Housepresso 10 October 21

All you need to know about the housing market this week in one quick hit

Will high wages and high skills mean high house prices?

A puzzling property problem

In his conference speech this week, Boris Johnson said that we are moving towards a high wage high skill economy, but will this also mean high house prices? And if it does, how will higher house prices impact the Government’s desire to solve the national productivity puzzle by fixing the broken housing market?

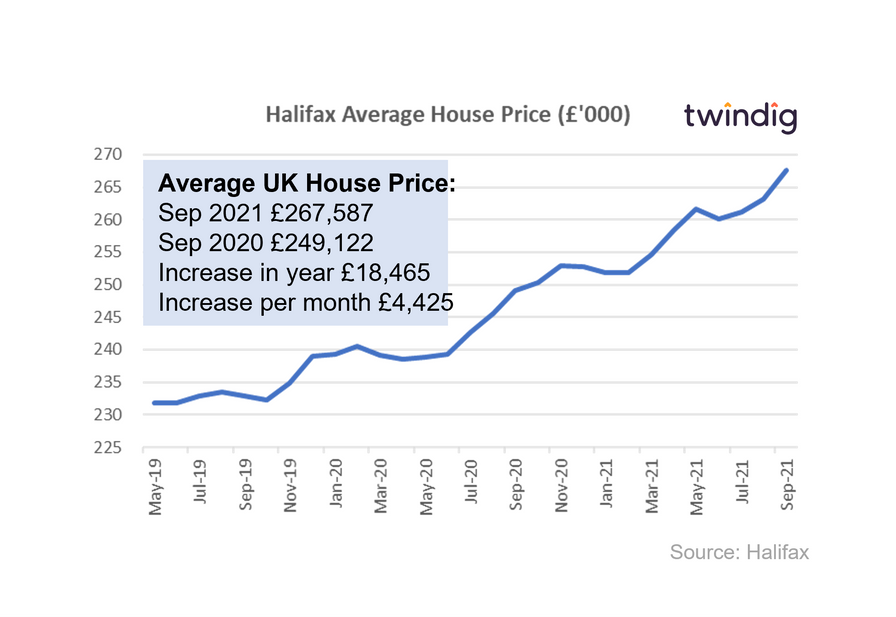

House prices reach record highs in September

UK house prices rose to their highest ever level in September 2021 according to the latest data from the Halifax. House prices rose by £4,425 in September to £267,587 as the Stamp Duty Holiday drew to a close.

The UK might not yet be a high wage, high skill economy but it is certainly a high house price one.

Whilst the Stamp Duty Holiday may have been a catalyst for house price growth, it does not explain the scale of the increase, house prices rose by almost £25,000 during the holiday against an average saving of £3,379. Homebuyers were made worse off not better off by the stamp duty holiday.

The unaffordability of London housing

For many aspiring first-time buyers, London housing is unaffordable, however, neither house prices nor the pandemic has led to an exodus of those aged 25-45 years currently living in London. It seems that for many, the call of the city is louder than that of the country

More than six in ten (63%) London renters believe owning a home would improve their quality of life, yet just two in ten (22%) are currently able to save money for a deposit, according to research from affordable housing developer Pocket Living, who surveyed more than 1,000 25-45 year-olds during August 2021.

Surprisingly, building more affordable homes may not be the answer, but there is a way to make homes more affordable.

