Housepresso 18 Dec 22

2022 an unprecedented year for the housing market

Earlier this week I joined Iain McKenzie and Holly Hibbett from the Guild of Property Professionals to discuss what happened to the housing market in 2022, our conclusion was it was an unprecedented year for the UK housing market.

In this podcast we discuss:

- What happened to house prices

- What happened to interest rates and why

- Housing transactions

- Inflation

Will 2022 be the peak for house prices?

Both Halifax and Nationwide house price indices have reported falling house prices, for the last three months and the latest data from the Land Registry also suggests that house prices are on the turn so it is likely, in our view, that we have passed the point of peak house prices

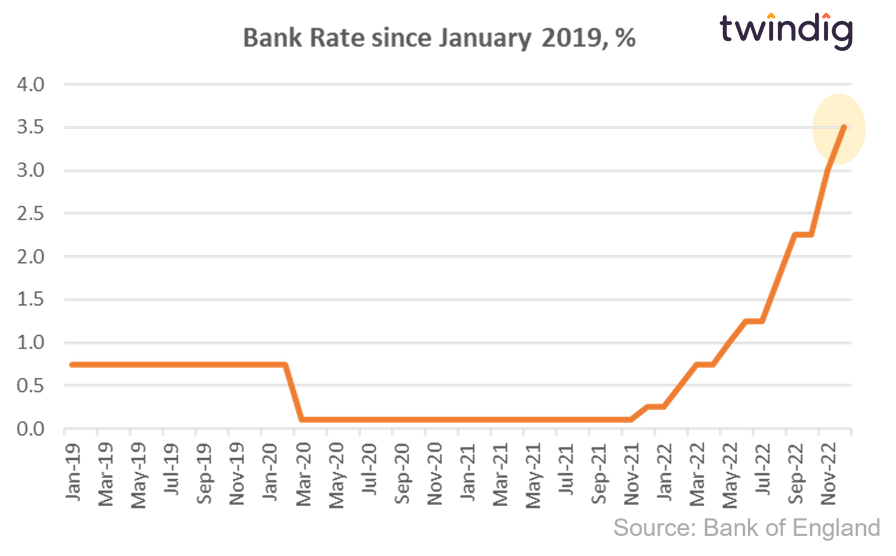

Bank Rate rises to 3.5%

On Thursday the Bank of England's Monetary Policy Committee (MPC) raised Bank rate to 3.5%. MPC members voted by a majority of 6-3 to increase Bank Rate by 50bp. Two members voted to maintain Bank Rate at 3.0%, the other member voted to increase Bank Rate to 3.75%

Bank rate up, but housing market on firm footing

The December Financial Stability Report from the Bank of England had both good news and bad news. The bad news, things are going to get worse before they get better. The good news we are in better shape and on a firmer footing than we were before both the early 1990s recession and the Global Financial Crisis.

Twindig Housing Market Index

It was a busy week for the housing market where Bank Rate rose to 3.5%, house prices nudged up 0.3%, the Bank of England published its Financial Stability Report and inflation fell from 11.1% to 10.7%, and the Twindig Housing Market Index nudged up by 0.3% to 67.5.