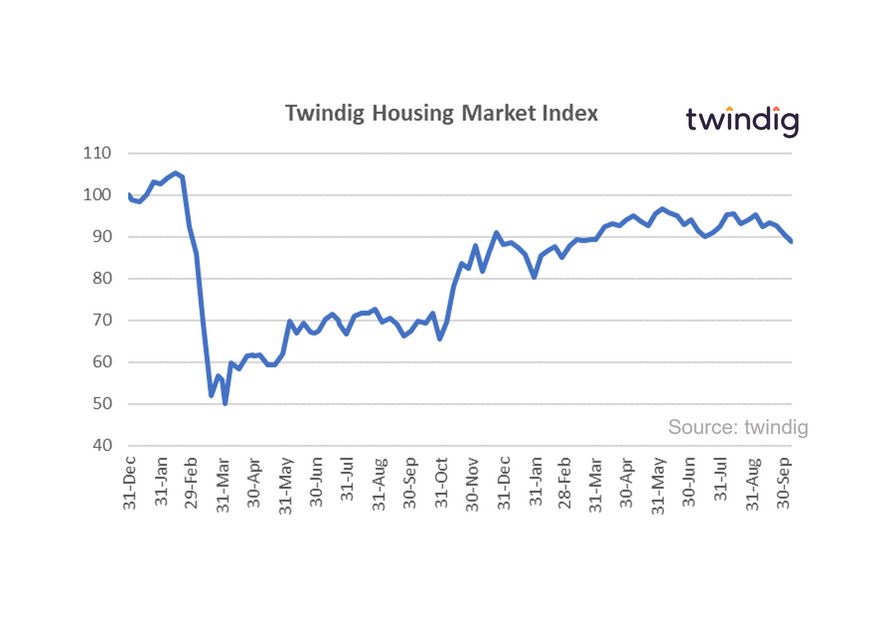

Twindig Housing Market Index (HMI) - 9 October 21

Boris's bullish building back rhetoric could not turn the tide on the Twindig Housing Market Index, which fell for a third week in a row this week. Investors did not share the Prime Minister's confidence that he could solve the national productivity puzzle, by fixing the broken housing market.

Many believed that a high wage high skill economy would push house prices up further still, widening the affordability gap rather than narrowing it. For our analysis of the High wage, high skill, high house price debate you can read our article The Puzzling Property Problem.

Away from the party conference opinions, the housing market facts were more promising. House prices reaching record highs in September according to the Halifax House Price Index as the stamp duty holiday came to close and mortgage rates, as reported by the Bank of England, continue to fall.

Falling mortgage rates suggest to us that either lenders are competing for business and/or they are feeling more bullish about the outlook for the UK housing market, whatever the reason now is a good time for those in a re-mortgaging window of opportunity, in our view.

We believe that rising house prices remain a factor of the stamp duty holiday catalyst and the race for space as our lifestyles and aspirations change in life after lockdown. A shortage of homes for sale will help underpin house prices for the rest of the year, and we do not expect a major fall in house prices now that the stamp duty holiday has ended - as house prices have risen by more than the available stamp duty savings, which implies there were other factors contributing to the rise of house prices during the stamp duty holiday.