The unaffordability of London housing

For many aspiring first-time buyers, London housing is unaffordable, however, neither house prices nor the pandemic has led to an exodus of those aged 25-45 years currently living in London. It seems that for many, the call of the city is louder than that of the country

More than six in ten (63%) London renters believe owning a home would improve their quality of life, yet just two in ten (22%) are currently able to save money for a deposit, according to research from affordable housing developer Pocket Living, who surveyed more than 1,000 25-45 year-olds during August 2021.

Surprisingly, building more affordable homes may not be the answer, but there is a way to make homes more affordable.

Unaffordable London Housing

Pocket Living found that almost three out of four renters in London (73%) wanted to own their own homes. However, high London house prices were cited as the biggest barrier to homeownership for more than half of London renters (51%), followed by the unaffordability of a mortgage (30%) and more than one in four (27%) saying they are struggling to save a big enough deposit.

Almost two thirds (62%) agreed with the statement:

‘I really don’t want to move outside London to afford a home because I would have to sacrifice too much to do so’

From a £20,000 to a £130,000 deposit

According to the Halifax, at the start of the millennium a typical professional couple needed to raise a £20,000 deposit to buy a home in London, However, 21 years later, in February 2021, the deposit requirement had risen to £132,685.

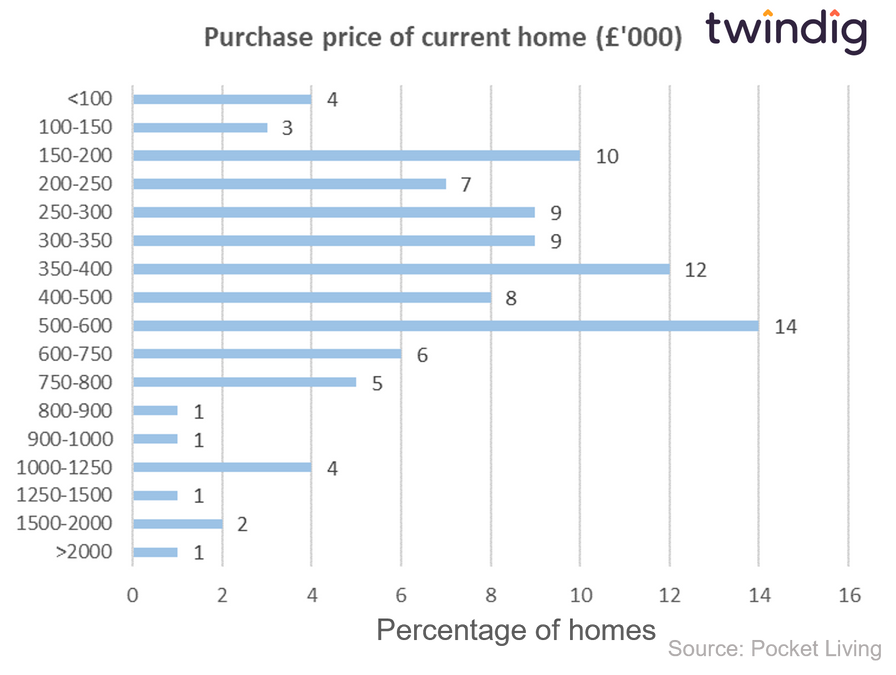

The half a million-pound average London home

Pocket Living found that the average price paid for a first home was £490,000, more than 12 times the average £40,000 income of the London first time buyer, implying that even with a 10% deposit a London first time buyer would need to borrow more than ten times their income to secure their first home. The lending multiple puts the London housing crisis into context because lenders have to ration the amount of lending they do which is more than 4.5x income, which for many, effectively slams shut the door of homeownership.

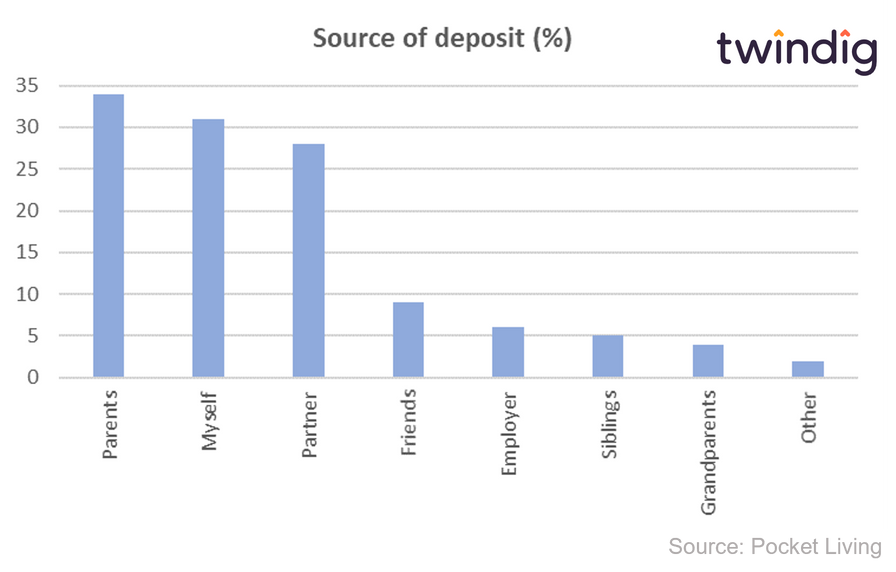

The London bank of Mum and Dad

Of those surveyed 38% were homeowners and around one in three homeowners owned their home outright, such is the size and scale of the Bank of Mum and Dad

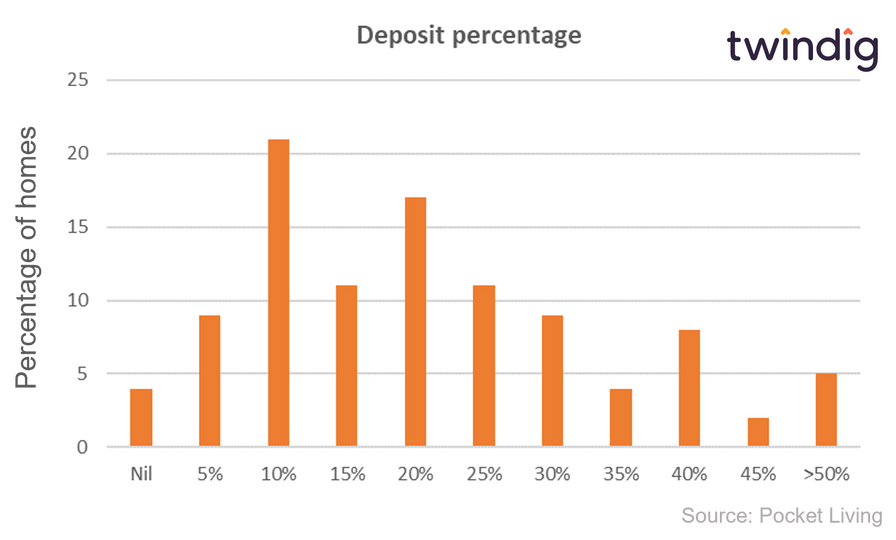

Of those who had bought their home, 62% had a deposit of 20% or less (10% deposit was the modal average) and more than two-thirds had external support for their deposit.

Will building more houses reduce prices?

Possibly. ‘A’ level economics would suggest that increasing supply will lead to a reduction in prices and this might be the case in the short term if many more homes are built in an area where first time buyers want to live, but as Alastair Parvin eloquently argues in his Thought Experiment Number 3, building more homes may, due to the agglomeration effect, lead to higher prices, in the same way, that building more roads leads to more traffic congestion not less and we prefer to eat in a busy restaurant than an empty one.

Do we really want more homes (to be built)?

Research from the Adam Smith Institute Build Me Up, Level Up found that less than half (46%) of voters would be more willing to vote for a party that builds more homes / affordable homes, which suggests that a vote-winning policy is to commit to building fewer homes…

However, homeownership is in decline and according to the Adam Smith Institute, three quarters (75%) of those who would like to purchase a home in the next five years are unsure that they can afford to buy a home.

The main issue facing housing supply, in our view, is that there are too few homes being built in areas where people want to live.

We might not build enough affordable homes, but we can make homes more affordable

We believe that fractional ownership is the key to solving the affordability crisis. In our view, it is very unlikely that we will be able to build enough homes in the right places to impact house prices.

We also believe that the chance of a material (downward) house price correction is low. House prices had an excellent opportunity to ‘correct’ during the Global Financial Crisis, but all that happened was that they fell by around 20% before starting to increase again and are now around one third (33%) above their prior peak.

In today’s world of Spotify, Uber and Airbnb, we are increasingly used to have use of rather than full ownership of assets. We believe that owning part of a home is better than not owning a home and in this model property investors would work with rather than against those looking to buy, helping them to buy a home rather than competing against them to own the home. If buyers were to work with rather than against each other more people would be able to actively participate in the UK housing market, which we believe is a good thing rather than a bad one.