Houselungo 31 July 22

Will house prices fall as interest rates rise?

Received wisdom suggests that as interest rates rise, house prices will fall. At first glance, this makes sense as the cost of mortgages rises, the size of mortgages will fall, putting downward pressure on house prices.

Many are, therefore, nervous that house prices will fall as the Bank of England continues to raise its Bank Rate (the underlying interest rate that impacts all other interest rates).

Twindig is not claiming to be able to predict the future, but we can look at the interaction between house prices and interest rates in the past.

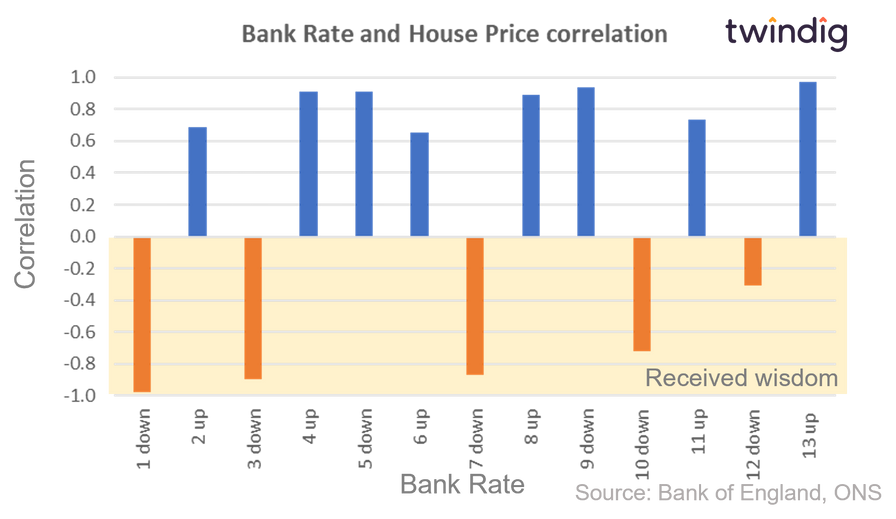

Since 1983 there have been 13 periods of either rising or falling interest rates. We have looked at each, in turn, to see if a pattern emerges. A pattern does emerge, but not the one received wisdom suggests.

A correlation, but not the one we were expecting...

The hypothesis we were testing was that if interest rates go up house prices come down, in technical terms a 'negative correlation'.

However, when we look at the 13 periods of either rising or falling interest rates since January 1983 we only see the 'received wisdom' negative correlation five times and a positive correlation - where interest rates and house prices move in the same direction eight times.

We also note that overall, the positive correlation is stronger (closer to 1.0) than the negative correlation is closer to minus -1.0.

This suggests to us that the received wisdom is not that wise...

Is Kettel Homes your cup of tea?

Kettel Home's mission is to help you ‘move in without a mortgage'. It is the latest in a growing number of rent-to-buy companies seeking to help aspiring first-time buyers without access to a large deposit to get a foot on the housing ladder

How does Kettel Homes work?

Kettel Homes buys your home, you rent it. After 36 months you move from renting to owning and hopefully save thousands of pounds in future rent. Over the three-year period, the rent is fixed, house price gains accrue to you and Kettel will help you design a savings plan to build a 10% deposit to help you buy the home at the end of the rental period. At first glance, Kettel Homes appears to be as comforting as a cup of tea.

Housing market activity falls for fifth month in a row

The Bank of England released mortgage approval data for June this morning

What the Bank of England said

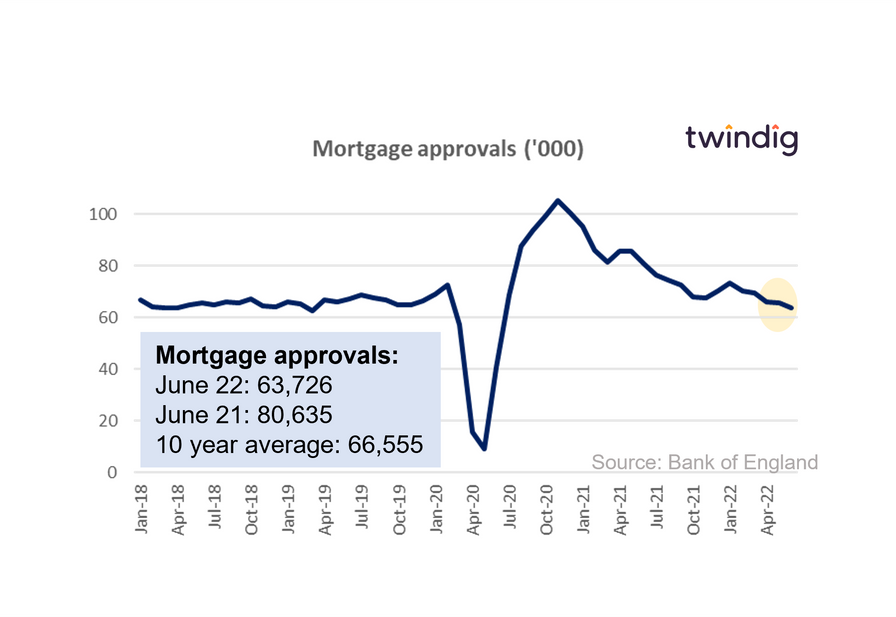

Mortgage approvals for June 2022 were 63,726

This was 3.0% lower than the 65,681 mortgages approved in May 2022

This was 21.0% lower than the 80,635 mortgages approved during June 2021

Twindig take

In June mortgage approvals fell for the fifth month in a row to 63,726 down 13% from the 73,220 approvals we saw in January.

