Is renting really cheaper than buying?

Estate agent Hamptons reported this week that for the first time in 6 years it was cheaper to rent a property than to buy it, but is this really the case, Twindig investigates

What Hamptons found

Hampton's research suggests that before the pandemic those buying a home with a 10% deposit would have been better off than renters by £102 per month. Fast forward to March 2021 and the position has reversed with the average renter now better off by £71 per month than their homebuying peers.

We show in the graph regional variations of the monthly rent vs mortgage payments

But is the headline the right line?

From a purely monthly cashflow basis it is fair to say that in many areas monthly rental payments are cheaper than the equivalent monthly mortgage payment, but whilst we like to live in the moment our lives are the sum of our long-term decisions.

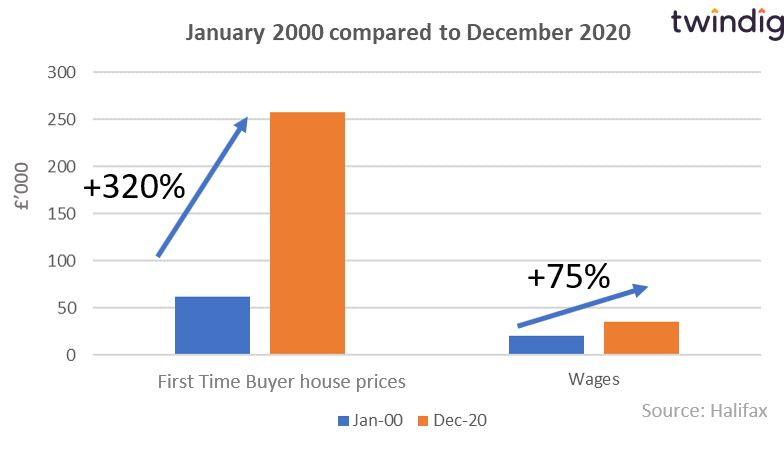

Between January 2000 and December 2020 the Halifax reported that the average price of a property purchased by a First Time Buyer increased by 320%. However, over the same period, average wages for full-time employees only increased by 75%.

Rents are linked to house prices. A rental yield is the rent received in a year divided by the price of the house. Many landlords will have a target yield in mind and others will seek to charge the appropriate ‘market rent’. This means typically that as house prices increase so do rents. Renters will have seen their rent increase at a faster rate than their income. Rent may have been cheaper than a mortgage in any one month, over time, as house prices rise, the renter may have found themselves priced out of the housing market.

So whilst rent might currently be cheaper now, in the longer term it may leave you paying more and having less wealth than your homebuying peers.

Is rent money is dead money?

From a purely financial asset basis yes. If you pay rent you are either paying someone else’s mortgage or paying away money that could be buying your own home. Renters are not building up housing equity, they do not end up owning a home, and do not benefit from house price inflation.

Also, many people do not simply have the choice between buying or renting due to a lack of deposit and a lack of access to sufficient mortgage finance.

It is important to remember that our homes are a source of shelter first and a financial asset second. It is unfortunate that in the UK today our fascination with the latter is restricting some households access to the former.

Is rent money smart money?

From a shelter perspective, it might be. Many homeowners will tell you of the pain of DIY, maintenance and repairs. However, if you are renting, the fear of a leaky roof, a busted boiler or Japanese Knotweed is someone else’s problem.

Renting also brings flexibility, you are not tied to one location, and you do not have to worry about the prospect of negative equity and buying at the top of the market