Housepresso 6 Nov 22

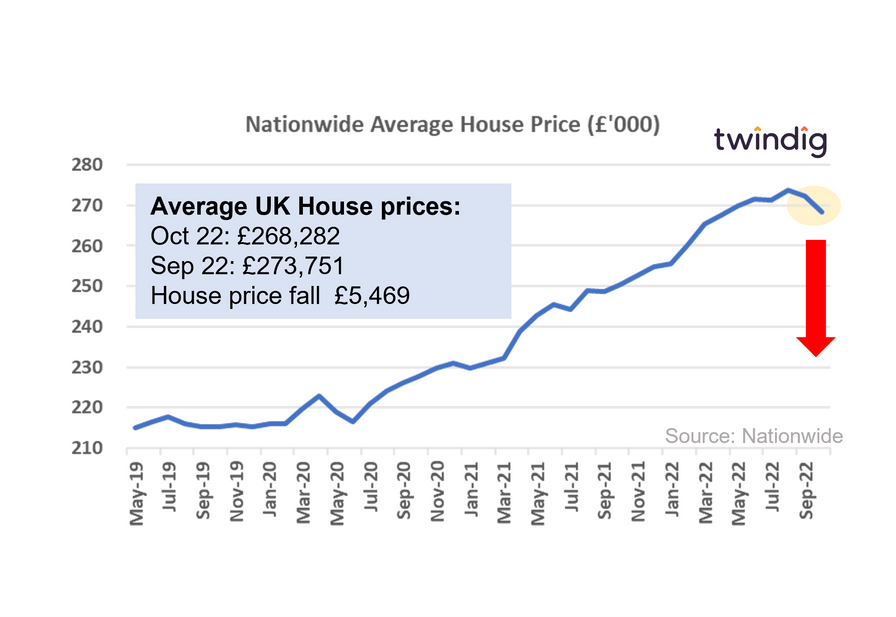

House prices fall by £5,500 in October

After Lloyds Bank suggested that house prices may fall by 8% next year, the Nationwide reported today that house prices fell by 1.5% in October alone, the biggest fall since June 2020 (the fall that led the then Chancellor Rishi Sunak to launch the COVID-19 Stamp Duty holiday).

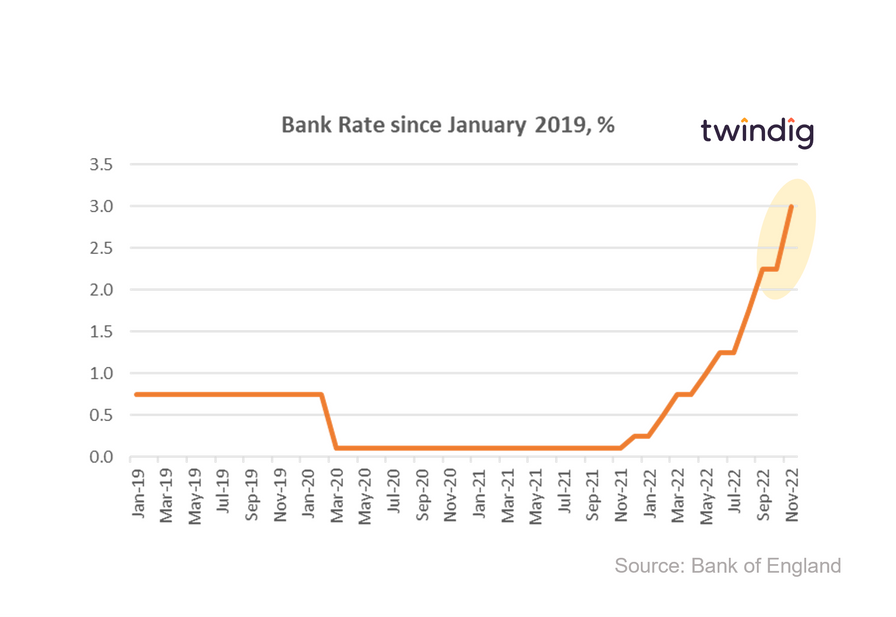

Biggest Bank Rate Rise for 30 years

Whilst the increase in Bank Rate his week was for many as unsavoury as picking up Bounty from a tub of Celebrations, it could have been worse. The recent actions of Chancellor Hunt and Prime Minister Sunak have steadied the markets and assisted rather than hindered the Bank of England's efforts to tackle inflation. We are likely to see further increases in the coming months, but once the medicine has been seen to work we can expect Bank Rate to fall, although not perhaps as quickly as it is currently rising.