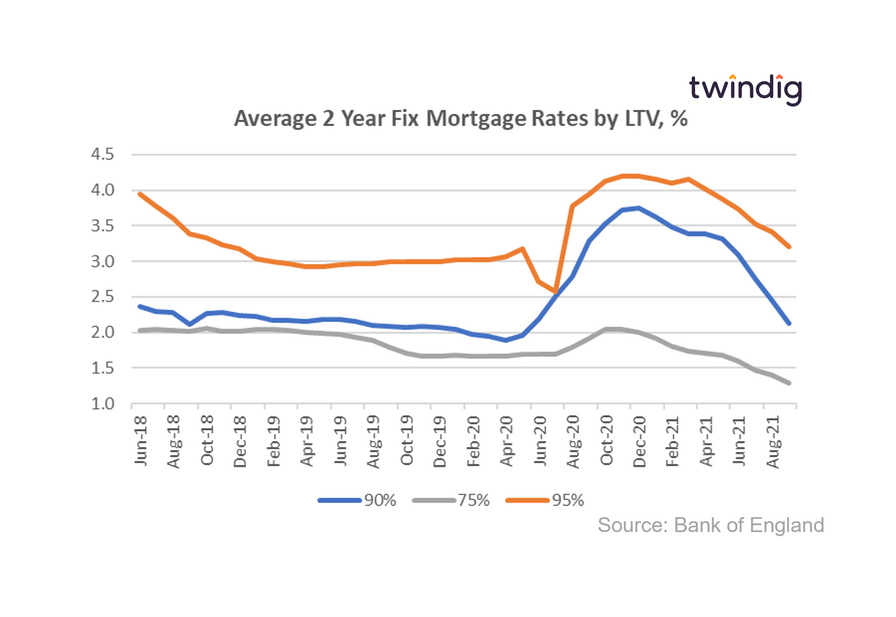

Mortgage rates fall as house prices reach record highs

As house prices reached new record highs in September it will come as a welcome relief that mortgage rates continue to fall. Falling mortgage rates are obviously good news for those with mortgages, but we can also take comfort for what they tell us about the health of the wider UK housing market.

Average mortgage rate for 75% LTV mortgages 1.20%

Average mortgage rate for 90% LTV mortgages 2.13%

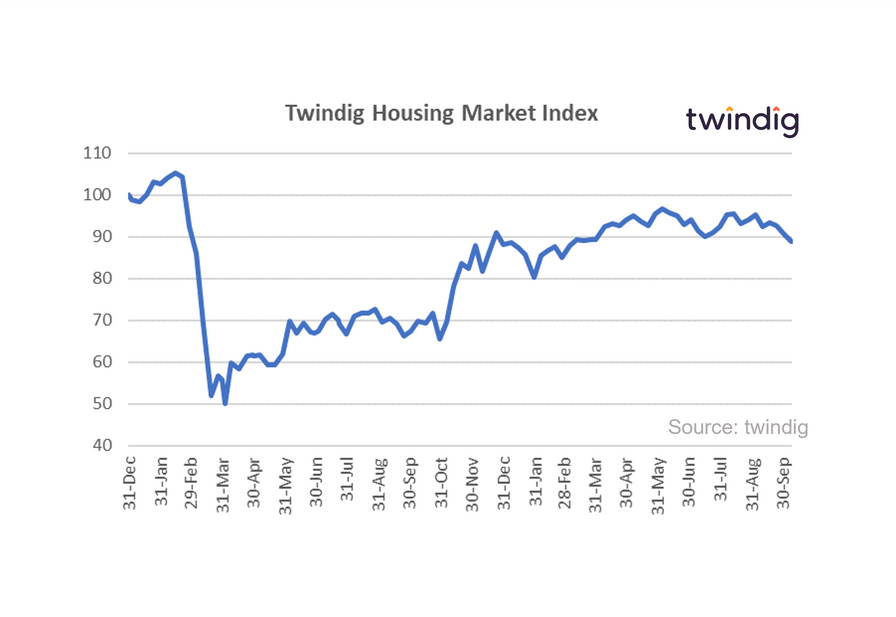

Twindig Housing Market Index

Boris's bullish building back rhetoric could not turn the tide on the Twindig Housing Market Index, which fell for a third week in a row this week. Investors did not share the Prime Minister's confidence that he could solve the national productivity puzzle, by fixing the broken housing market. Many believed that a high wage high skill economy would push house prices up further still, widening the affordability gap rather than narrowing it.