Houselungo 19 Feb 23

It's official - Land Registry saying house prices are falling

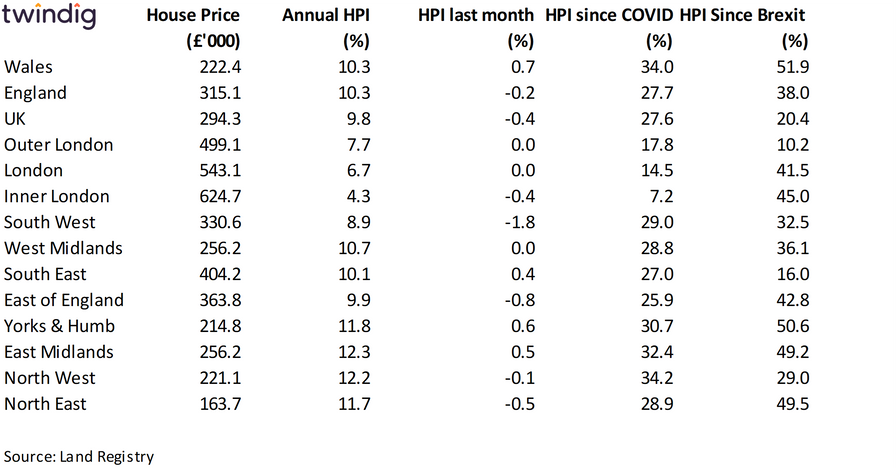

The average house price in the UK is £294,329, average prices have increased by 9.8% or (£26,214) over the last year, but fell by 0.4% or £1,279 last month. We note that these figures are provisional and subject to change, but it seemed that in December 2022 house prices have started to fall and the peak of house prices may be behind us as the cost of living crisis and rising mortgage rate rises start to bite.

There are significant regional variations in house price inflation. Over the last 12 months, house price inflation across the UK was 9.8%, but varied from 4.3% in Inner London to a rise of 12.3% in the East Midlands.

We show in the table below a summary of the regional house prices and annual house price inflation, house price inflation in the last month and house price inflation since the start of the COVID Pandemic in the UK.

Charlie says house prices will fall by 35%

In this week's podcast, Daniel and I are joined by the homebuyer's advocate Charlie Lamdin. In this episode, we explore, discuss and debate Charlie's view that house prices will fall by 35% before they level out.

Why house prices will fall by 35%

The thrust of Charlie's argument is that high house prices, rising mortgage rates, and a cost of living crisis have effectively shut first-time buyers out of the UK housing market, reducing the demand for housing. Therefore, those wanting to sell to a first-time buyer will need to adjust their pricing expectations.

Charlie also believes that returns are so low in the amateur buy-to-let market that many landlords are seeking to exit the market, because rents are no longer covering their costs and such 'forced' selling will need to be priced to go.

We at Twindig take a different view, tune in to hear what we have to say.

London house prices on the fence

The latest data from the Land Registry shows that the average house price in London rose by 0.03% or £188 to £543,100 in December 2022. However, house prices fell in 18 of the 34 London boroughs during December.

The biggest rises were in Tower Hamlets up £21,130 (4.2%), the City of London up £19,990 (2.1%), and Harrow up £9,230 (1.7%).

The biggest London house price falls last month were to be found in Kensington down £60,710 (4.5%), Islington down £24,270 (3.4%) and Hammersmith and Fulham down £21,370 (2.9%).

The average house price in London is £543,099. This is 72% or £227,980 higher than the £315,119 average house price in England.

House prices in London have risen by 6.5% over the last twelve months compared to an average increase in house prices across England of 10.3%.

In absolute monetary terms, this translates to an average increase of £33,988 in London and £29,335 in England. House prices in England have therefore increased more in relative, but less in absolute terms than they have in London over the last 12 months.

