Houselungo 21 August 22

The truth about negative equity

In July 2022 it seemed that for the first time since the start of the pandemic house price growth had stalled. The Nationwide reported that house prices had increased by 0.1% whereas the Halifax reported that house prices had fallen by 0.1%. With one index up and the other down was the house price party about to end and is negative equity going to be the next big thing?

What are the risks of getting into negative equity today?

Homeowners are only at risk of negative equity if house prices fall. Since the start of the COVID-19 pandemic house prices across the UK have increased significantly, on average by more than £52,000 since the start of lockdown one. Following such large increases in house prices, many are starting to think that what goes up can also come down.

Rather than speculate about the future path of house prices, we thought it would be helpful to look at what happened to house prices during the last two housing recessions.

Average house prices rise but at a slower rate..

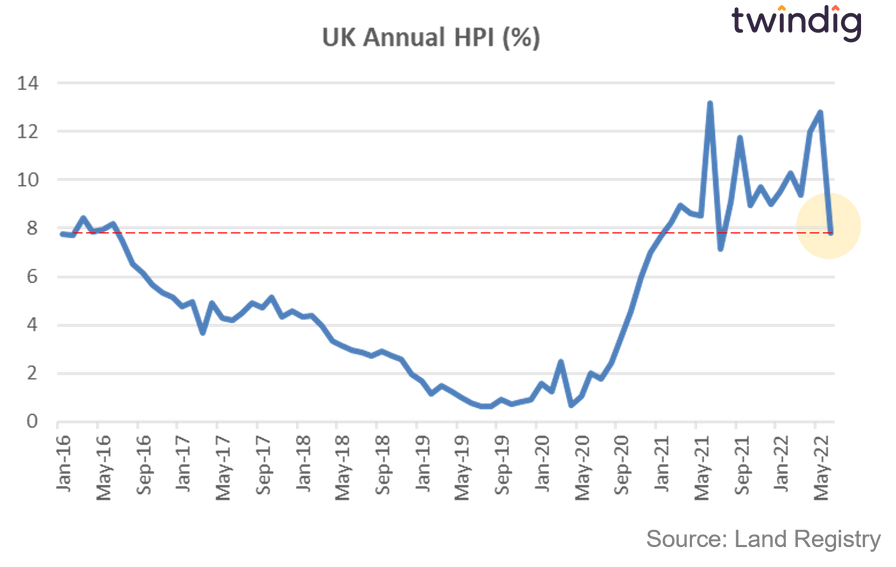

The average house price in the UK is £286,397, average prices have increased by 7.8% or (£20,720) over the last year, and increased by 1.0% or (£2,920) last month. We note that these figures are provisional and subject to change, but it seemed that in June 2022 house prices continued to increase one year after the end of the £500,000 Stamp Duty Holiday.

The fact that UK average house prices continue to increase suggests that so far rising mortgage rates and cost of living increases have done little to dampen the UK housing market.

UK average house prices have increased by 24.2% (£52,887) since the start of the COVID-19 pandemic.

Although house prices continued to rise in June many were alarmed that the rate of growth was slowing. It is slowing, but still remains at elevated levels. House price growth is likely to slow as inflation rages and mortgage rates rise, but are we now at the beginning of the end?

Average house prices London

The average house price in London is £537,920. This is 76% or £233,053 higher than the £304,867 average house price in England.

House prices in London have risen by 6.3% over the last twelve months compared to an average increase in house prices across England of 7.8%.

In absolute monetary terms, this translates to an average increase of £31,922 in London and £20,720 in England. House prices in England have therefore increased more in relative terms, but less in absolute terms than they have in London over the last 12 months.

The latest data from the Land Registry shows that the average house price in London rose by 1.9% or £9,846 to £537,920 in June 2022. House prices rose in 27 of the 34 London boroughs during June.

The biggest rises were in Hackney up £42,250 (7.2%), the City of London up £27,880 (3.5%) and Harrow up £24,760 (3.4%).

The biggest London house price falls last month were to be found in Kensington and Chelsea down £33,220 (2.4%), Islington down £17,460 (2.4%) and Harringey down £13,050 (2.1%).

Perenna: fixing mortgages for life

With mortgage rates rising and the cost of living surging many homebuyers and households are looking for certainty. Perenna is looking to meet those needs by offering mortgage certainty in an increasingly uncertain world. Long-term fixed-rate mortgages are popular and big business in other countries, Perenna is about to launch them in the UK and they might just shake up the whole UK mortgage market.

Twindig Housing Market Index

In the week that saw house prices rise in every region of the UK apart from Yorkshire and Humberside and inflation reach a 40-year high the Twindig Housing Market Index fell by 1.0% to 77.9 this week as residential investors worried that rising inflation and soaring energy costs may cause the housing market to miss a step as it recalibrates. However, housebuilder Persimmon delivered reassuring results this week and the banking licence awarded to Perenna suggests that there could be some much-needed innovation in the UK mortgage market.