Bank Rate raised to 3.5% as inflationary pressures remain

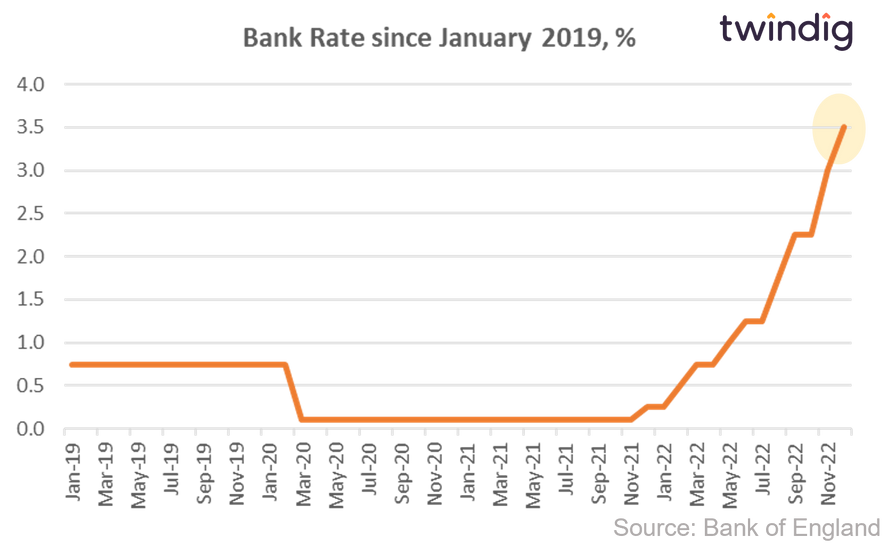

As widely expected, the Bank of England raised Bank Rate by 50 basis points today from 3.0% to 3.5%

What the Bank of England said

The Bank of England's Monetary Policy Committee (MPC) raised Bank rate to 3.5%

MPC members voted by a majority of 6-3 to increase Bank Rate by 50bp

Two members voted to maintain Bank Rate at 3.0%, the other member voted to increase Bank Rate to 3.75%

Twindig take

Today's Bank Rate rise of 50 basis points was widely expected and it implies that the MPC believes that inflation (the Consumer Price Index CPI inflation) will remain very high in the near term. However, inflation is expected to fall sharply from mid-2023 to below the Bank of England's 2% target over the next 2-3 years.

In our view, the increase in Bank Rate reflects that the labour remains tight and that current inflationary pressures in domestic prices and wages led the MPC to take a stronger stance on inflation and raise Bank Rate.

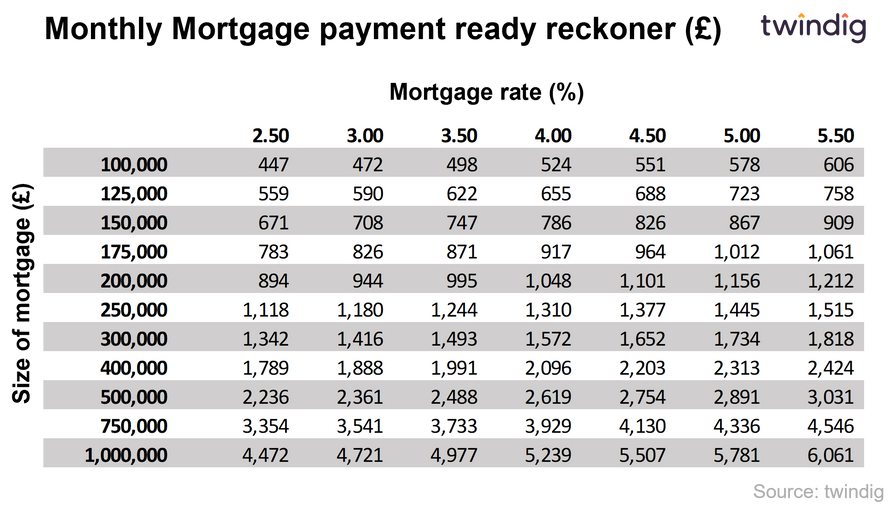

If today's Bank Rate increase were passed on to mortgage rates we would see an increase in a monthly mortgage payment of around £26 per month for every £100,000 borrowed.

Will Bank Rate increase in 2023?

Yes (in our view). The Bank of England is using Bank Rate as its primary tool to control inflation. It was reported yesterday that the Consumer Price Index (CPI) the measure of inflation targeted by the Bank of England was 10.7% in November, whilst the Bank of England's target is just 2.0%. The war on inflation is not yet over and so we are likely to see further rises. However, there is a silver lining, inflation did all from its 41-year high in October of 11.1%. The interest rate medicine is starting work, but there is more work to do.

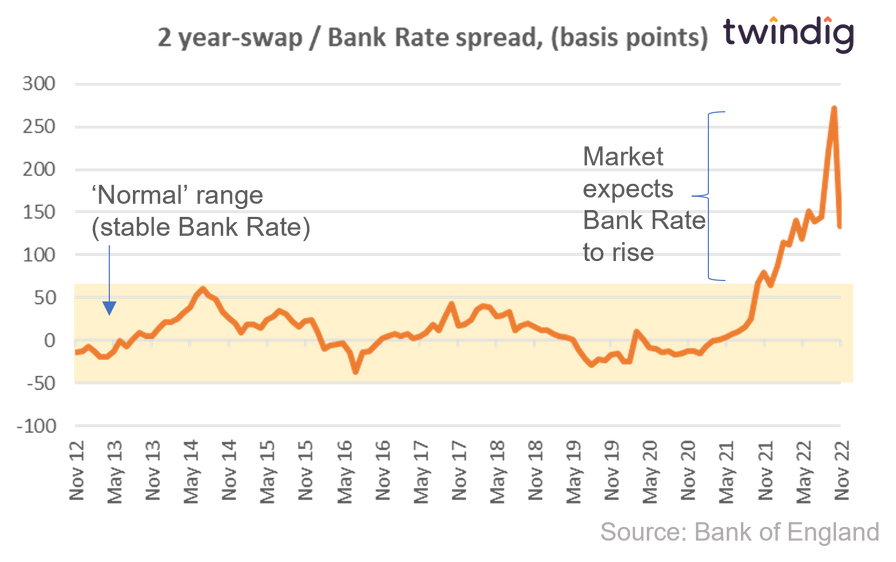

We can also see (in the chart below) that the financial markets expect Bank Rate to rise. The chart shows the spread (or difference) between the 2-year swap rate and Bank Rate. The pricing of fixed rate mortgages is closely related to swap rates, which largely reflect expectations for the path of Bank Rate. In the chart we can see that the swap rates are unusually high compared to Bank Rate, this is because the market expects Bank Rate to rise. This provides us with a usual guide as to where mortgage rates might go in the future.

Once again we have a silver lining (but still the cloud..) the swap rate has reduced significantly since the Autumn Statement, which reduced many of the concerns raised by the mini-budget. Mortgage rates are likely to go up, but not as much as we had once thought.

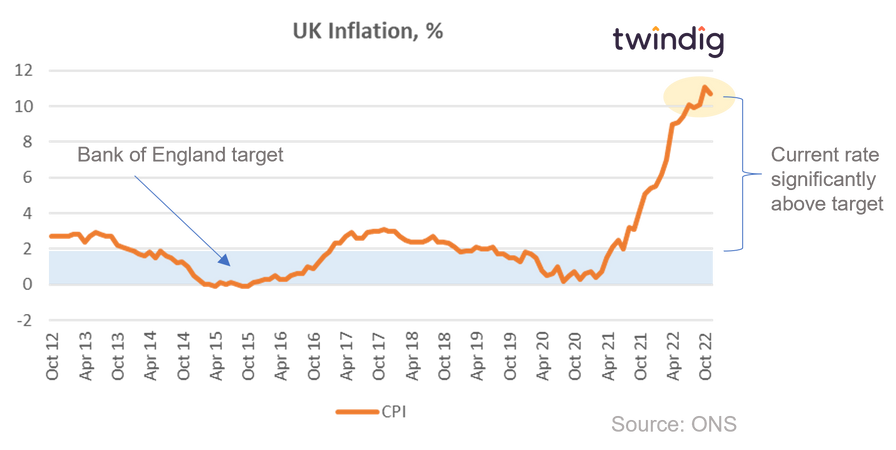

What about inflation?

Inflation is still significantly ahead of the Bank of England's 2% target as illustrated in the chart below. The latest move in inflation was down, but there is still a lot of work to be done.

The MPC's central forecast will see inflation (Consumer Price Inflation - CPI) start to fall early next year as previous increases in energy prices drop out of the annual comparison. The MPC expects that CPI inflation will drop below 2% in two years' time.

How much will my mortgage cost now?

For those on fixed-rate mortgages the monthly payments will remain fixed for the duration of the fixed term, after that it is likely that the remortgaged rate will be higher than it currently is.

To calculate mortgage payments you can use the Twindig mortgage calculator below