It seems to us that we are currently on a glide path to a more normal level of housing market activity following a frenetic two-year period punctuated by working from home, races for space and stamp duty holidays.

The cost of living and rising interest rates will no doubt be playing on homebuyers' and home movers' minds, but as we reported in our report 'What does the cost of living crisis mean for house prices?' those in a position to move are currently shielded from the cost of living crisis by savings and high levels of discretionary spending, both of which could be diverted to housing.

Average mortgage payments break the £1,000 barrier

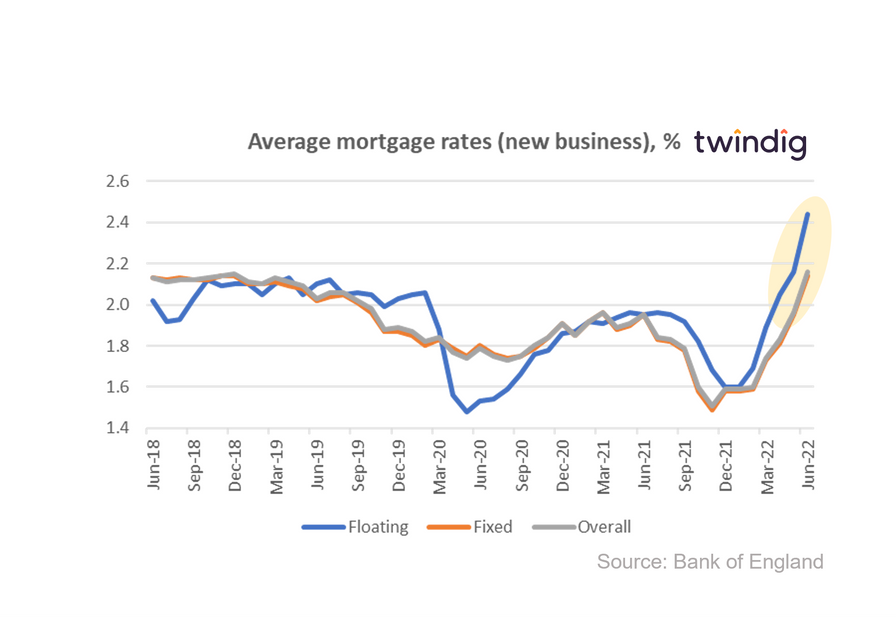

Whilst mortgage approvals declined slightly, mortgage rates rose significantly, rising, on average, by more than 10% in June according to the latest data released from the Bank of England this week

What the Bank of England said

The average floating mortgage rate for new business 2.44% (up 13.0%)

The average fixed mortgage rate for new business 2.14% (up 9.7%)

The average overall mortgage rate for new business 2.6% (up 10.2%)

Twindig take

The trend in mortgage rates paints an unwelcome picture, as the cost of living rises, mortgage rates are rising at an even faster pace. The (temporary) good news is that most households have fixed-rate mortgages, but when the time comes to re-mortgage if current trends continue it is likely that their monthly mortgage payments will rise significantly.

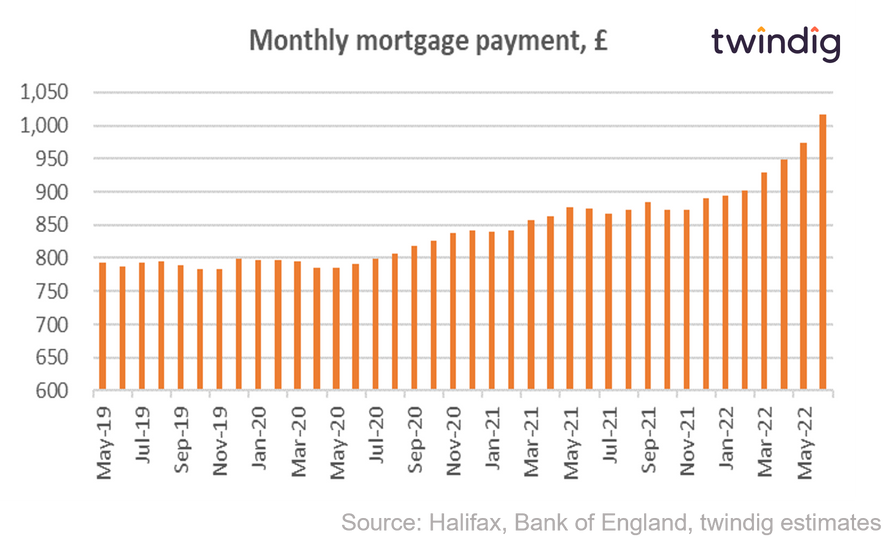

The combined impact of mortgage rate and house price rises mean that the mortgage payment on the averagely priced home in the UK assuming a 80% LTV Mortgage broke the £1,000 barrier for the first time in June, rising from £974 in May 2022 to £1,016 in June

Twindig Housing Market Index

In the week that saw mortgage approvals fall and mortgage rates rise the Twindig Housing Market Index rose by 3.4% to 77.4 as residential investors brushed off concerns about rising mortgage rates and slowing housing market activity. Most felt that the decline in mortgage approvals was a return to normality rather than a step into the unknown and the upward passage of mortgage rates was already baked into expectations, with more expected to come.

Despite the macroeconomic uncertainty, London-focused estate agent Foxtons and property portal Rightmove delivered, what in our view, were robust results for the first half of the year and both are in good shape for the rest of the year.