Housepresso 17 April 22

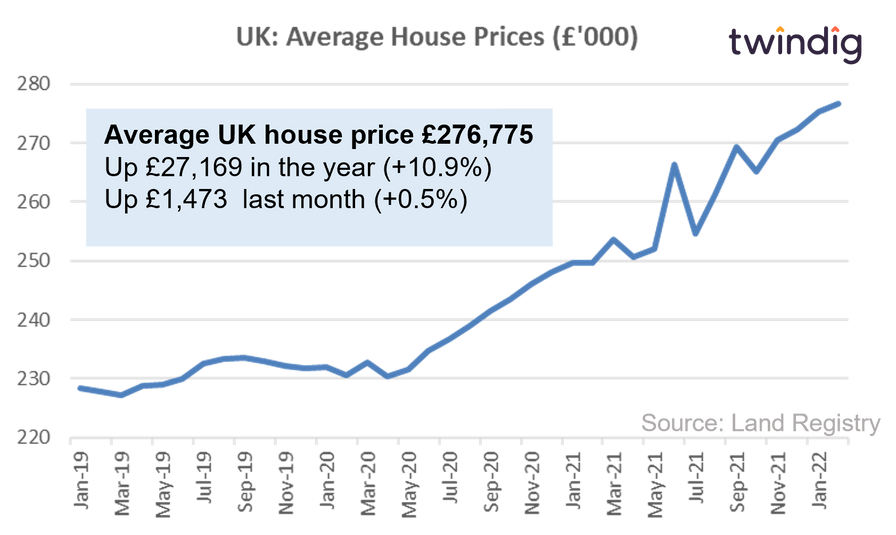

Land Registry reports house prices reach new highs

The average house price in the UK is £276,775, average prices have increased by 10.9% or (£27,169) over the last year, and increased by 0.5% or (£1,473) last month. We note that these figures are provisional and subject to change, but it seemed that in February 2022 the momentum of 2021 had returned.

UK average house prices have increased by 20.0% (£46,146) since the start of the COVID-19 pandemic.

The hottest 25 housing markets right now

The biggest house price winner last month was in Merthyr Tydfil in Wales where house prices increased by 7.2% or £9,940.

In second place came South Holland in Lincolnshire where house prices increased by 6.4% and in third place with house prices rising by 6.3% was Cambridge.

Interesting to see that three different regions make up the top three.

For the full list of 25 click read more below:

The tide finally turns on housing supply

New instructions indicator turns positive for the first time in 12 months as buyer demand continues to increase according to the latest RICS Housing Market Survey. It is good news that Agents reported an increase in the supply of homes to the market for the first time in 12 months, in 2022 vendors are putting the 'selling' into the spring selling season. The increase is only a small one, and stock levels remain close to historic lows, but hopefully, the tide is turning with more supply waiting in the wings. If the supply of homes continues to increase it should help alleviate some of the pressure on house prices which continue to rise at pace.

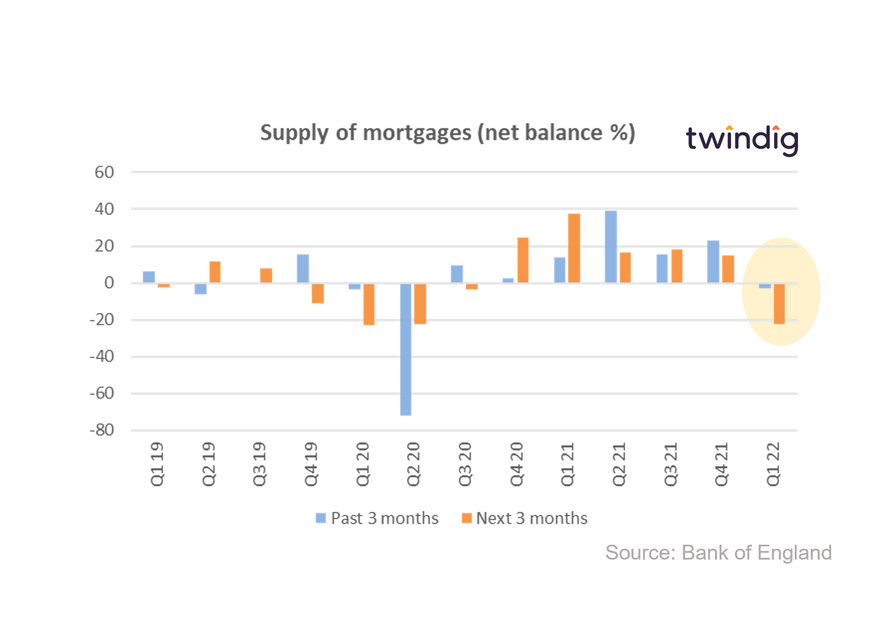

Mortgage supply to fall?

Coming on the back of record house prices and RICS suggesting that housing supply was finally starting to respond to the high levels of demand, the Bank of England's Credit Conditions Survey was rather downbeat, and risked putting a bit of a downer on the Easter Weekend

In our view, lenders expecting the supply of mortgages to reduce in the next three months was the headline of the report.

Twindig Housing Market Index

This week was a mixed week for the housing market, for the most part, it was sunny and warm (house prices rising, supply of homes to the market increasing), but on Thursday, there was a sting in the tail as the Bank of England released its latest Credit Conditions Survey. Against this backdrop of yin and yan, the Twindig Housing Market Index fell by 1.4% to 78.4