What drives house prices up and down?

Housing immunity

The UK housing market has not only been immune to the effects of the Covid-19 pandemic it has thrived under it. Despite a global pandemic house prices have reached record levels due, in my view, to house price inflation ignited by five key drivers:

- the Stamp Duty Holiday,

- the race for space

- the increase in savings as most avenues for spending money were either closed or severely restricted

- the access to low mortgage rates for those with sizeable deposits, and

- a shortage of homes for sale

Driver 1: The Stamp Duty Holiday

Stamp Duty Holidays are a tried and tested method of stimulating the UK housing market. They have worked in the past and they are at work today. Typically, life carries on as usual until the deadline looms and then we see a spike in activity (housing transactions) approaches, much like my university essay deadlines… We saw a big spike in March 2021 the original deadline and I suspect we will see another in June and a smaller one in September before a period of calm.

However, what is fascinating about this stamp duty holiday is that house prices have increased by more than the potential stamp duty saving. Homebuyers are rushing to pay more than they would have done before the stamp duty holiday began. On average UK house prices gave increased by around £20,000 since the start of the Stamp Duty holiday against a maximum saving (for those spending £500,000) of £15,000. The Stamp Duty saving for the averagely priced house is around £2,500, implying that buyers are about £17,500 worse off.

There must be more to pandemic house price inflation than the stamp duty holiday.

2. The space race

The pandemic has caused us to question how we live and where we live. Working from home means two things: we are no longer tied to a life of commuting to the office and we need adequate space at home to enable us to work from home. Small city or urban centre homes have therefore lost some of their appeal, if you don’t need to be within 40 minutes of the office you can let life rather than work guide your buying decisions.

A very positive side effect of the space race is the levelling up it could lead to as wealth ripples out to the regions. The space race is a new form of housing demand we have not seen before. A migration out of urban centres increases housing demand elsewhere pushing up prices.

3. Increased savings

If you are lucky enough to have kept your job the chances are you have saved more money as holidays overseas have been off the agenda, restaurants and theatres closed, social lives shut down. Irrespective of what you earn, you can spend only so much on your supermarket delivery and after a time you have bought everything you think you need from Amazon. Savings increase and the brits tend to spend as much as they can afford on their homes. Higher savings means more money flowing into the housing market putting more upward pressure on house prices.

4 Low mortgage rates

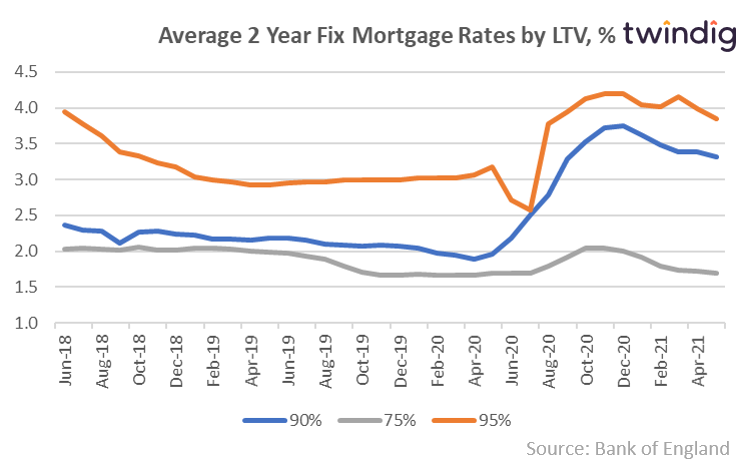

Money is cheap for those who can afford it. The Bank of England reported this week that the average mortgage rate on a 75% LTV mortgage in May was 1.46% rising to 3.85% for a 95% LTV mortgage. Compare this to the long-run average mortgage rate of around 6% and you can see how cheap credit currently is. Lower rates mean that you can borrow more, which allow house prices to rise.

5 shortage of supply

I speak to a lot of estate agents from one branch firms to national chains, they all share one thing in common, all of them need more homes to sell. Demand exceeds supply and as my A level economics reminds me, where housing demand exceeds housing supply, house prices will rise.

What could be the crack or cracks that bring the housing market down?

Simply put a reversal of one or more of the drivers currently pushing house prices up.

Stamp Duty Holiday

The Stamp Duty holiday has two end points. Until 30 June 2021 relief is available up to £500,000 and between 1 July and 30 September relief is available up to £250,000. As we pass those two end dates demand, in my view, is likely to fall or temper. Lower demand will lead to lower house price inflation.

The Space Race

The space race It will be fascinating to see if working from home is a short-term phenomenon or a long-term trend. I expect it will end up somewhere in between with those who can work from home 2-3 days a week. On this basis demand will continue to rise outside of urban centres for some time.

Increased Savings

Increased savings Once they are gone they are gone. No doubt as soon as restriction are lifted on overseas travel many will treat themselves to a more expensive holiday than usual and as our social lives come out of hibernation so will our wallets. All these factors point to less additional cash flowing into the housing market tempering house price inflation.

Mortgage rates

Mortgage rates When mortgage rates are low as they are now, small changes have a big impact on borrowing capacity. If we see a post-pandemic economic boom the Bank of England may raise Bank Rate to keep a check on inflation. This will have a direct impact on borrowing capacity reducing how much homebuyers can spend on housing.

Shortage of supply At the moment we are in a catch 22 situation – people who want to move cannot find anywhere to buy and therefore do not put their home in the market. At this point, the economic modelling assumption of rational behaviour clearly stumbles. With record-high house prices, basic economics would say now is a good time to sell especially as the shortage of supply is pushing prices higher. If more homes become available the prices achieved then may be lower than they are now. However economic models rarely deal with the situation where you have sold your home today but have nowhere to live tomorrow…

The supply of homes for sale is likely to increase once the majority believe that we have left the pandemic behind and live in a post-pandemic world.

I would hope that the many housing market leavers adjust slowly so that we do not see house prices fall as quickly as they rose. History does tell us that the current level of house price inflation is not sustainable and there are risks that those that buy-in haste today will have plenty of time to repent in their larger homes.

Could cladding be the elephant on the roof?

The cladding issues impact a very small percentage of the UK’s housing stock. Typically high rise buildings in urban centres. At the moment, there is a stalemate as the UK Government decides who should foot the bill for the repairs and remediation works. The near-term impacts are that those homes affected are essentially unsaleable and excluded from the housing market.

The good or bad news depending on whether or not you own a home embroiled in the cladding scandal is that this is an issue that impacts specific identifiable homes rather than the market as a whole.

If contractors or developers have to foot the bill the impact will be on their balance sheets and will lead to a short term or one-off hit to share prices to reflect the impact of the remediations on cashflow.

If the Government foots the bill the cost will be spread over the taxpayer base

If the homeowners have to foot the bill they are likely to have to take on more debt and hope that once rectified their homes will become saleable again and that when they come to sell they will be able to clear the additional debt. If this route is taken I would hope that the UK Government would offer homeowners low-interest loans that are only repayable should the home be sold.