Mortgage rates fall as house prices reach new highs

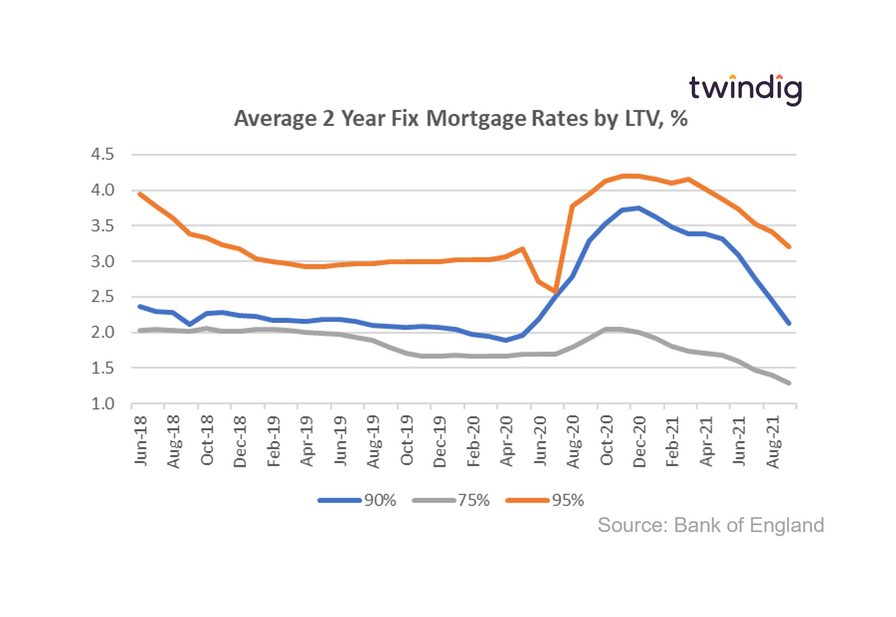

The Bank of England released data today about mortgage rates by Loan To Values (LTVs)

What they said

Average mortgage rate for 75% LTV mortgages 1.20%

Average mortgage rate for 90% LTV mortgages 2.13%

Average mortgage rate for 95% LTV mortgages 3.21%

Twindig take

As house prices reached new record highs in September it will come as a welcome relief that mortgage rates continue to fall. Falling mortgage rates are obviously good news for those with mortgages, but we can also take comfort for what they tell us about the health of the wider UK housing market.

Mortgage rates are set by the mortgage lenders and falling mortgage rates imply that they are feeling more upbeat about the outlook for UK house prices. The risk of lending is falling, which means the lenders are less worried than they were about falling house prices on a two-year view.

Mortgage rates for 75% LTV mortgages

At 1.20% mortgage rates for 75% LTV mortgages are now lower than they were before the start of the COVID-19 pandemic, around 15% lower. For those with equity in their homes mortgage credit is cheap. Welcome news in an environment where energy, fuel and food prices are rising.

Mortgage rates for 90% LTV mortgages

As the LTV rises so does the mortgage rate, the higher the LTV the more risk there is for the lender (smaller house price falls will lead to a loss for the mortgage lender). However, the mortgage rates for 90% LTV mortgage have been falling dramatically over the course of 2021 and they are now only 5% above their pre-pandemic levels

Mortgage rates for 95% LTV mortgages

The mortgage rates for 95% LTV mortgages are also falling and at 3.21% are 24% below their December 2020 highs of 4.2%, and only 6% ahead of their pre-pandemic levels.

The implication for house prices

As mentioned above, falling mortgage rates implies a favourable outlook for house prices. This is welcome news as the stamp duty holiday draws to a close, implying that lenders are not expecting a sharp house price correction following the home-buying frenzy during the stamp duty holiday. Time will of course tell, but for now the glass is half full rather than half empty