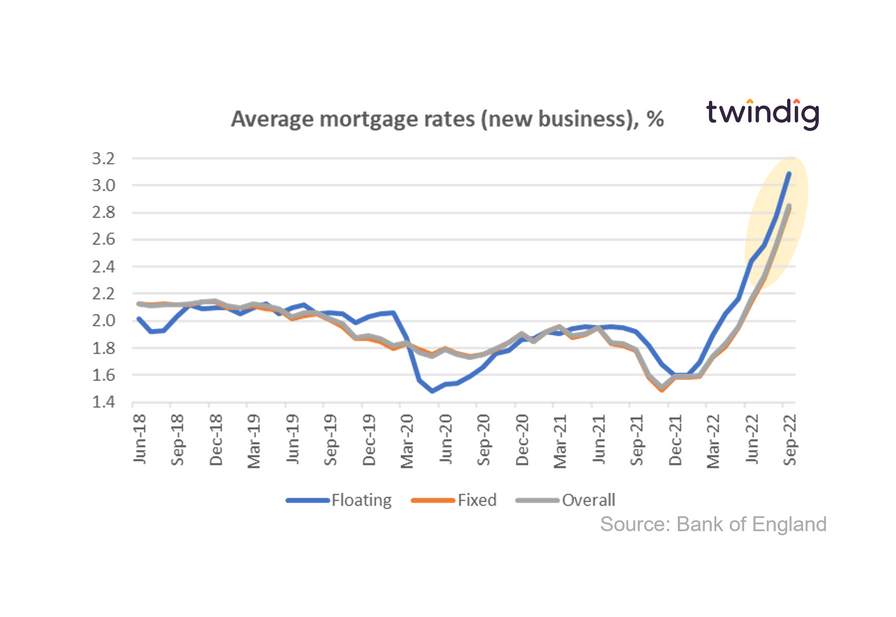

Mortgage rates up 10% in September

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in September 2022, rising by more than 10%, buying a home or re-mortgaging suddenly got more expensive.

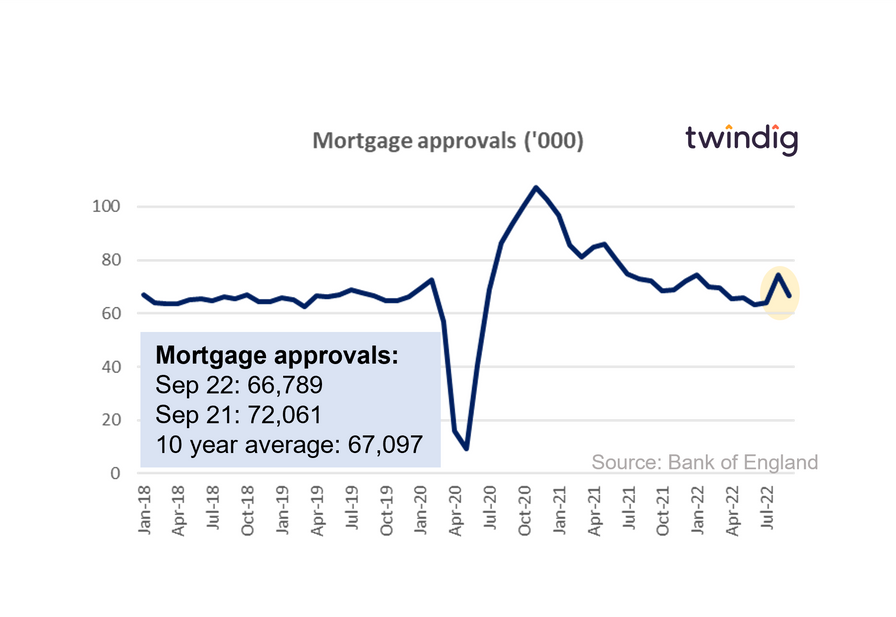

Mortgage approvals dip in September

After a surprise leap in August, mortgage approvals fell back to a more normal level in September. Whilst the 10% drop month on month and 7% drop year on year will grab the headlines, the key is that, in September, mortgage approvals were broadly in-line (just 308 short) with their ten-year average of 67,097.

Twindig Housing Market Index

Well, this was certainly a week to remember, as the Nationwide reported that house prices fell by £5,500 in October and the Bank of England made the biggest rise in Bank Rate for 33 years, the Twindig Housing Market Index rose by 2.8% this week to 62.8.