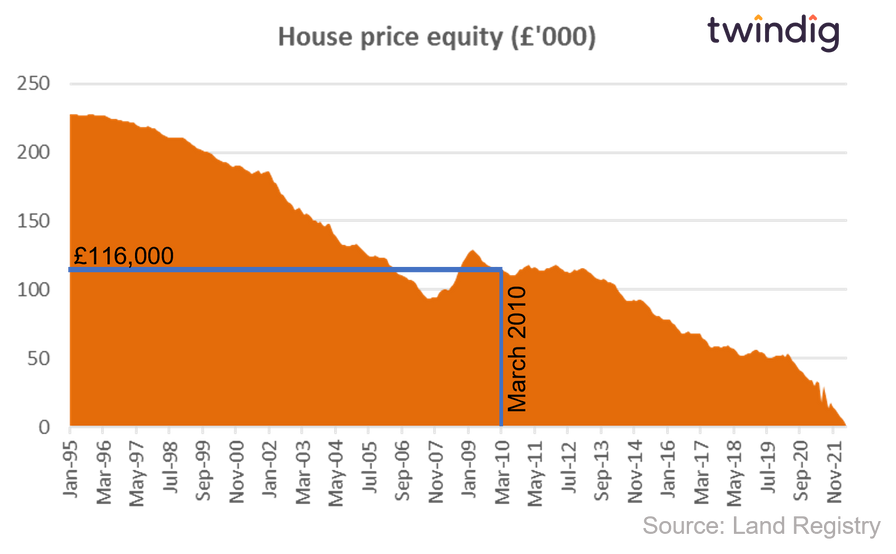

The charts below show, for the average house in the UK, how much equity has been gained by general house price growth since the date of purchase.

In March 2010 the average UK house price was £167,878 and the latest average UK house price from the Land Registry is £283,496 this means the equity gain due to house price inflation is £115,618.

Average house prices could therefore fall by £115,618 before the purchaser would see prices fall below their purchase price.

Those most at risk from negative equity are those who purchased most recently as house price growth has yet to create a meaningful additional house price equity buffer.

However, even those who purchased just before the first COVID-19 lockdown have built up an equity buffer of around £50,000 of equity in addition to their own deposit.

For the latest regional house price trends click on the button below: