Falling supply keeping house prices and rents high

RICS released their July 2022 UK Residential Market Survey this morning

What RICS said

New buyer enquiries continue to decline at a steady pace

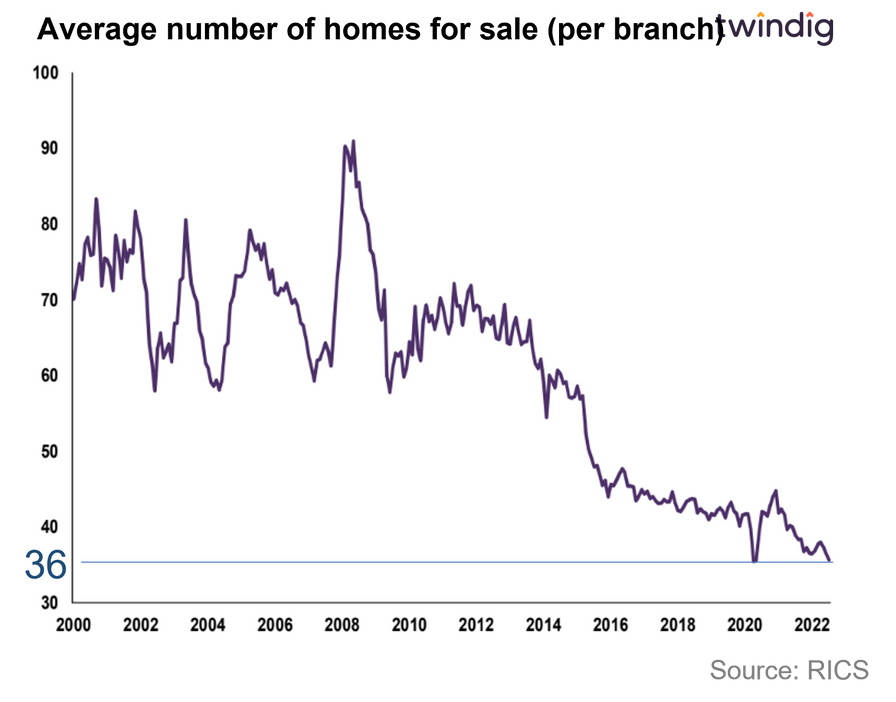

New instructions remain stagnant and stock levels remain close to all-time lows

House prices continue to rise, but the rate of growth is slowing

Twindig take

It seems that the Bank of England's monetary policy is working. It has set clear expectations and communicated that mortgage rates are going to rise, which has taken some of the heat out of the housing market.

New buyer enquiries have been in negative territory for three months in a row, the longest run since the start of the pandemic, and July saw declines across all regions of the UK.

Agents reported that the number of sales reduced in July and that they expect the volume of sales to decline in both a three and twelve-month view.

Stock levels (the number of homes for sale) averaged 36 per agent, which remains close to the all-time low and the trend in valuations and market appraisals does not suggest that stock levels will rise in the near future.

However, whilst activity levels are starting to soften, house prices and rents remain firm.

House prices continue to rise

The one 'benefit' of the lack of supply is that the shortage continues to underpin house price growth, which although slowing, remains positive. A net balance of +63% of agents reported an increase in house prices during July.

Lettings picking up the slack

Tenant demand continues to rise with a net +36% of agents reporting an increase in demand, but supply is also an issue for renters. A net negative balance of -8% of agents reported a decline in new landlord instructions in July. We would therefore expect average rent levels to continue rising, which will not be welcomed by tenants already facing significant increases in their living costs.