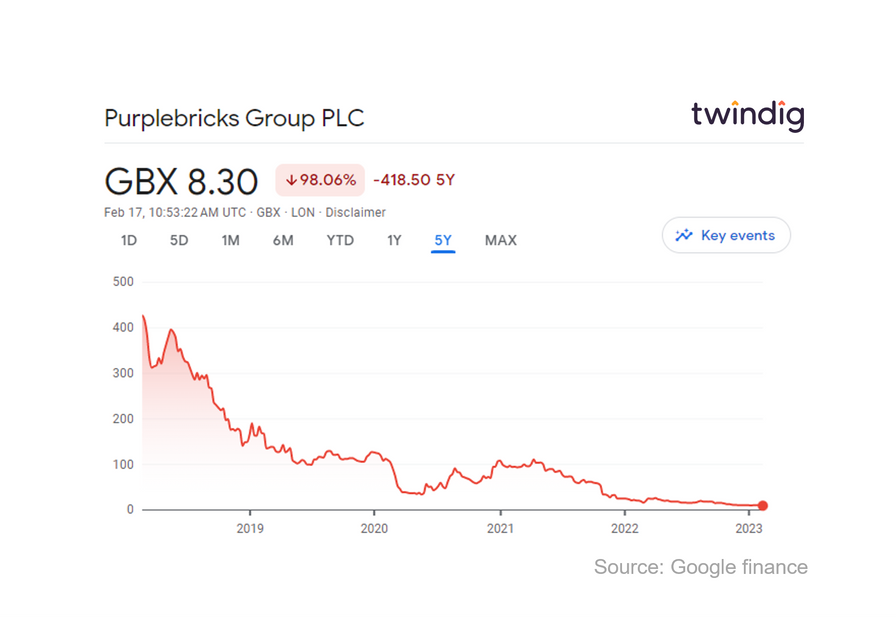

Purplebricks over and out?

Purplebricks issued a profit warning Friday morning and revealed that it has decided to conduct a strategic review. The term 'strategic review' is often used in the city as code for 'up for sale'. If this is the case, is this over and out from Purplebricks and will it seek to disrupt the banking market by offering to pay a fixed fee whether or not the bankers are able to sell the company?

Disrupting the market with a fixed fee

Whilst the share price graph above looking at the last five years is one of terminal and consistent decline, it is perhaps difficult to remember that initially, Purplebricks was the darling of the stock market and many believed that its different approach would change the way we buy and sell houses forever.

It was thought for a time that Purplebricks would become the biggest agent in the country and that traditional agents would find that innovation had rendered their businesses no longer fit for purpose.

But something went wrong...

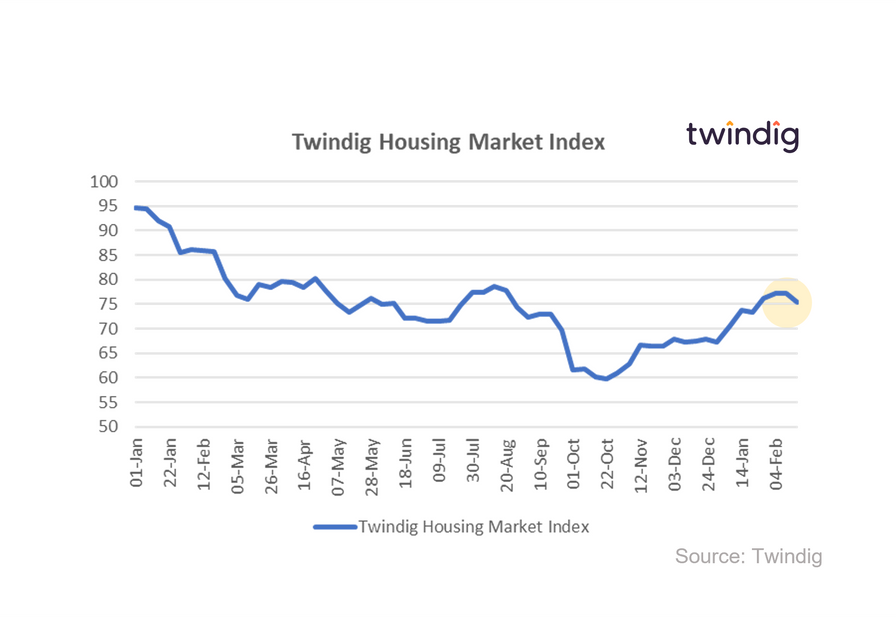

Twindig Housing Market Index

In the week that saw house prices fall a little and Purplebricks share price fall a lot, and London house prices sitting on the fence, the Twindig Housing Market Index of housing market investor confidence fell by 2.3% to 75.5 this week.

The Land Registry house price data confirmed what the Halifax and Nationwide house price indices had already told us, house prices fell in December. The Land Registry reported an average house price fall of 0.4% or £1,279 in December as the impact of the cost of living crisis was compounded by rising mortgage rates.

However, housing market investors were not too phased by this news, many had expected it and some still believe this to merely be the tip of the iceberg, and for an interesting debate on the future of UK house prices tne into the latest episode of our podcast/vlog where we debate house prices with Charlie Lamdin who believes house prices in the current cycle will see a peak to trough fall of 35%.