Housepresso 20 June 21

All you need to know about the housing market this week in one quick hit

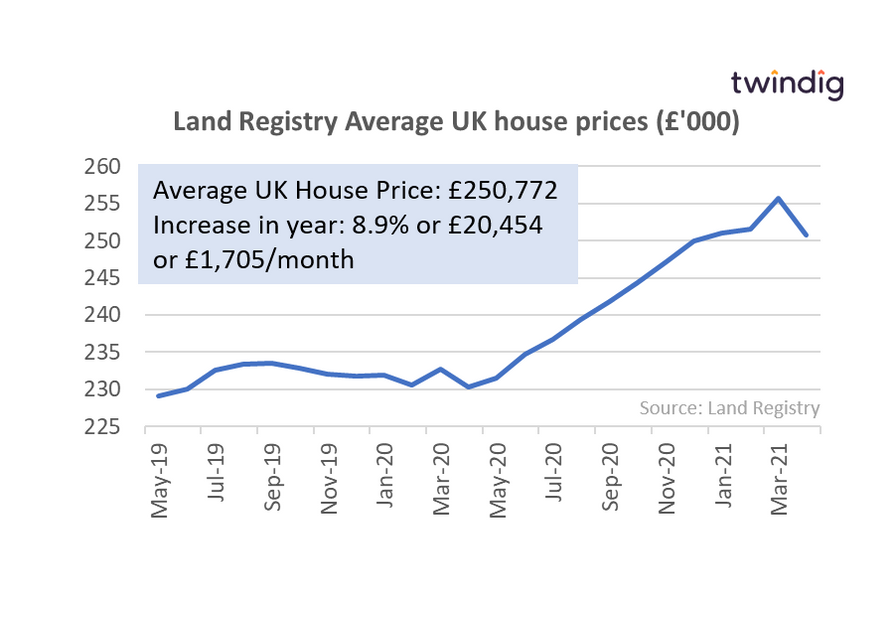

House prices fall in April...

The latest Land Registry data suggests that UK house prices fell by 1.9% in Apr 21 to £250,772, good news for buyers, but not really bad news for sellers as the increase in the year is still more than £20,000 (c. £1,700 / month). The land registry data relates sold house prices, so the small reduction, in our view, will have reflect prices agreed by those who thought they might miss the 31 March 2021 Stamp Duty Holiday deadline. Following the stamp duty holiday extension, we expect the house price data over the coming months show more ups than downs.

London house prices by borough

The latest data from the Land Registry shows that the average house price in London fell by 2.0% or £10,073 to £491,687 in April 2021. During April 2021 house prices rose in 19 of the 34 London boroughs. We expect that the house price falls relate to the initially scheduled end to the Stamp Duty Holiday and would expect house prices in London to rise in the coming months.

The 5 key drivers of house prices

The UK housing market has not only been immune to the effects of the Covid-19 pandemic it has thrived under it. Despite a global pandemic house prices have reached record levels due, in our view, to house price inflation ignited by five key drivers:

- the Stamp Duty Holiday,

- the race for space

- the increase in savings as most avenues for spending money were either closed or severely restricted

- the access to low mortgage rates for those with sizeable deposits, and

- a shortage of homes for sale

To find out why these drivers have ignited the housing market you can read our article below

Is renting a home really cheaper than buying one?

Estate agent Hamptons reported this week that for the first time in 6 years it was cheaper to rent a property than to buy it, but is this really the case?

Find out if it is cheaper to rent than buy in your area by reading our full article