Supply of mortgages expected to fall

The Bank of England published its Q1 2022 Credit Conditions Survey this morning

What they said

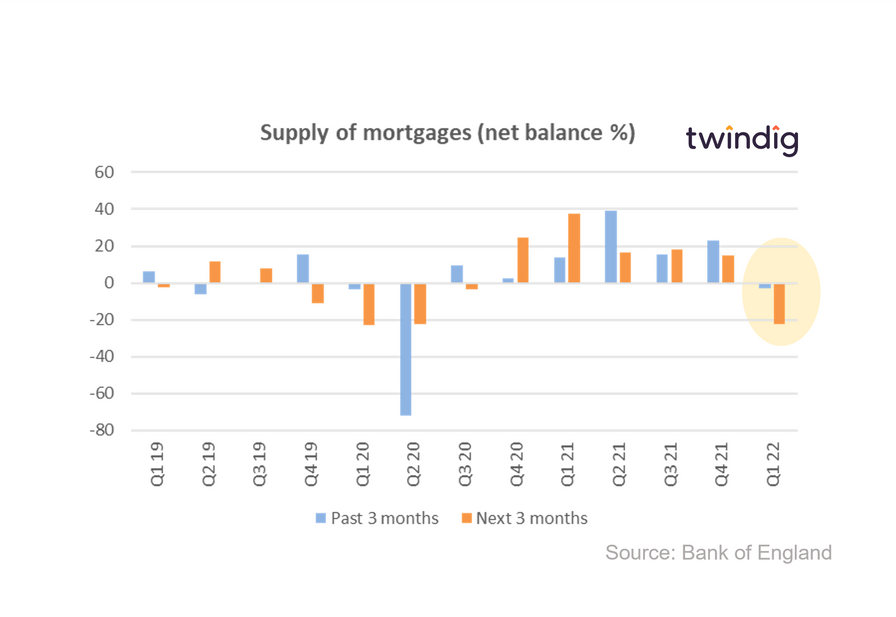

Mortgage supply expected to decrease in the coming quarter

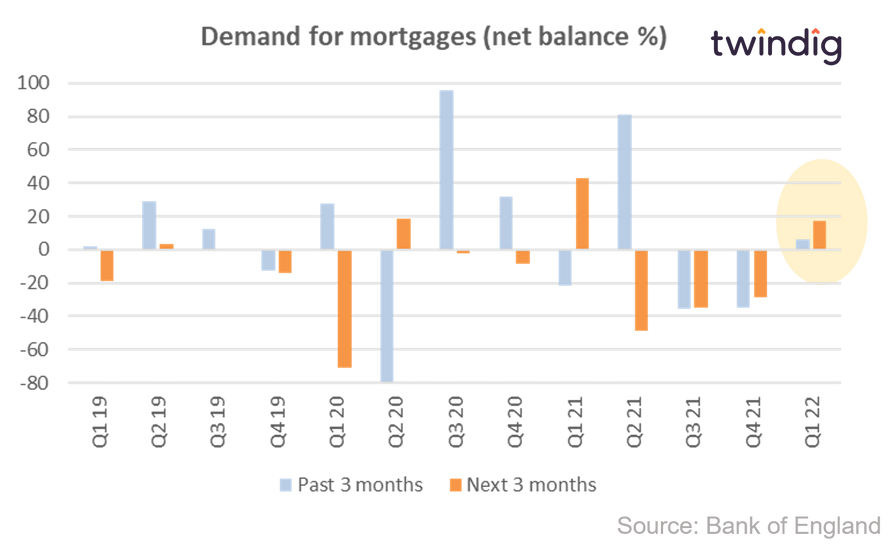

Demand for mortgages expected to increase in the next three months

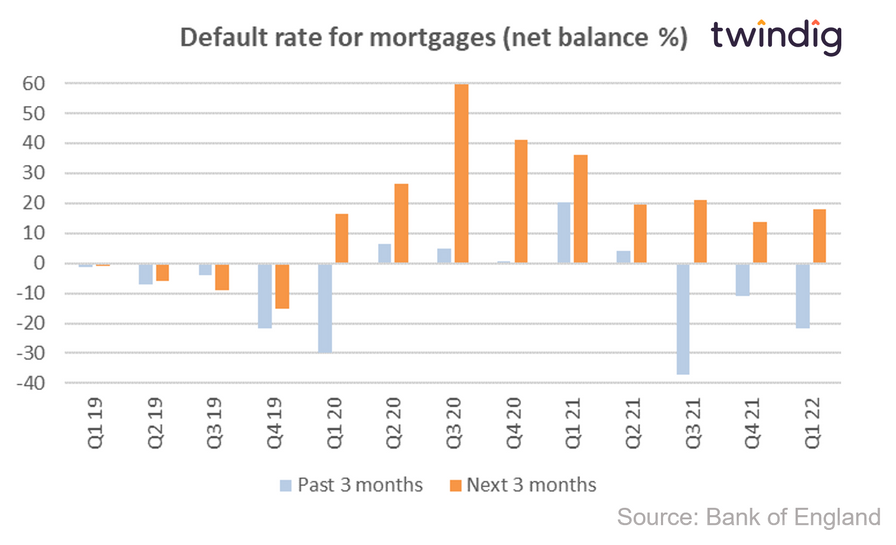

Default rates on mortgages expected to rise

Twindig take

Coming on the back of record house prices and RICS suggesting that housing supply was finally starting to respond to the high levels of demand, the Bank of England's Credit Conditions Survey was rather downbeat, and risked putting a bit of a downer on the Easter Weekend

In our view, lenders expecting the supply of mortgages to reduce in the next three months was the headline of the report.

This is the first time mortgage supply has been expected to reduce since Q3 2020. No doubt the increased costs of living and rising trajectory of bank rate are on lender's minds. The majority of house purchases are funded by a mortgage and as we saw during the Credit Crunch the supply of mortgages is critical to the overall health of the housing market. Whilst the COVID-19 pandemic did little damage to the housing market a reduction in mortgage supply, if significant, could knock it for six.

We often say that the mortgage approvals data is the key lead indicator for the UK housing market and we will be watching the mortgage approval data with eagle eyes to see if they indicate any problems ahead.

Ironically, although lenders are perhaps signalling a note of caution in the face of rising interest rates and cost of living increases, the demand for mortgages is expected to rise for the first time since Q1 2021.

Homebuyer's confidence appears to be higher than that of the lenders and as we mentioned above, RICS reported today that the number of homes coming to the market for sale is increasing for the first time in 12 months. It seems the demand and supply of mortgages might be mismatched.

The level of mortgage defaults is expected to increase in the coming quarter. Given the pressures on household finances, this is perhaps not a surprise, although as you can see from the graph lender's forecasts typically overestimate the level of mortgage defaults