Houselungo 14 August 22

The Big Bank Rate Rise Podcast

Following the biggest bank rate rise for 27 years, Twindig CEO Housing Hailey discusses what the Bank Rate rise means for house prices, the housing market and mortgage payments with Iain McKenzie (CEO of The Guild of Property Professionals)

In the Bank Rate podcast we discuss:

What is the Bank Rate?

What the increase in Bank Rate means for the housing market,

What it means for house prices,

What it means for monthly mortgage payments, and

the current temperature of the UK housing market

Help to buy losing the battle for Generation Rent

The UK Government released the Q1 2022 Help to Buy Statistics this week

What they said

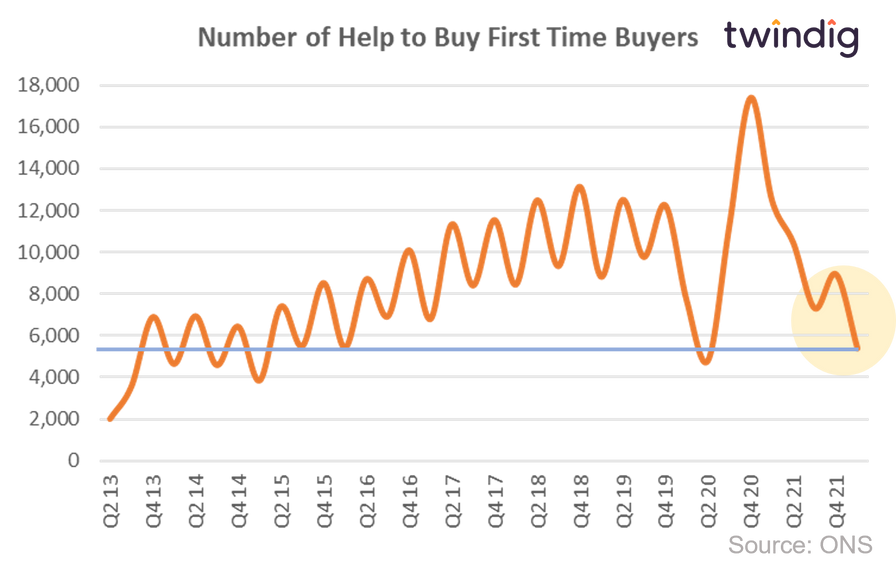

Between 1 January and 31 March 2022 5,395 properties were purchased with a Help to Buy equity loan

This was 65% lower than the same period last year, and 40% lower than in the previous quarter

The value of Help to Buy Equity loans in Q1 2022 was £447.8m this was 61% lower than in the same period last year and 26% lower than in the previous quarter

Twindig Take

The number of first-time buyers helped by Help to Buy fell significantly in Q1 2022 and it seems that the UK Government is losing its battle to turn Generation Rent into Generation Buy.

At 5,395 this was the lowest number of first-time buyers helped on to the housing ladder since the 4,810 in Q2 2020 a period during which the housing market was actually closed and the UK was hit by COVID-19 and the first of three lockdowns.

Aside from the COVID-19 pandemic Q1 2022 Help to Buy helped the fewest first-time buyers onto the housing ladder for seven years (Q1 2015).

Is Help to Buy broken?

Housing affordability can you join the dots?

Whilst the interactive chart above may look like something from The Matrix, unfortunately, it is science fact, not fiction. The chart shows the house price-earnings ratio by income decile for the averagely priced home. Whilst many charts paint a picture of affordability, this one clearly presents the stark and chilling reality that property ownership is increasingly for the few, not the many.

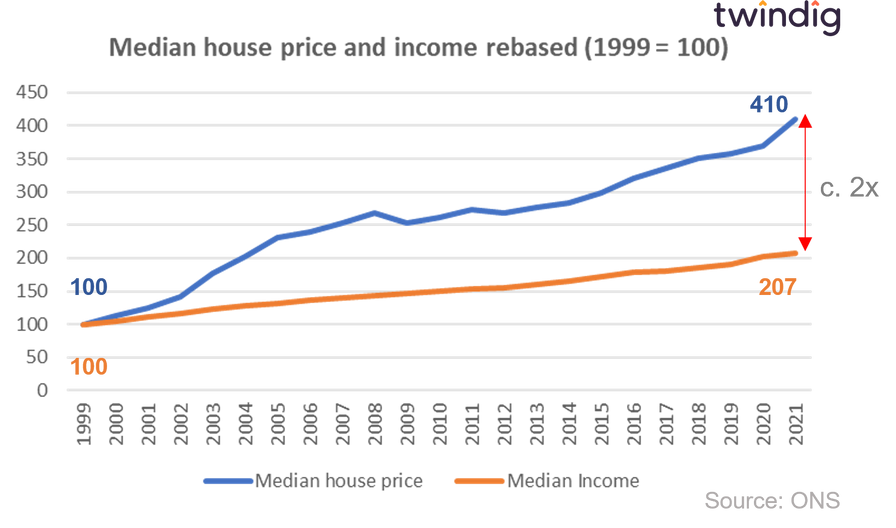

What has caused the housing affordability problem?

Simply put, house prices have grown at a much faster rate than wages, between 1999 and 2021 average wages doubled, but the average house prices have quadrupled. Average house prices have increased by almost twice the amount that wages have. This has put homeownership out of the reach of many aspiring first-time buyers.

Housing supply down, rents and house prices up

RICS released their July 2022 UK Residential Market Survey on Thursday

What RICS said

New buyer enquiries continue to decline at a steady pace

New instructions remain stagnant and stock levels remain close to all-time lows

House prices continue to rise, but the rate of growth is slowing

Twindig take

It seems that the Bank of England's monetary policy is working. It has set clear expectations and communicated that mortgage rates are going to rise, which has taken some of the heat out of the housing market.

New buyer enquiries have been in negative territory for three months in a row, the longest run since the start of the pandemic, and July saw declines across all regions of the UK.

Agents reported that the number of sales reduced in July and that they expect the volume of sales to decline in both a three and twelve-month view.

Stock levels (the number of homes for sale) averaged 36 per agent, which remains close to the all-time low and the trend in valuations and market appraisals does not suggest that stock levels will rise in the near future.

Twindig Housing Market Index

In the week that housebuilder Bellway delivered record revenues and Savills results laid bare the impact of last year's stamp duty holiday the Twindig Housing Market Index rise by 1.6% to 78.7. The consensus remains among residential investors that last week's Bank Rate rise will not cause the housing market to stall. The number of housing transactions may ease back, but demand still outweighs the supply of homes for sale underpinning house prices.

Housebuilder Bellway delivered record revenues, a record number of homes completed and a growing forward order book, if the rises in the costs of living and mortgage rates are about to cause the housing market to turn, no one has told Bellway. The challenge for the UK housing market seems to be a shortage of homes for sale rather than a shortage of buyers which is welcome news for those building houses.

However, Help to Buy, which has previously boosted housebuilder's sales was starting to wane, only helping 5,395 first time buyers in Q1 2022 down from 8,949 in the previous quarter and 15,351 in Q1 2021, in the week that the BBC stopped presenting the football scores, a case of Help to Buy 'nil' : Generation Rent 'one'